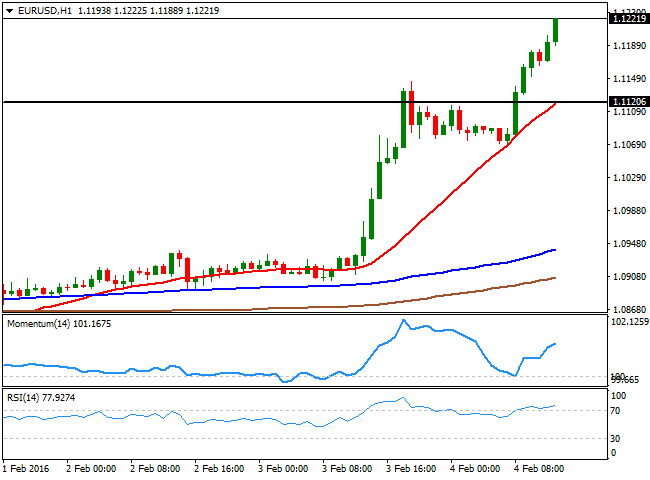

EUR/USD Current Price: 1.1221

View Live Chart for the EUR/USD

The EUR/USD pair extends its advance, trading above the 1.1200 level ahead of the US opening. The market continues selling the greenback without caring much of what else may be happening around, as fears of a US economic slowdown accelerated after yesterday FED Dudley's comments. The US has just released some minor employment reports, with the weekly unemployment claims below previous, but above expected, at 2.255M. Unit labor cost improved during the last quarter of 2015, up by 4.5% against expectations of a 3.9% advance. With a light calendar ahead, the EUR/USD 1 hour chart shows that the 20 SMA is currently around 1.1120, converging with the static support, and a probable buying level in the case of retracements. In the same chart, the technical indicators maintain their bullish slopes, in spite being at overbought levels, with no signs of a downward corrective movement ahead. In the 4 hours chart, the technical indicators head sharply higher in extreme overbought territory, while the moving averages are too far below the current level to be relevant. The rally is poised to continue higher, but considering the upcoming release of the US Nonfarm Payroll report to be release this Friday, majors may enter in a consolidative range.

Support levels: 1.1200 1.1160 1.1120

ReSistance levels: 1.1240 1.1285 1.1320

GBP/USD Current price: 1.4625

View Live Chart for the GBP/USD

The GBP/USD pair posted a limited decline following a dovish BOE, as for the first time since July, all of the nine MPC members voted for keeping rates on hold. Additionally, growth forecast was slashed to 2.2% from previous 2.5%, while the Central Bank has no clear picture on when inflation will reach its 2% target. However, there was no surprise that the BOE joined all of the major Central Banks in the extreme easing bias, since ever since the year started. The pair fell down to 1.4528, meeting support around the 38.2% retracement of the latest daily decline, but quickly recovered. The 1 hour chart shows that the price is above a bullish 20 SMA, while the technical indicators lack directional strength within bullish territory. In the 4 hours chart, the 20 SMA continued advancing far below the current level, while the 200 EMA reinforces the mentioned Fibonacci support by standing at 1.5325. In the same chart, the technical indicators head higher near overbought territory, supporting some further advances towards the recent highs, around 1.4660.

Support levels: 1.4570 1.4530 1.4490

Resistance levels: 1.4660 1.4690 1.4730

USD/JPY Current price: 117.34

View Live Chart for the USD/JPY

The USD/JPY pair resumes its decline this Thursday, as dollar sell-off continues. The pair corrected slightly higher after bottoming at 117.04 last Wednesday, up to 117.70, where a Fibonacci resistance capped the advance. Technically, the downside remains favored, with the 1 hour chart showing that the 100 and 200 SMAs are turning south well above the current level, while the technical indicators head strongly lower within bearish territory. In the 4 hours chart, the technical indicators also maintain their bearish slopes in oversold territory, supporting a retest of the 115.96 January low should the 117.00 level give up. Advances towards the mentioned 117.70 region, will likely be seen as selling opportunities, particularly if stocks in the US fall again.

Support levels: 117.05 116.60 116.20

Resistance levels: 117.70 118.10 118.40

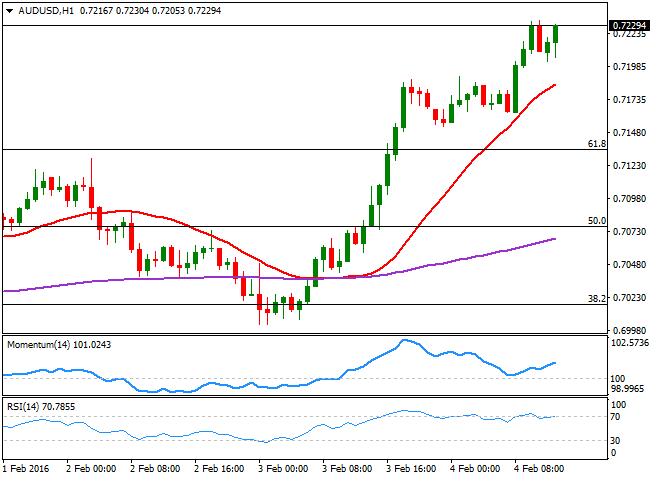

AUD/USD Current price: 0.7229

View Live Chart for the AUD/USD

The AUD/USD soared up to 0.7237 during the Asian session, helped by a strong rally in the Kiwi after better-than-expected employment data in New Zealand. A downward corrective movement briefly sent the pair below 0.7200, but the pair recovered fast as the market keeps selling the greenback. Short term, the 1 hour chart shows that the price continues advanced beyond a strongly bullish 20 SMA, while the technical indicators maintain their bullish strength. In the 4 hours chart, the technical indicators head north in overbought territory, while the moving averages gain bullish slopes below the current level, all of which supports some further advances.

Support levels: 0.7200 0.7160 0.7125

Resistance levels: 0.7245 0.7290 0.7330

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY crashes nearly 450 pips to 155.50 on likely Japanese intervention

Having briefly recaptured 160.00, USD/JPY came under intense selling to test 155.00 on what seems like a Japanese FX intervention underway. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD rallies toward 0.6600 on risk flows, hawkish RBA expectations

AUD/USD extends gains toward 0.6600 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.