Good morning from Hamburg and welcome to our latest Daily FX Report. National Guard troops and police aimed to head off a third night of violence on Wednesday in Ferguson, Missouri, as more than 400 people have been arrested in the St. Louis suburb and around the United States in unrest after a white policeman was cleared in the killing of an unarmed black teenager. There have been protests in Boston, New York, Los Angeles, Dallas, Atlanta and other cities decrying Monday's grand jury decision not to indict officer Darren Wilson in the Aug. 9 shooting death of 18-year-old Michael Brown in a case that has touched off a debate about race relations in the United States.

Anyway, we wish you a successful trading day!

Market Review – Fundamental Perspective

The dollar held losses against the yen and the euro as investors digestes U.S. economic data, while the Standard & Poor´s 500 Index climbed to a fresh record ahead of the Thanksgiving holiday. It was steady at 117.70 yen in the morning, following a second day of declines in the Bloomberg Dollar Spot Index. Jobless claims rose to an almost three-month high, demand for capital goods unexpectedly fell and new homes sold at a slower pace than forecast, according to data in the U.S., where equity volumes were about 21 percent below the 30-day average. Oil ministers from the 12 Organization of Petroleum Exporting Countries meet today in Vienna. Saudi Arabia said sliding prices will stabilize on their own after Venezuela, Saudi Arabia, Mexico and Russia failed this week to agree to an a supply cut. The group, which pumps about 40 percent of the world´s oil, will discuss its official production target of 30 million barrels a day at the meeting today. Crude has collapsed into a bear market amid the hghest U.S. oil output in three decades and signs of slowing demand globally. WTI crude for January delivery fell to $73.69 a barrel in New York last session, its lowest settlement since Sept. 21, 2010. Prices have tumbled 25 percent this year.

U.S. equity and bond markets are closed today for the Thanksgiving holiday, and trading is shortened Nov. 28. The Dow gained 0.1 percent to 17,827.75 yesterday after falling less than 0.1 percent the day before. The Nasdaq 100 Index of technology shares climbed 0.7 percent to its highest level since March 2000. The euro was little changed at $1.250 after climbing 0.3 percent yesterday in a third straight day of gains.

Daily Technical Analysis

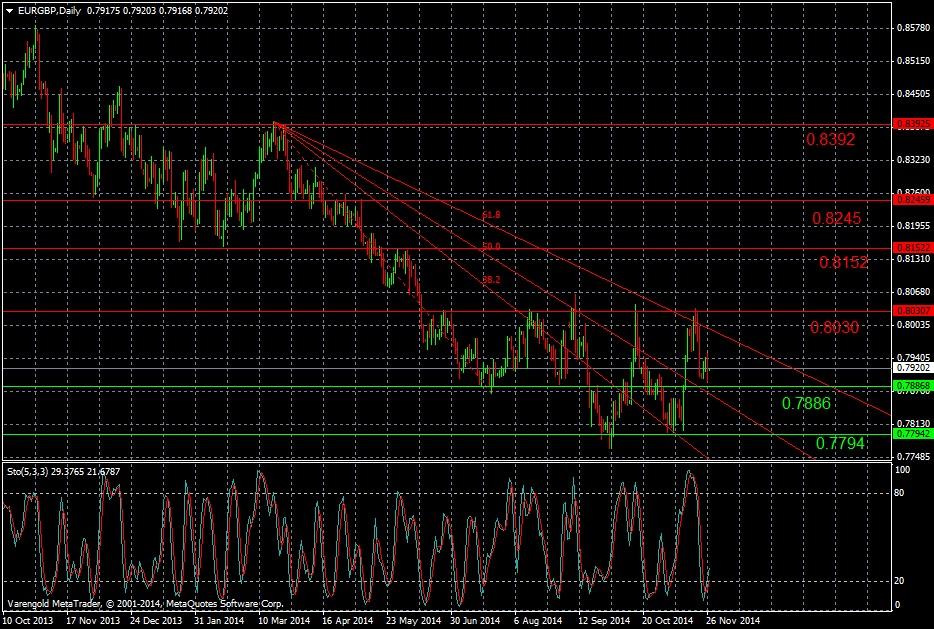

EUR/GBP (Daily)

Since the middle of March this currency pair is experiencing a storng control of the bears as it is falling below an downward Fibonacci fan. It could break through the first resistance line (38.2) twice but couldn’t strengthen its position and dropped back below it. Recently it touched the third resistance level. It tried several times to break through the resistance level 0.8038, but dropped back. Looking at the Stochastic one can see that it moves above the 20-line toward the Center line, signaling that wins are possible.

Support & Resistance (Daily)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY recovers 156.00 after testing 155.50 on likely Japanese intervention

USD/JPY has recovered some ground above 156.00 after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.