Good morning from beautiful Hamburg and welcome to our first Daily FX Report for this week. On Sunday, Washington said that countries in the Middle East had offered their military help to join air strikes against Islamic State (IS) militants. Australia became the first country to detail troop numbers and aircraft to fight the militants. It said it would send a 600 strong force and eight fighter jets to the region. On Thursday, Kerry won already the backing for a “coordinated military campaign” from 10 Arab countries. Other countries, including France also might support the military offensive against the IS.

Anyway, we wish you a successful trading day and a nice start of the week!

Market Review – Fundamental Perspective

The European Central Bank expects the euro zone will return to modest growth in the third quarter but full year growth will be less than 1 percent. The EUR has experienced a sharp decline during the last weeks and months and fell under the level of 1.30 U.S. cents per EUR. In the U.K. Queen Elizabeth II has broken her silence over the Scottish independence vote, telling a member of the public on Sunday that she hoped Scots would think very carefully about the future when voting in a referendum that could break up the United Kingdom. Before a referendum on Scottish independence on Sept. 18, the GBP stayed lower following a decline last week. The GBP lost 0.2 percent and depreciated to $1.6241 after touching $1.6052 on Sept. 10, a level not seen since Nov. 15. In the U.S. the USD has risen as signs of a strengthening U.S. economy boosted speculation the Federal Reserve is moving closer to raising interest rates. Australia`s currency came in the cross hairs of sellers first thing on Monday, sliding to a fresh six-month low after a set of disappointing Chinese data weighed on already soft demand. This boosts the chances that the South Pacific nation`s policy makers will hold interest rates at a record low. Until recent weeks, Australia`s interest rates, which are the highest in the developed world after New Zealand, had allowed its currency to resist a rally in the dollar. The Australian dollar fell towards 90 U.S. cents, from around $0.9040 late in New York on Friday and is now traded at $0.9015. While the AUD is the only Group-of-10 currency to advance against the USD this year, its gain has eroded to 1.1 percent from 6.5 percent at the start of July.

Daily Technical Analysis

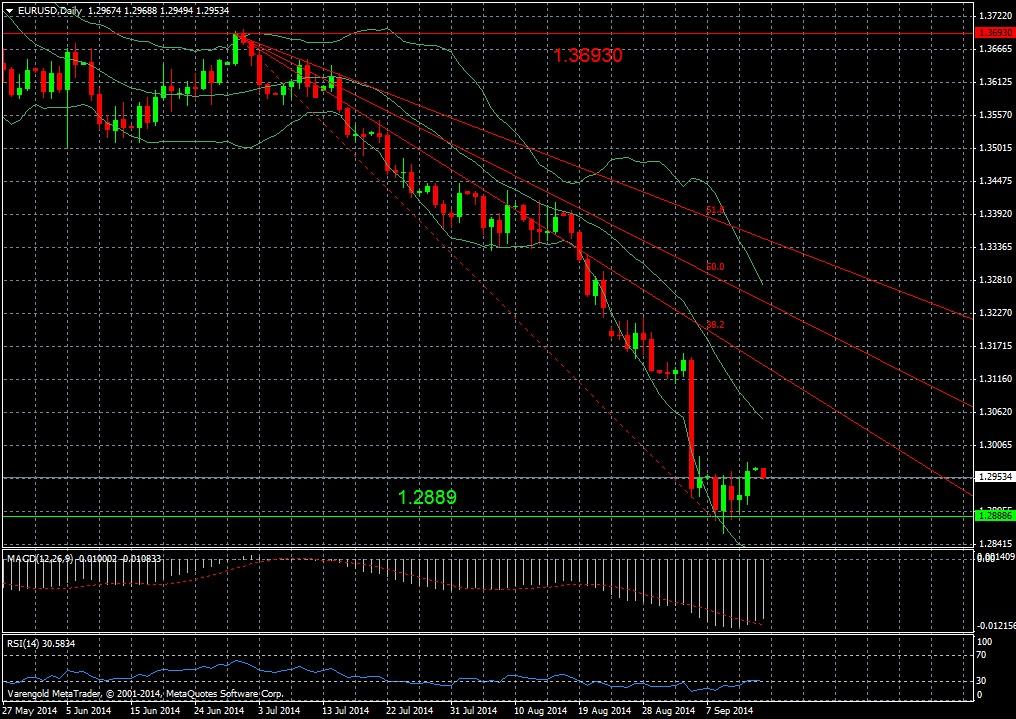

EUR/USD (Daily)

After reaching the resistance level at 1.3693 in the end of June, the EUR experienced a sharp decline against the USD till the pair reached the support level at 1.2889, where it rebounded. At the moment we see a slightly recovery. However, the MACD and the RSI both indicate that the pair might suffer further losses in the near future. Should the currency further decline and break through the support level, we may even expect more significant losses beyond the level of 1.28.

Support & Resistance (Daily)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.