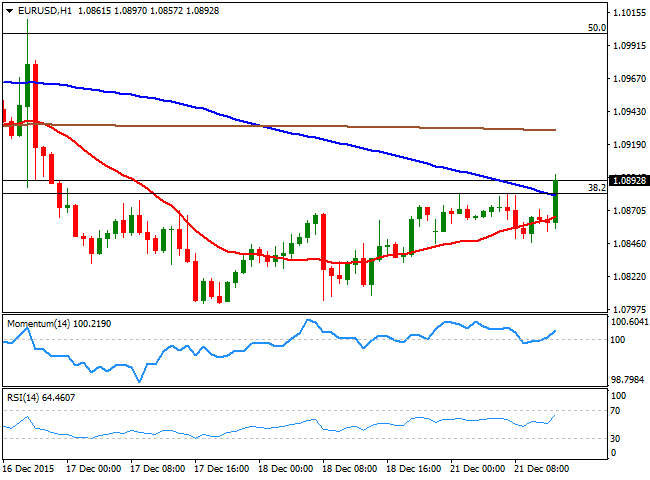

EUR/USD Current price: 1.0892

View Live Chart for the EUR/USD

The market has entered holiday season already, with practically no volumes and a reduced 3-day week due to Christmas eve. Many markets will saw an early close on Thursday, and remain closed on Friday, and is common to see major pairs confined to tight ranges during these two weeks. Nevertheless, the US will release its final review of the third quarter GDP on Tuesday, and Durable Goods Orders on Wednesday, with both probably triggering some short lived moves. As for the EUR/USD pair, the 1 hour chart shows that the price has met selling interest around 1.0880, the 38.2% retracement of the latest monthly decline, but now advances above it, while the technical indicators are heading higher above their mid-lines and the price advances a few pips above a bullish 20 SMA. In the 4 hours chart, the technical indicators are turning slightly higher in neutral territory, whilst the price advances above a bearish 20 SMA, lacking any kind of directional momentum at the time being.

Support levels: 1.0840 1.0790 1.0750

Resistance levels: 1.0915 1.0950 1.1000

GBP/USD Current price: 1.4892

View Live Chart for the GPB/USD

The GBP/USD pair hovers around the 1.4900 level, consolidating its latest losses, and overall bearish despite the ongoing lack of directional strength. The pair trades a handful of pips above the 8-month low posted last week at 1.4863, and the 1 hour chart shows that the price is currently developing below a horizontal 20 SMA, while the technical indicators head slightly lower below their mid-lines. In the 4 hours chart, the price remains well below a bearish 20 SMA, the Momentum indicator has corrected oversold readings and approaches its 100 level from below, while the RSI indicator remains around 38, all of which maintains the risk towards the downside.

Support levels: 1.4860 1.4815 1.4770

Resistance levels: 1.4920 1.4950 1.4995

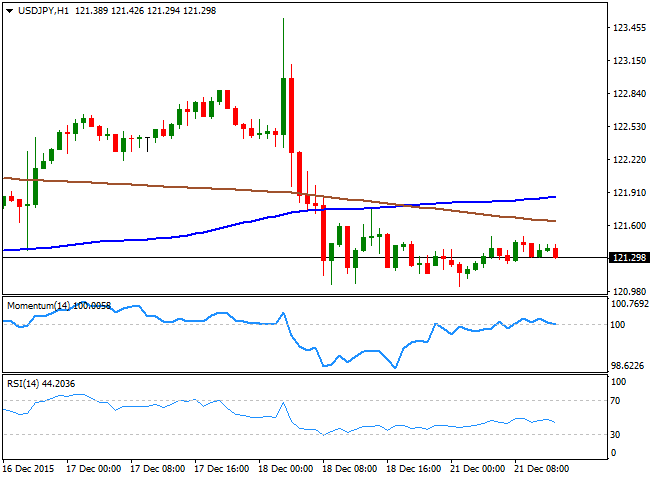

USD/JPY Current price: 121.29

View Live Chart for the USD/JPY

Consolidating near the recent lows. The USD/JPY pair consolidates near its recent lows, achieved after BOJ's announcement to change its facilities programs. The pair is holding around its 100 DMA, but the technical stance is bearish in the longer term, as the recent failure to advance beyond 123.00 and the following slump, point for a downward continuation. Shorter term, and according to the 1 hour chart, the downside is also favored, despite the lack of momentum present, given that the price is below its moving averages, whilst the technical indicators head south around their mid-lines. In the 4 hours chart, the bearish tone is clearer, given that the price develops well below its moving averages, whilst the technical indicators maintain their bearish slopes within negative territory. Nevertheless, a clear break below 121.05 is required to confirm additional declines that can extend down to 120.30 before meeting buying interest.

Support levels: 121.05 120.60 120.30

Resistance levels: 121.70 122.20 122.66

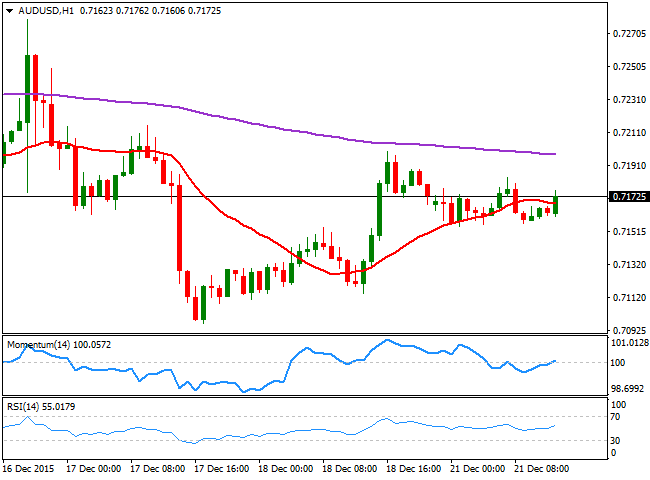

AUD/USD Current price: 0.7171

View Live Chart for the AUD/USD

The AUD/USD pair trades flat around its daily opening, also showing no aims to go far away from it. The Australian calendar will remain pretty much empty this week, which means markets' direction will depend solely on the USD. Technically speaking and in the short term, the downside seems limited as the technical indicators have crossed their mid-lines towards the upside, whilst the price advances above its 20 SMA. In 4 hours chart, however, the technical picture is flat and will remain so as long as the 0.7150/0.7200 range persists.

Support levels: 0.7150 0.7120 0.7070

Resistance levels: 0.7200 0.7240 0.7280

-------

What will 2016 bring to the Forex traders? Attend our event, Forex Forecast 2016 - The Panel with Ashraf Laidi, Valeria Bednarik, Boris Schlossberg, Adam Button, Ivan Delgado and Dale Pinkert. Register for the live event on Dec. 18th and get the recording too.

-------

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.