Today's Highlights

GBP slips on manufacturing sentiment

Euro gains on PMI data

Australian interest rates on hold - RBA watching China

FX Market Overview

Welcome back from the long break in the UK and welcome to September. Monday was awash with European data including Portuguese economic growth figures and Eurozone inflation data. That was largely positive but was enhanced by a number of positive manufacturing indices this morning. The euro has gained further strength on the news.

We heard overnight that the Reserve Bank of Australia left their base rate on hold in the first central banker meeting of the month. They commented that they are alert but not alarmed over the slowdown in China. The debate is raging over whether that is the correct stance after China announced a 3 year low in its purchasing managers index and Australia announced a larger current account deficit in Q2 as exports dived as well as a fall in business sales of 0.2%.

Sterling is a tad weaker across the board this morning after UK manufacturing activity slowed in August. The drop in the index from 51.9 last month to 51.5 doesn't look much but the markets were expecting a small rise to 52.0. Perhaps more significantly, the employment component of this index dropped below the 50 level that marks the difference between expansion and contraction of the job market. This was seen as a further sign that the UK economy may have started to slow its pace of growth.

The major events for the rest of the week are the release of the Federal Reserve's Beige book tomorrow, the European Central Bank's interest rate and QE setting meeting on Thursday and US employment report on Friday. All could be market moving and there is even an outside chance the ECB might take some creative measures to stimulate growth in Europe but don't hold your breath.

Have a great week and let's hope September isn't as wet as August was for the UK.

Currency - GBP/Australian Dollar

We can't talk about the Australian Dollar without mentioning China. The slowdown in China has severely hampered Australia's export prospects and reduced the income from the raw material exports that are still happening. That leaves big questions over whether the Reserve Bank of Australia, in spite of their unwillingness to consider it, may have to reduce their base rate and perhaps take other measures to boost the domestic economy. The commodity boom appears to be over for now, so this is a good time for the Australian authorities to re-assess their economic strategy. The RBA announced early this morning that they are just watching events for now. Meanwhile, having spiked to the A$2.22 high on Monday, the GBP-AUD exchange rate has fallen back to around A$2.15. The trend is still a positive one and the retracement is more to do with stock market activity than anything else but there is every reason to suspect we may move back to A$2.22 in the weeks ahead. If the move is as fleeting as Monday's, you will need to have an automated order in place to achieve it though. No human can trade that fast.

Currency - GBP/Canadian Dollar

The fall in commodity prices and the uncertain nature of US economic demand are combining to weaken the Canadian Dollar. The CAD had the same sort of spike on the previous Monday as other commodity related currencies after the Chinese rate cut etc. and the subsequent correction is also in line with other aligned currencies like the Aussie and Kiwi Dollars and the South African Rand. Much of the Canadian Dollar's fortunes will continue to be influenced by demand from china and the way that this affects global commodity markets because Canada is a major exporter of raw material and energy products. The current trading range is a broad one; C$1.95 to C$2.10 would be a good estimate. Use these outer limits to manage your needs.

Currency - GBP/Euro

Just when it looked like the Greek crisis had turned a corner, the Greek Prime Minister called an election and everything is in turmoil again. Add in the volatility created by China's woes and the scene is set for a very bouncy euro. I apologise for the technical terminology but bouncy is the most accurate description I could bring to mind. Confidence in the Eurozone is still terribly weak but that has been side-lined by events in the far east. We even saw the euro strengthen for a few days but that upbeat mood has now evaporated again. The Sterling – Euro exchange rate is back in the trading channel it has occupied for the whole of 2015. Sterling buyers seem happy to fill their boots at €1.35 (74p) and Euro buyers would probably be very happy if we see €1.39 or above. Having fallen from €1.44 to €1.35, that €1.3950 level is the 50% retracement level and that would be my medium term target.

Currency - GBP/New Zealand Dollar

The huge spike in the Sterling – NZ Dollar exchange rate last Monday was as unexpected as it was short lived. The People's Bank of China looked like it was panicking and that kind of nervousness is highly infectious. Things have settled back to a more calm kind of level and the Pound is trading at around NZ$2.35 as I write. Whilst the NZ$2.42 resistance level did give way briefly, it is still a tough nut to crack because it marks the midpoint between the 2006 high; an Epistaxis inducing NZ$3.07 and the scarily low NZ$1.77 seen in 2013. That was always going to make it a tough level to break but, with time, Sterling looks like it has the mettle to do so. It may be a little while before it pushes upwards again though.

Currency - GBP/US Dollar

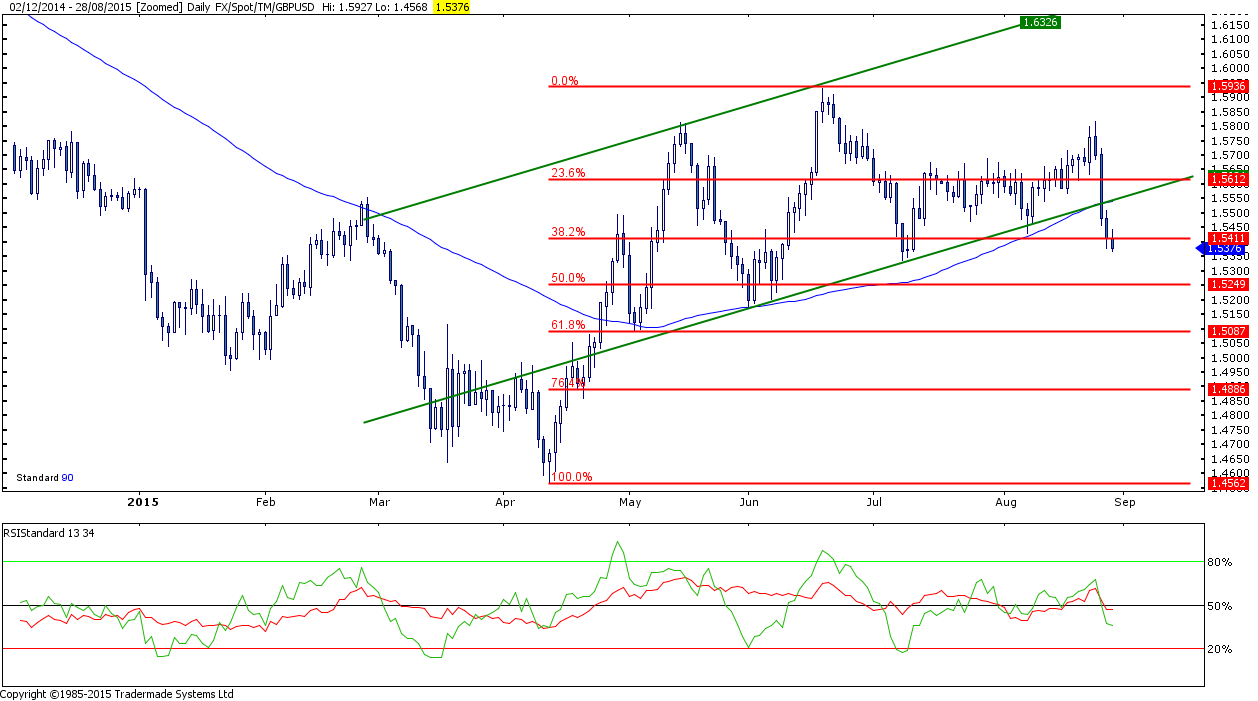

A trend line that has supported the Sterling - US Dollar exchange rate since May was finally breached last week. Strength in the US dollar met a lack of enthusiasm for the Pound and down she went. Chinese turmoil, European jiggery-pokery and commodity market slumps are all culprits but the Pound found favour around the $1.54 level and that stopped the fall. The crucial levels as we head into September are $1.5250 below the market and $1.5550; the previous support line, above the market. If either of these levels is breached, the pace of travel will increase and we could either be pushing down to $1.50 or pressing higher towards $1.60 again. It is extremely hard to determine which level will break first but US and UK interest rates will play a part in this, as will the events in China and Europe and pretty much everywhere else at the moment.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.