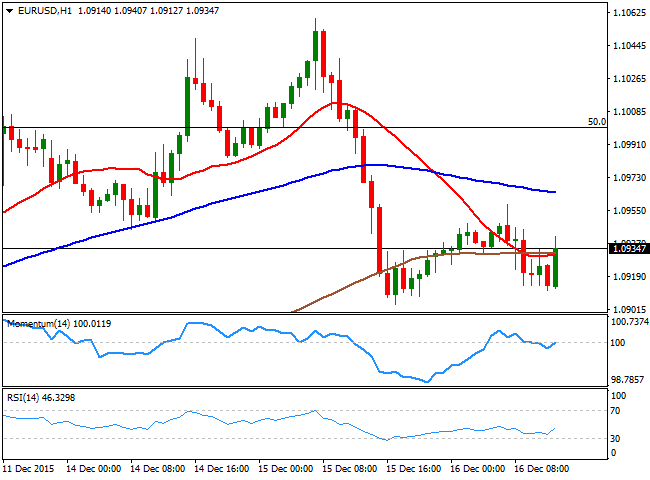

EUR/USD Current price: 1.0934

View Live Chart for the EUR/USD

The American dollar trades higher ahead of the FED's latest meeting outcome, advancing mostly on sentiment rather than anything else. The pair traded as low as 1.0911 and recovered a handful of pips above the level, with the greenback holding into gains after the release of solid housing data. According to official data, new-home construction climbed 10.5% in November, to a 1.17 million annualized rate. The EUR/USD 1 hour chart shows that the price is currently struggling around the 20 SMA, which stands flat and converges with the 200 SMA, while the technical indicators aim slightly higher around their mid-lines. In the 4 hours chart, the price is below its 20 SMA, while the technical indicators hold horizontal below their mid-lines, maintaining the risk towards the downside. Nevertheless, whatever Yellen decides is what's going to determinate the pair's upcoming moves; a rate hike may have been already priced in, but that does not implies the dollar can't run. Overall, it's the market belief that what will decide the future of the greenback is any announcement regarding future movements.

Support levels: 1.0910 1.0880 1.0830

Resistance levels: 1.0950 1.0990 1.1045

GBP/USD Current price: 1.5032

View Live Chart for the GPB/USD

The GBP/USD pair is recovering ahead of the US opening, recovering from the daily low of 1.4981, reached after the release of the UK employment figures, showing a strong setback in wages. Wage growth excluding bonuses fell to 2.0% from 2.4%YoY while including bonuses fell to 2.4% from a previous 3.0% also YoY. The number of people filing for unemployment rose more than expected, although the unemployment rate fell to 5.2%. The 1 hour chart shows that dips below the 1.5000 figure are resulting in quick bounces, as short term buying interest surges, but that the general tone is still bearish for the pair, given that it holds below a bearish 20 SMA, while the technical indicators remain in negative territory. In the 4 hours chart, the bearish tone is even clearer, given that the pair is below a bearish 20 SMA, while the technical indicators maintain their strong bearish slopes below their mid-lines.

Support levels: 1.4980 1.4940 1.4890

Resistance levels: 1.5050 1.5090 1.5135

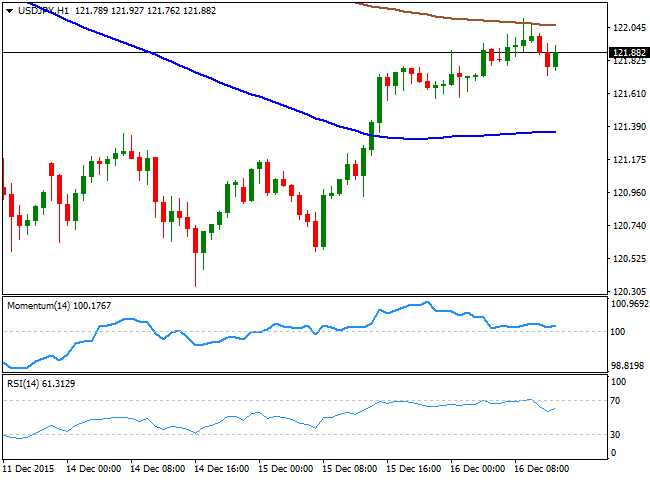

USD/JPY Current price: 121.90

View Live Chart for the USD/JPY

Nearing critical resistance at 122.20. The USD/JPY pair flirts with the 122.00 level this Wednesday, having extended its rally during the Asian session on hopes the US will raise rates and therefore favor some dollar demand. Despite the upcoming directional move will depend solely on how the market reacts to the FED, the technical picture is mildly positive in the short term, as in the 1 hour chart, the price extended further above its 100 SMA, and pressures the 200 SMA around the mentioned 122.00 figure. In the same chart however, the technical indicators have lost their upward strength and turned lower above their mid-lines. In the 4 hours chart, the price remains below its moving average, while the technical indicators lack directional strength, well above their mid-lines. The level to watch to confirm further gains is 122.20, as the level has been a major support for most of the past two months, and a break above it should revert the ongoing bearish tone.

Support levels: 121.70 121.30 121.00

Resistance levels: 122.20 122.60 123.00

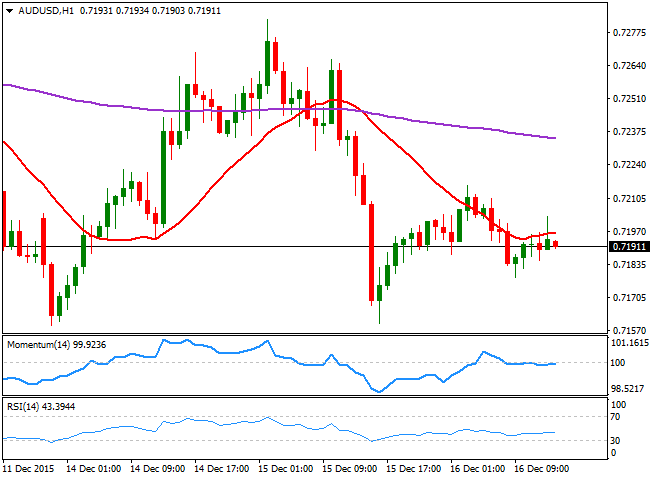

AUD/USD Current price: 0.7191

View Live Chart for the AUD/USD

The AUD/USD pair trades flat daily basis, right below the 0.7200 figure and mostly range bound, as investors wait for the US Central Bank. Gold prices are recovering strongly ahead of the news, limiting the downside for the Aussie, as investors square positions ahead of the event. Technically speaking, the short term outlook is neutral, given that the price is now below a flat 20 SMA while the technical indicators head nowhere around their mid-lines. In the 4 hours chart, the technical indicators are biased lower around their mid-lines, while the price remains below its 20 SMA, with only a recovery above 0.7240 opening doors for further recoveries.

Support levels: 0.7160 0.7125 0.7090

Resistance levels: 0.7240 0.7285 0.7335

-------

What will 2016 bring to the Forex traders? Attend our event, Forex Forecast 2016 - The Panel with Ashraf Laidi, Valeria Bednarik, Boris Schlossberg, Adam Button, Ivan Delgado and Dale Pinkert. Register for the live event on Dec. 18th and get the recording too.

-------

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD extends its upside above 0.6600, eyes on RBA rate decision

The AUD/USD pair extends its upside around 0.6610 during the Asian session on Monday. The downbeat US employment data for April has exerted some selling pressure on the US Dollar across the board. Investors will closely monitor the Reserve Bank of Australia interest rate decision on Tuesday.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold bears take action on mixed signals from US economy

Gold price fell more than 2% for the second consecutive week, erased a small portion of its losses but finally came under renewed bearish pressure. The near-term technical outlook points to a loss of bullish momentum as the market focus shifts to Fedspeak.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.