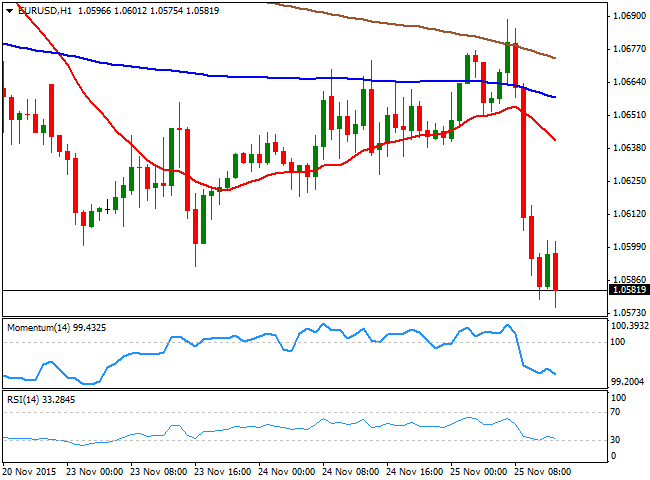

EUR/USD Current price: 1.0581

View Live Chart for the EUR/USD

After a limited upward move at the beginning of the day, the EUR/USD pair plummeted to a fresh 7-month low of 1.0578, on renewed speculation the ECB will extend its facilities programs next December. Local share markets jumped, commodities eased, and the common currency plunged across the board. The pair bounced back towards the 1.0600 level, but was unable to recover the level ahead of the release of US data. The ECB is having its an economic policy meeting next week, and investors are considering that even negative rates can be announced then. In the US, Durable Goods Orders in October beat expectations, rising 3.0% from a previous 1.2% decline, while weekly unemployment claims fell to 260K, against 270K expected. Core PCE remained muted at 1.3%, while personal spending grew less than expected in the same month.

Nothing shockingly positive, yet all dollar supportive: the EUR/USD pair extended its decline down to 1.0575 and maintains a strong bearish tone in the short term, as in the 1 hour chart, the price is well below its moving averages, whilst the technical indicators head sharply lower near oversold levels. In the 4 hours chart, the technical indicators head south below their mid-lines, whilst the price is currently developing below a mild bearish 20 SMA, supporting further declines towards 1.0550 in the short term, but eyeing the year low of 1.0460 for the upcoming days.

Support levels: 1.0550 1.0520 1.0490

Resistance levels: 1.0590 1.0630 1.0660

GBP/USD Current price: 1.5092

View Live Chart for the GPB/USD

The Pound suffered a strong set back early Wednesday, hit by policymakers comments in the Autumn Statement, an update of the economic outlook and a preview of the government budget for 2016. The GBP/USD pair initially fell down to 1.5058 after failing to extend beyond 1.5115 earlier on the day, as a rate hike in the UK is depending on what the FED will do and when. The pair however, later bounced as 2016 GDP growth forecast was raised to 2.4% from 2.3%, but remains below the 1.5100 level. Technically, the 1 hour chart shows that the price is back above its 20 SMA, whilst the technical indicators recovered positive territory, suggesting strong buying interest defending the 1.5000 mark. In the 4 hours chart, however, the technical picture is still quite bearish, with the price below a strongly bearish 20 SMA, and the technical indicators barely bouncing from oversold levels, implying limited upward potential for the upcoming hours.

Support levels: 1.5050 1.5010 1.4980

Resistance levels: 1.5135 1.5160 1.5190

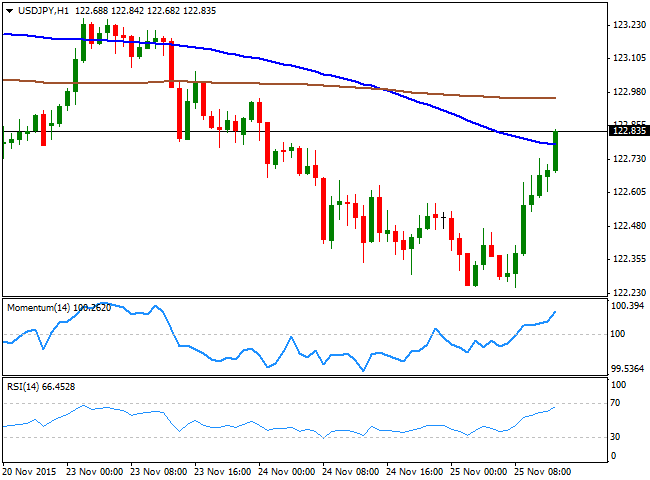

USD/JPY Current price: 122.85

View Live Chart for the USD/JPY

Recovering from key support. The USD/JPY pair started the day falling down to 122.25, a few pips above the base of these last 3-weeks range, but bounced over 60 pips as risk sentiment pushed stocks sharply higher, and the 1 hour chart shows that the price is back approaching the 123.00 level, with the price above its 100 SMA and the technical indicators heading south above their mid-lines. In the 4 hours chart, the technical indicators turned higher, but remain below their mid-lines, whilst the price is aiming to recover above its 100 SMA. Should the ongoing rally extend beyond 123.00, the pair can continue advancing, moreover it US stocks follow their European counterparts, towards the recent highs set at 123.70/80.

Support levels: 122.60 122.20 121.70

Resistance levels: 123.00 123.40 123.75

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Australian Dollar maintains ground amid subdued US Dollar, US Nonfarm Payrolls awaited

The Australian Dollar rises on hawkish sentiment surrounding the RBA prolonging higher interest rates. Australia’s central bank is expected to maintain its current rate at 4.35% until the end of September. US Nonfarm Payrolls is expected to print a reading of 243K for April, compared to 303K prior.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold bears take action on mixed signals from US economy

Gold price fell more than 2% for the second consecutive week, erased a small portion of its losses but finally came under renewed bearish pressure. The near-term technical outlook points to a loss of bullish momentum as the market focus shifts to Fedspeak.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.