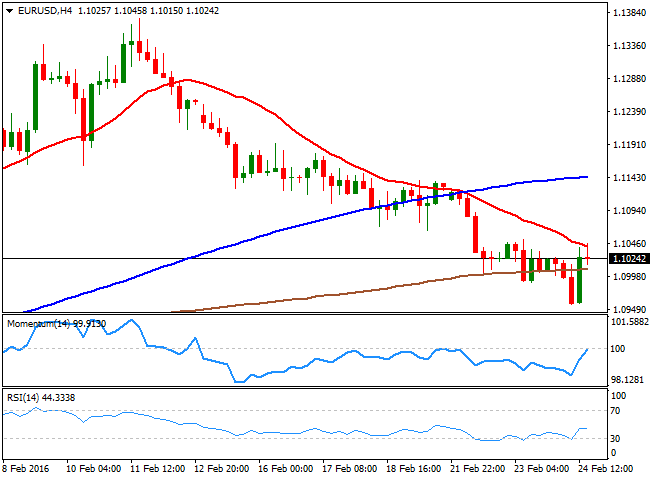

EUR/USD Current Price: 1.1024

View Live Chart for the EUR/USD

After hitting fresh highs versus the euro and the pound during the European session, the US dollar gave up most of its early gains as it took a hit from disappointing economic data. US Markit services PMI fell to 49.8 in February, below the 53.5 expected while the composite PMI also fell to 50.1 from 53.2 in January. Meanwhile, new home sales dropped by 9.2% in January, much more than the expected fall of 4.4%.

EUR/USD bounced from a 3-week low of 1.0957 and regained the 1.1000 level, erasing almost completely intraday losses. However, the pair lacked momentum to extend the recovery beyond the 1.1025 zone and settled just below that level. Technically speaking, EUR/USD maintains the short-term negative perspective, with spot capped below the 20-SMA in the 4 hours chart and indicators attempting bounces below their mid-lines. The negative outlook seems stronger in the daily chart as per indicators heading lower, but a decisive break below 1.0960, Fibonacci 61.8% of 1.0710/1.1376 ascend, to confirm bearish resumption of pullback from 1.1376 and expose 2016 lows.

Support levels: 1.0960 1.0900 1.0880

Resistance levels: 1.1050 1.1090 1.1140

GBP/USD Current price: 1.3917

View Live Chart for the GBP/USD

The British pound extended losses into a third consecutive day on Wednesday and scored a fresh 7-year low of 1.3877 during the European session amid uncertainty surrounding UK referendum on EU membership and fears of a ‘Brexit’. Even though GBP/USD managed to recover from lows as the greenback weakened during the New York session, the downside remains favored according to short-term charts. In the 4 hours chart, the pair hovers well below a bearish 20-SMA while indicators attempt to recover from lows. However, the RSI remains in oversold territory in 4 hours and daily charts, suggesting the pound might enjoy a phase of consolidation and even stage a mild bounce before resuming the fall. A break below 1.3850 would pave the way toward next target at 1.3652, which is the March 2009 monthly low.

Support levels: 1.3850 1.3800 1.3700

Resistance levels: 1.4000 1.4080 1.4155

USD/JPY Current price: 111.48

View Live Chart for the USD/JPY

USD/JPY edged lower on Wednesday and hit fresh 2-week lows during the American session on the back of disappointing US data, although the decline stalled a few pips ahead the 111.00 level and its 2016 low set at 110.97 earlier this month. A late recovery in US stocks helped USD/JPY to trim daily losses but the upside remained limited with the overall picture still bearish. In the 1 hour chart indicators head higher, reflecting the recent bounce, but hold in negative territory. In the 4 hours charts, indicators hover well below their mid-lines and the RSI corrects from oversold conditions, while the 20-SMA maintains the upside limited around 112.30. It will take a clear break below 111.00 to confirm a steeper decline with the 110.10/00 zone as immediate target. On the other hand, USD/JPY needs to regain the 113.50 zone to ease the immediate bearish pressure.

Support levels: 110.97 110.10 109.20

Resistance levels: 112.25 113.05 113.50

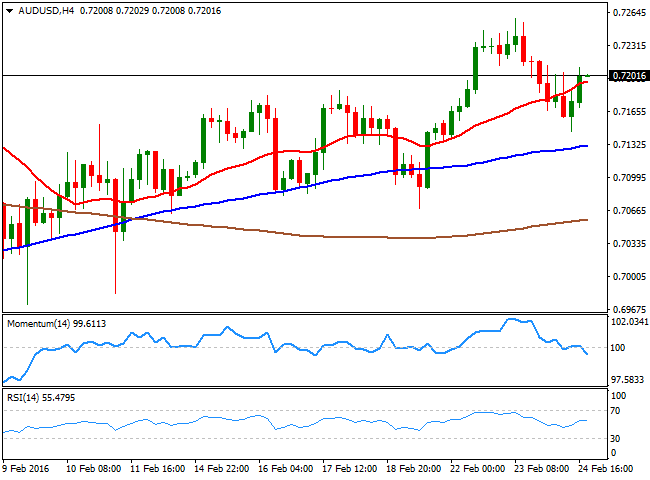

AUD/USD Current price: 0.7202

View Live Chart for the AUD/USD

The Australian dollar began the day on the back foot, weighed by the risk-off environment, although it managed to take back most of its daily losses against the greenback during the American afternoon. AUD/USD benefited from a bounce in oil and stocks and climbed back above 0.7200. From a technical point of view, short-term perspective favors the upside although indicators have lost upward strength in the 1 hour and 4 hours charts. As long as the 0.7150 support area holds, focus remains on the upside, with the 0.7260 area as immediate target followed by 0.7300. On the other hand, a fall below 0.7150 would threaten the positive bias.

Support levels: 0.7150 0.7100 0.7070

Resistance levels: 0.7260 0.7280 0.7300

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD trades above 1.0700 after EU inflation data

EUR/USD regained its traction and climbed above 1.0700 in the European session. Eurostat reported that the annual Core HICP inflation edged lower to 2.7% in April from 2.9% in March. This reading came in above the market expectation of 2.6% and supported the Euro.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. The focus now stays on the mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Mixed earnings for Europe as battle against inflation in UK takes step forward

Corporate updates are dominating this morning after HSBC’s earnings report contained the surprise news that its CEO is stepping down after 5 years in the job. However, HSBC’s share price is rising this morning and is higher by nearly 2%.