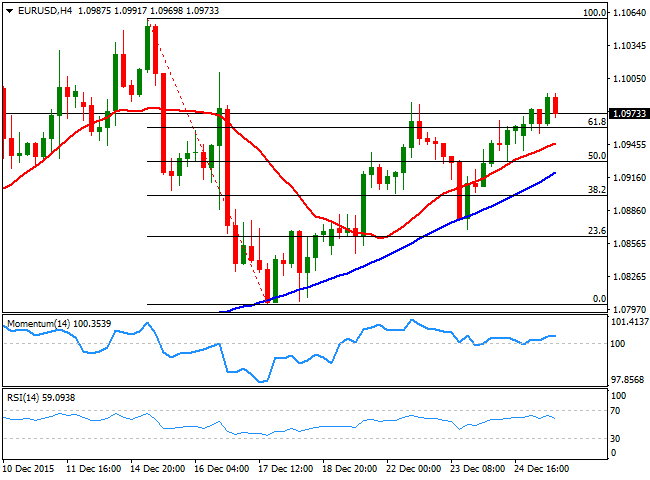

EUR/USD Current price: 1.0972

View Live Chart for the EUR/USD

The EUR/USD pair trades slightly higher this Monday, having reached so far a daily high of 1.0991 ahead of the US opening. The last week of the month is seeing a strong lack of volumes across the financial world, and currencies' pairs trade within tight ranges. With no relevant macroeconomic releases having been published in Europe, and only a minor manufacturing index scheduled for the US afternoon, the 4 hours chart presents a neutral-to-bullish stance, as the price holds above a bullish 20 SMA and above the 61.8% retracement of the latest daily decline, while the technical indicators stand directionless above their mid-lines. During this upcoming days, majors will likely trade in slow motion, with some short lived intraday spikes in between.

Support levels: 1.0955 1.0920 1.0880

Resistance levels: 1.1000 1.1045 1.1090

GBP/USD Current price: 1.4902

View Live Chart for the GPB/USD

The GBP/USD trades near a daily low set at 1.8495 during the European session, having remained capped by the 1.4950 level ever since breaking below it mid December. The pair has been trading within a descendant channel for the past three months, and the pair bounced from the base of it last week when it reached 1.4804, although the bearish tone persists, as the 4 hours chart shows that the price is now standing above a flat 20 SMA while the technical indicators have turned lower above their mid-lines, pointing for a bearish short term move ahead. The limited volume, however, may see the downward potential limited to the 1.4850/60 region, on a break towards fresh lows.

Support levels: 1.4890 1.4860 1.4825

Resistance levels: 1.4920 1.4950 1.4985

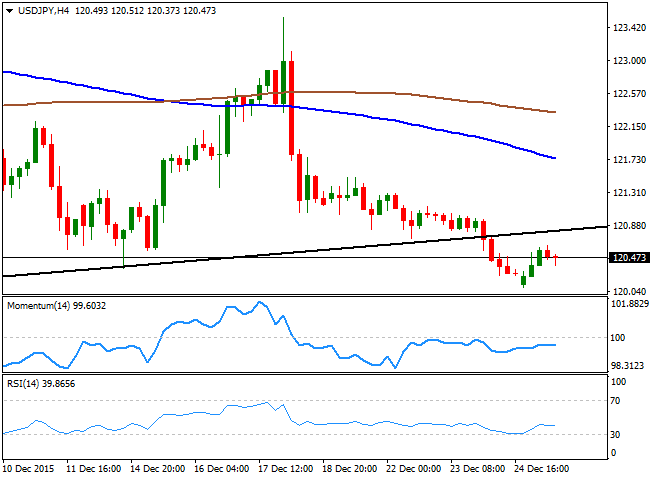

USD/JPY Current price: 120.47

View Live Chart for the USD/JPY

Japan data released at the beginning of the week showed that retail sales disappointed big, falling by 2.5% in November compared to a month before, and down 1.0% yearly basis. Preliminary Industrial Production in the country and for the same month show an improvement yearly basis, up to 1.6%, although the monthly reading came out negative, the first fall in three months. The USD/JPY started the day with a downward gap, falling down to 120.09, but quickly recovered, as buying interest defends the psychological figure. Technically, the pair maintains a bearish tone, after breaking below a daily ascendant trend line coming from August low, now providing a strong resistance around 121.10. Additionally, the 4 hours chart shows that the price is far below its 100 and 200 SMAs, quite bearish , whilst the technical indicators remain within bearish territory. The RSI indictor is the one leading the way, heading lower around 39, although a break below 120.00 is required to confirm additional falls during the upcoming days.

Support levels: 120.35 120.00 119.60

Resistance levels: 120.70 121.10 121.40

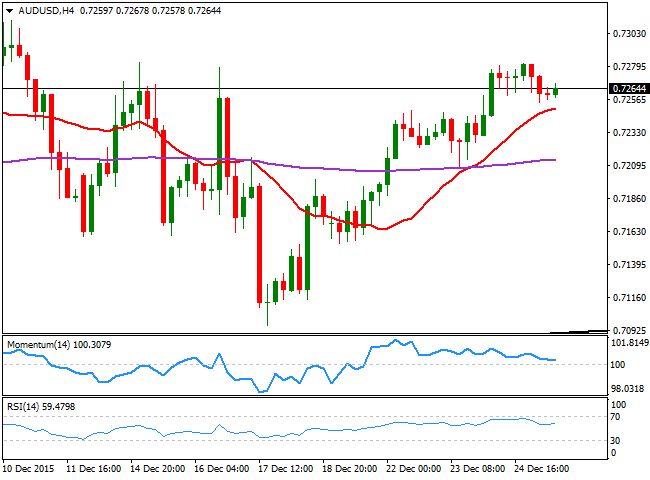

AUD/USD Current price: 0.7265

View Live Chart for the AUD/USD

The Aussie started the day with a positive tone, posting a tepid advance against the greenback during the Asian session. A retracement following London's opening met buyers around 0.7254, keeping the pair near its recent highs. Trading in the red daily basis, the 4 hours chart shows that the price is holding above its 20 SMA and the 200 EMA broken last week, whilst the technical indicators hold above their mid-lines, showing no directional strength. The heavy tone in commodities is set to keep the upside limited, while a key support stands at 0.7240, and it will take a break below it to see a downward move towards 0.7200.

Support levels: 0.7240 0.7200 0.7165

Resistance levels: 0.7280 0.7330 0.7365

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Ethereum plunges outside key range briefly as US Dollar Index gains strength

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.