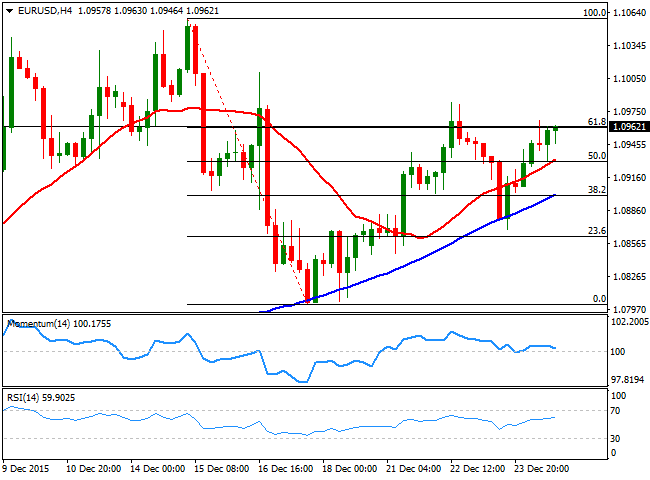

EUR/USD Current price: 1.0962

View Live Chart for the EUR/USD

The dollar edged sharply lower in thin trading and ahead of Friday's holiday, with the EUR/USD pair ending last week at 1.0962, the 61.8% retracement of the 1.1059/1.0802 decline. With another short week ahead, there's even less to expect from financial markets than what they offered last week, as the New Year holiday extends to more countries, and the only relevant data will be the release of the US Consumer confidence and the ECB Monetary Policy Meeting accounts on Thursday. But usually, the market is already on holidays after Christmas, and activity won't resume until early January, with the release of the US Nonfarm Payrolls report.

In the meantime, the common currency is still fighting dollar's strength having recovered above the 1.0880 level, which acted as a strong resistance in the previous days. Nevertheless, the pair is still contained below the 1.1000 level, having been unable to advance beyond it on short lived spikes through it. The 4 hours chart presents a slightly bullish tone, as despite the price is developing above a bullish 20 SMA, the Momentum indicator holds flat right above its 100 level, indicating not enough upward strength at the time being.

Support levels: 1.0955 1.0920 1.0880

Resistance levels: 1.1000 1.1045 1.1090

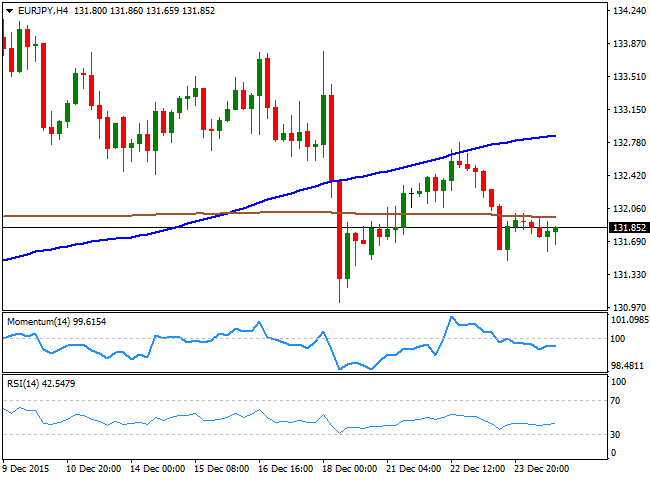

EUR/JPY Current price: 131.85

View Live Chart for the EUR/JPY

The EUR/JPY pair closed last week flat below the 132.00 level, as both the EUR and the JPY advanced in tandem against the greenback. The dollar was under pressure as commodities recovered strongly before the close, and as investors continued to lock in gains ahead of the year-end, leading to limited moves in the EUR/JPY pair. Technically speaking, the downside is still favored as in the 4 hours chart, the price continued developing below its moving averages, whilst the technical indicators lack directional strength, but hold within negative territory. Renewed selling pressure below the 131.00 level, last week low, is still required to confirm a more sustainable bearish move, down to the 128.40 region.

Support levels: 131.40 130.90 130.50

Resistance levels: 132.15 132.60 133.10

GBP/USD Current price: 1.4922

View Live Chart for the GPB/USD

After printing a fresh 8-month low of 1.4804 last week, the GBP/USD pair managed to close the week with some modest gains at 1.4922. Despite the recent recovery, the upside potential in term seems limited, as the daily chart shows that the pair is developing well below a bearish 20 SMA, currently in the 1.5040 region while the technical indicators are correcting oversold readings, but still below their mid-lines. Additionally, the price remains below 1.4950, the level where short term sellers have been surging ever since breaking lower a couple of weeks ago. Shorter term, the 4 hours chart points for some advances for this Monday, as the price holds above a horizontal 20 SMA, and the technical indicators stand in positive territory, although partially losing their upward strength.

Support levels: 1.4890 1.4860 1.4825

Resistance levels: 1.4950 1.4985 1.5010

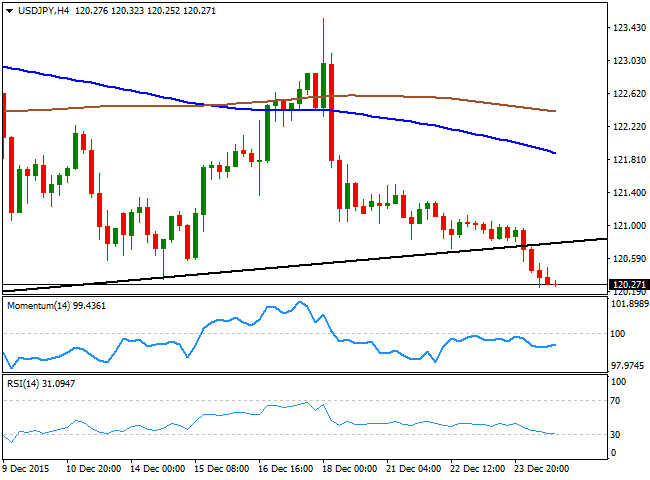

USD/JPY Current price: 120.27

View Live Chart for the USD/JPY

The USD/JPY pair plummeted to its lowest in two months, but more important, it broke below a daily ascendant trend line coming from 116.13, the low posted on Augusts 24th. The Japanese yen has gained strength after the BOJ announced a series of measures to modify its ongoing monetary stimulus programs, which were far less than what market was expecting. The initial reaction was a rally up to 123.50 in the pair, but it was quickly reversed, and seems poised to continue its way south during the upcoming days, given that in the daily chart the technical indicators present clear bearish slopes below their mid-lines, whilst the price extends below its 100 and 200 DMAs. In the 4 hours chart, the technical indicators have lost their bearish strength, but are still well below their mid-lines, whilst the price holds near its lows, and well below its moving averages, all of which maintains the risk towards the downside, particularly on a break below the 120.00 figure, now the immediate support.

Support levels: 120.00 119.60 119.20

Resistance levels: 120.35 120.70 121.00

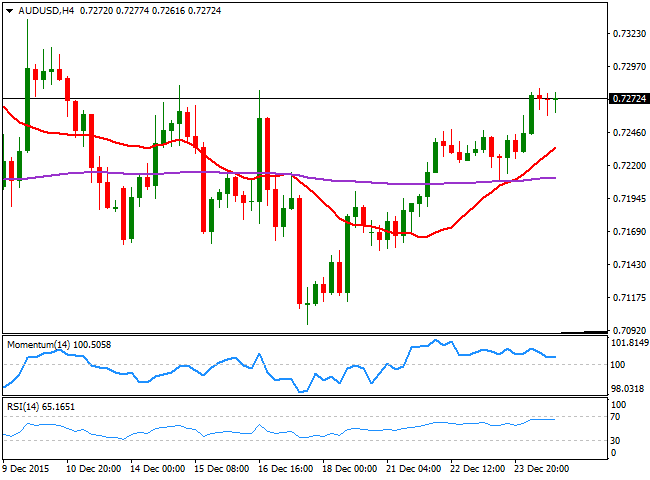

AUD/USD Current price: 0.7272

View Live Chart for the AUD/USD

The Australian dollar ended the week with solid gains at 0.7272, supported by a recovery in commodities prices, particularly base metals. The dollar's broad weakness ahead of the holiday was also due to profit taking and position adjustment ahead of the new year, as markets are expected to maintain extreme low volatility these days. Technically, the daily chart shows that the pair remains within its latest range, contained by a symmetrical triangle which should be finally broken towards the downside to confirm a continuation of the long term bearish trend. In the same chart, the pair is slightly above a flat 20 SMA, while the technical indicators aim higher above their mid-lines, in line with further advances. In the 4 hours chart, the 20 SMA has crossed above the 200 EMA and the price remains well above both, while the technical indicators have turned horizontal within positive territory, rather reflecting the latest range than suggesting a bearish move under way.

Support levels: 0.7240 0.7200 0.7165

Resistance levels: 0.7280 0.7330 0.7365

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD keeps the constructive tone near 1.0800

EUR/USD started the week in a positive note amidst the Dollar’s inconclusive price action, altogether motivating the pair to attempt a move to the proximity of the 1.0800 region, where the 200-day SMA also converges.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.