EUR/USD Current Price: 1.1085

View Live Chart for the EUR/USD

The dollar traded slightly higher after the European opening, but sentiment continued seesawing within appetite and aversion, with no certain winner during the first half of the day. Asian shares plummeted, dragging down European equities, although the decline in these last has been so far moderated. Early data released in Europe showed that in Germany, the index of producer prices for industrial products fell by 2.4% compared with the corresponding month of the preceding year, and by 0.7% compared to December 2015. Anyway, investors held their breath ahead of the release of the US inflation figures for January, which resulted better than expected, triggering a round of dollar's buying. Core inflation yearly basis rose 2.2%, above market's expectations of 2.1%, while monthly basis, it advanced 0.3%.

The EUR/USD extended its decline towards its weekly low, and seems ready to continue falling, given that in the 1 hour chart, the technical indicators are gaining bearish strength within negative territory, as the price develops below its 20 SMA. In the 4 hours chart, the bearish tone is even more clear, with the pair also being capped by a bearish 20 SMA and the technical indicators accelerating their declines towards their mid-lines.

Support levels: 1.1045 1.1000 1.0960

Resistance levels: 1.1120 1.1160 1.1200

GBP/USD Current price: 1.4253

View Live Chart for the GBP/USD

The GBP/USD pair plummeted in spite of positive UK data. According to official data retail sales in January surged by 5.2% compared to a year before, and 2.3% monthly basis. Previous month readings suffered downward revisions, probably the main reason why the pair was unable to rally. Following the release of US inflation figures, the pair fell to a fresh daily low, and the 1 hour chart shows that the 20 SMA has turned sharply lower well above the current level, while the technical indicators maintain sharp bearish slopes within negative territory, supporting further declines for today. In the 4 hours chart, the 20 SMA continues leading the way lower, attracting sellers on approaches to it, while the Momentum indicator hovers around its mid-line, lacking clear directional strength, and the RSI indicator heads lower around 36. A break below 1.4234, the weekly low, should see the pair extending towards the 1.4100 region, should dollar's strength prevails.

Support levels: 1.4234 1.4190 1.4155

Resistance levels: 1.4290 1.4330 1.4370

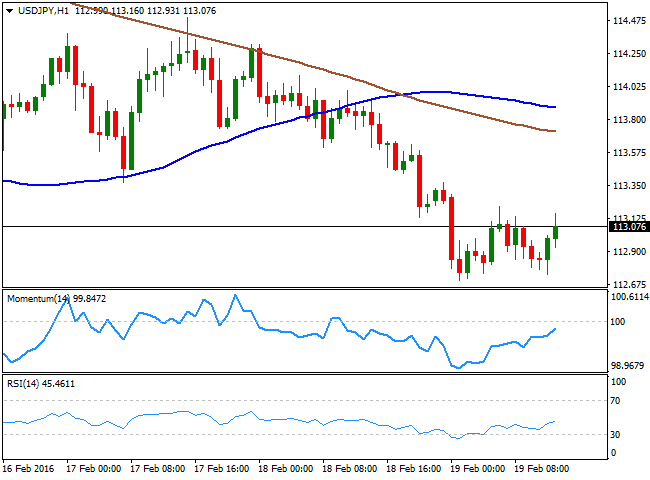

USD/JPY Current price: 113.15

View Live Chart for the USD/JPY

Limited upward potential. The USD/JPY fell down to 112.70 at the beginning of the day, with the yen strengthening amid resurging risk aversion. The pair hovered around the 113.00 for most of the European morning, and positive US inflation data is doing little for the pair, given that it barely advance 20 pips after the release of strong figures. The pair may advance further, but there are no technical signs that the movement will be firm, given that in the 1 hour chart, the price remains well below its moving averages, while the technical indicators aim higher, but still below their mid-lines. In the 4 hours chart, the technical indicators also aim higher below their mid-lines, but the price is still far below their mid-lines. The pair needs at least to advance beyond 113.70, to have a more constructive outlook at least in the short term.

Support levels: 112.90 112.50 112.10

Resistance levels: 113.35 113.70 114.00

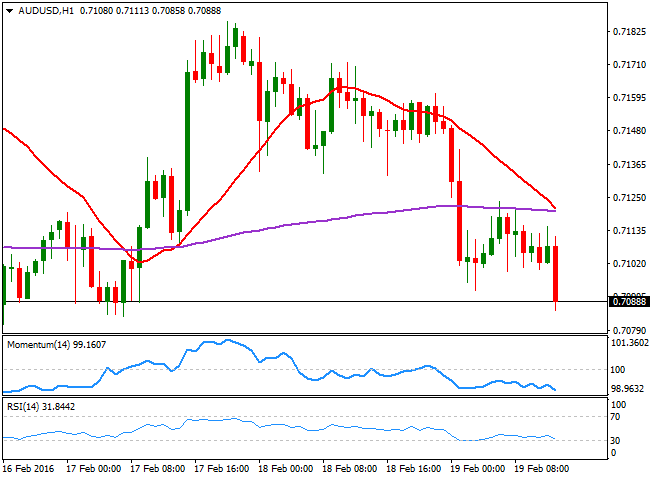

AUD/USD Current price: 0.7089

View Live Chart for the AUD/USD

The AUD/USD pair is pressuring its weekly low around the 0.7080 region, as broad dollar's strength weighs. The risk is towards the downside, with the 20 SMA heading south well above their mid-lines, whilst the technical indicators have turned south near oversold levels. In the 4 hours chart, the technical indicators head south slightly below their mid-lines, as the price battles to extend below its 200 EMA, which may open doors for a sharper decline during the upcoming week.

Support levels: 0.7070 0.7025 0.6980

Resistance levels: 0.7110 0.7145 0.7190

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD gains ground on hawkish RBA, Nonfarm Payrolls awaited

The Australian Dollar continues its winning streak for the third successive session on Friday. The hawkish sentiment surrounding the Reserve Bank of Australia bolsters the strength of the Aussie Dollar, consequently, underpinning the AUD/USD pair.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.