EUR/USD Current Price: 1.1185

View Live Chart for the EUR/USD

The EUR/USD pair trades in quite a limited range this Wednesday, falling down to 1.1179, a fresh weekly low, and unable to recover above the 1.1200 level ever since the European opening. Local share markets have bounced after yesterday's decline, keeping the common currency under pressure. Ahead of the US opening and the release of New Home Sales data for February, the pair trades near the mentioned daily low, with a bearish bias in the short term, as in the 1 hour chart, the price is currently developing below all of its moving averages, with the 200 SMA capping the upside around 1.1195. In the same chart, the technical indicators present mild-bearish slopes within negative territory, but lack momentum at the time being. In the 4 hours chart, the price stands mid-way inside a daily descendant channel, while the technical indicators hold well below their mid-lines, but with no clear directional strength. The main support now is 1.1160, a strong static level that if broken, could see the pair ending the day near the 1.1100 region.

Support levels: 1.1160 1.1120 1.1085

Resistance levels: 1.1210 1.1245 1.1290

GBP/USD Current price: 1.4178

View Live Chart for the GBP/USD

The GBP/USD pair trades continues heading south this Wednesday, having so far posted a shallow bounce from 1.4154, the fresh weekly low set during after London's opening. There were no macroeconomic releases in the UK, and the US will only release some housing data and last week EIA crude oil stockpiles, this last, probably affecting the most this particular pair. Anyway, the downward potential is strong, in spite the lack of directional strength coming from intraday technical readings. The 1 hour chart shows that the price is now being capped by selling interest aligned around a bearish 20 SMA, while the technical indicators lack directional strength below their mid-lines. In the 4 hours chart, the technical indicators are bouncing from oversold levels, but with the price near is lows and having breached several key supports, now resistances, the risk remains towards the downside as long as the price remains below 1.4220.

Support levels: 1.4155 1.4120 1.4075

Resistance levels: 1.4220 1.4260 1.4300

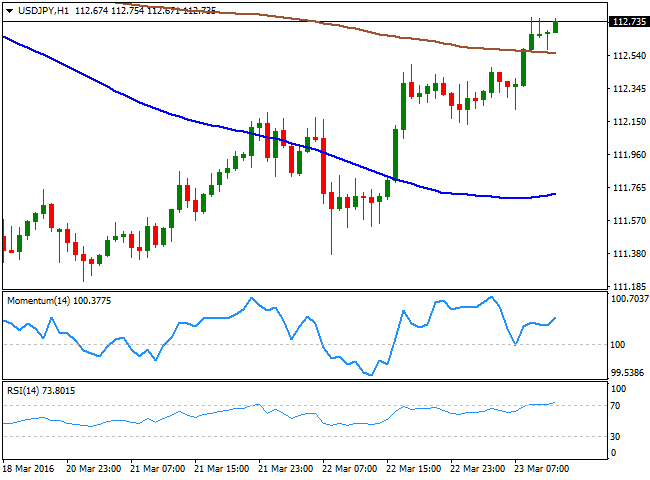

USD/JPY Current price: 112.72

View Live Chart for the USD/JPY

Persistent buying interest. The USD/JPY extends its advance for fourth day in-a-row, boosted by BOJ policy makers, who down-talked the economic situation during the past Asian session. Despite reaffirming Japan's economy remains on track for recovery, officers are concerned that said sluggish emerging market demand and volatile financial markets may hurt exports and capital expenditure. The pair advanced up to 112.75, and remains nearby ahead of the US opening, supported also by the positive mood among stocks' traders. From a technical point of view, there's scope for further advances, as in the 1 hour chart, the price is above its 100 and 200 SMAs, this last now an immediate support around 112.60, while the technical indicators maintain their bullish slopes within bullish territory. In the 4 hours chart, the price is nearing its moving averages, with the 100 SMA in the 113.00 region, while the technical indicators are partially losing their upward strength, but remain well above their mid-lines, limiting chances of a downward move.

Support levels: 112.60 112.20 111.70

Resistance levels: 112.95 113.30 113.75

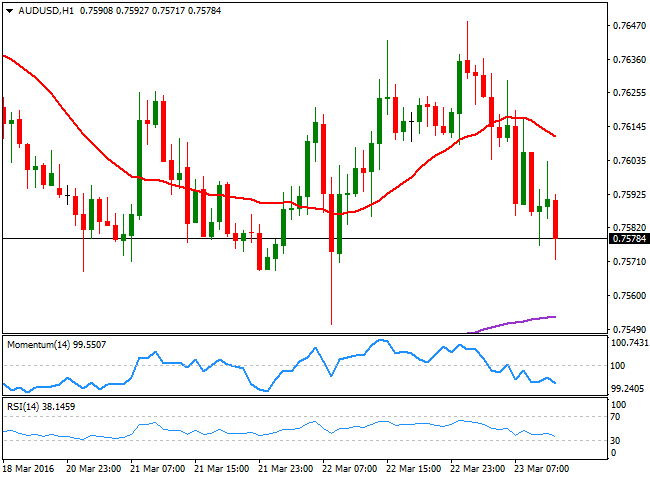

AUD/USD Current price: 0.7578

View Live Chart for the AUD/USD

The Australian dollar trades heavily this Wednesday, weighed by a sharp decline in commodities. Crude oil is slightly down after late Tuesday, the US API report showed a sharp increase in local stockpiles. Gold, however, is sharply lower, with spot approaching a critical support around $1,225.00 a troy ounce. The AUD/USD pair pressure its daily lows in the 0.7570 region, and seems poised to extend its decline, given that in the 1 hour chart, the price is below a bearish 20 SMA, while the technical indicators have accelerated their declines within negative territory. In the 4 hours chart, technical readings are also biased lower, supporting some additional declines on a break below 0.7550, the immediate support.

Support levels: 0.7550 0.7510 0.7470

Resistance levels: 0.7605 0.7640 0.7685

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0750 following Monday's indecisive action

EUR/USD continues to fluctuate in a tight channel at around 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

AUD/USD drops below 0.6600 after RBA policy announcements

AUD/USD stays under bearish pressure and trades deep in negative territory slightly below 0.6600. The RBA left the policy settings unchanged as expected but Governor Bullock said that there was no necessity to further tighten the policy.

Gold price turns red amid the renewed US dollar demand

Gold price trades in negative territory on Tuesday amid the renewed USD demand. A downbeat US jobs data for April prompted speculation of potential rate cuts by the Fed in the coming months.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.