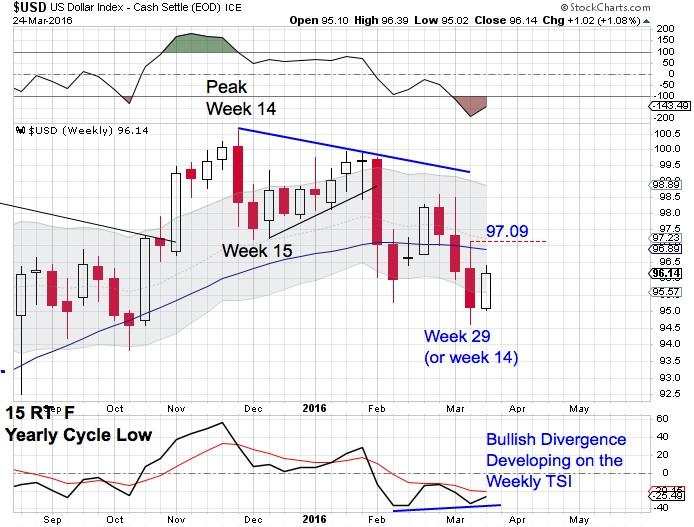

The Dollar

After peaking on day 13, the dollar printed its lowest point on the previous Friday, day 25. Wednesday's close above the lower daily cycle band confirms that the dollar has left behind a 25 day, daily cycle low.

Thursday was day 4 for the new daily cycle. The dollar has been in a daily down trend that is characterized by closing below the lower daily cycle band. The dollar will remain in a daily down trend until it closes above the upper daily cycle band.

The dollar closed the previous week, which was week 29, below the lower weekly cycle band. The close below the lower weekly cycle band indicates that the yearly cycle is in decline. The close this week above the lower weekly cycle band gives us our first indication that week 29 hosted the intermediate cycle low. A weekly swing low is required for more confirmation. A break above 97.09 is necessary to form a weekly swing low.

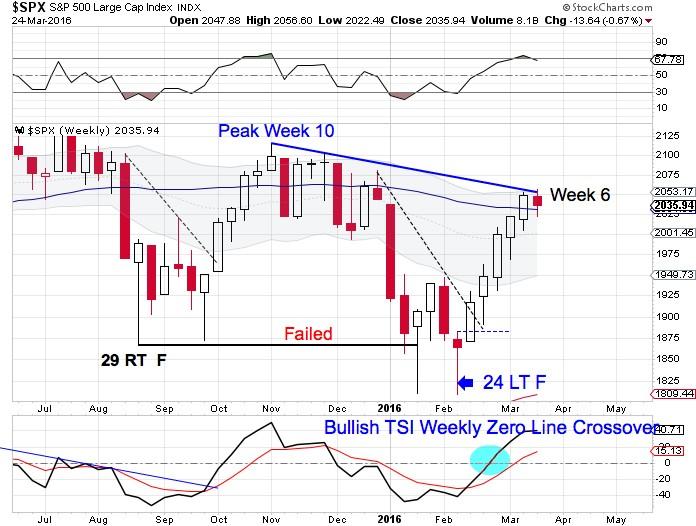

Stocks

A peak on day 27 assures us of a right translated cycle formation. The swing high and break of the daily cycle trend line indicate the daily cycle decline.

Thursday was day 29 for the daily equity cycle. Which places stocks just 1 day shy of entering its timing band for a daily cycle low. Thursday's bullish reversal has eased the parameters for forming a swing low. A break above 2036.04 will form a swing low. And if Thursday is confirmed as the daily cycle low, that will indicate a reestablishment of a monthly trend.

This is week 6 of the new intermediate cycle. A clear and convincing close above the declining weekly trend line will signal that this is a new yearly cycle for stocks.

Stocks have been in a monthly uptrend through July that was characterized by closing above the upper monthly cycle band. Stocks managed to close above the lower monthly cycle band during their decline into its yearly cycle low. Therefore stocks remain in a monthly uptrend. A monthly close above the upper monthly cycle band will reestablish the monthly uptrend.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD stays slightly above 1.0700 after mixed US data

EUR/USD lost its traction and turned negative on the day but managed to hold above 1.0700. Although the upbeat Employment Cost Index data boosted the USD earlier in the day, the weak consumer sentiment reading limits the currency's gains.

GBP/USD declines toward 1.2500 on renewed USD strength

GBP/USD turned south and dropped toward 1.2500 in the second half of the day. The US Dollar stays resilient against its rivals following the strong wage inflation data and doesn't allow the pair to gain traction.

Gold extends daily slide toward $2,300 as US yields edge higher

Gold stays under bearish pressure and declines toward $2,300 on Tuesday. The benchmark 10-year US Treasury bond yield stays in positive territory above 4.6% after US Employment Cost Index data, weighing on XAU/USD.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.