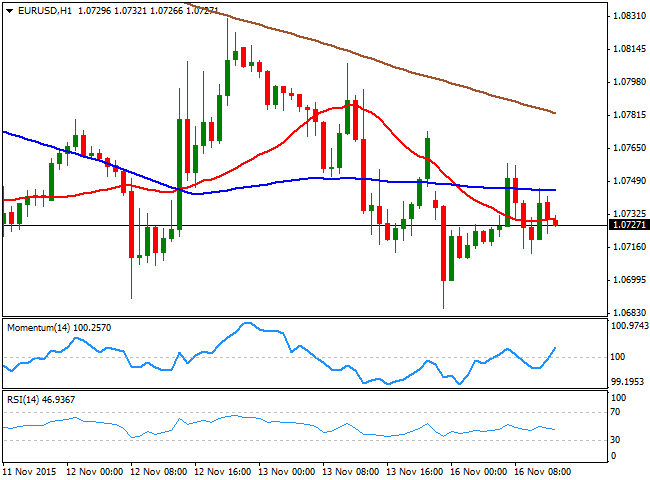

EUR/USD Current price: 1.0726

View Live Chart for the EUR/USD

The EUR/USD pair traded as low as 1.0685 this Monday, with markets being driven by risk sentiment at the beginning of the week, amid the terrorist attacks in France last Friday. Safe havens edged higher with gold and the JPY being the most benefited, during the Asian session. The EUR/USD pair advanced up to 1.0757 during the London session, but was unable to extend beyond it, and consolidates in a quiet range ahead of the US opening. With little macroeconomic news doing the rounds, the 1 hour chart for the pair shows that there's no directional strength, as the price is well below its 100 and 200 SMAs, whilst the RSI indicator hovers around 47. In the 4 hours chart, a horizontal 20 SMA caps the upside around the mentioned daily high, whilst the technical indicators remain stuck around their mid-lines. The pair has been trading in between 1.0670 and 1.0810 for over a week already, which means only some clear break of those extremes will open doors for some directional moves during the upcoming sessions.Support levels: 1.0715 1.0670 1.0630

Resistance levels: 1.0760 1.0810 1.0850

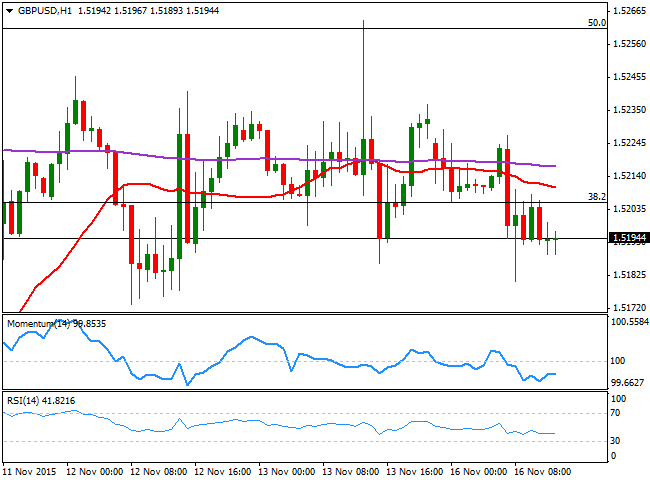

GBP/USD Current price: 1.5194

View Live Chart for the GPB/USD

The GBP/USD pair trades lower in range, unable to recover firmly above the 1.5200 figure, but holding nearby a few pips below it. The British Pound gapped slightly lower at the weekly opening, but the market filled it pretty fast before turning slightly lower. Short term, the 1 hour chart shows that the price is trading below a horizontal 20 SMA, and below the 38.2%retracement of its latest bearish move, while the technical indicators head nowhere below their mid-lines. In the 4 hours chart, the 20 SMA converges with the mentioned Fibonacci resistance around 1.5215, offering an immediate strong resistance, whilst the technical indicators lack directional strength in neutral territory. The pair has held above the 1.5160 region ever since recovering above it mid last week, which means a break below it is required to confirm additional slides this Monday.

Support levels: 1.5160 1.5120 1.5070

Resistance levels: 1.5215 1.5265 1.5310

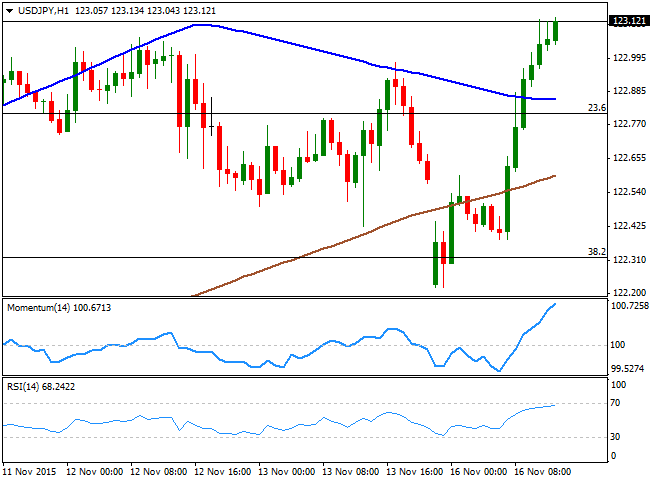

USD/JPY Current price: 123.12

View Live Chart for the USD/JPY

Bullish above 123.55. The Japanese yen started the day advancing against most of its major rivals amid risk sentiment leading the way, with the USD/JPY falling down to 122.21. The currency however, changed course after the release of the latest GDP figures, showing that the economy contracted in the third quarter. Gross domestic product declined an annualized 0.8% in the three months to September, well beyond the 0.2% contraction forecasted. The negative reading fueled hopes of a QE extension in Japan, leading to a steady advance in the pair beyond the 123.00 level. Technically, the 1 hour chart shows that the price is well above its 100 and 200 SMAs, whilst the Momentum indicator continues heading higher above its 100 level, and the RSI indicator losses upward strength near overbought territory. In the 4 hours chart, the technical indicators have lost their upward momentum after crossing their mid-lines towards the upside, which at least should keep the downside limited during the upcoming hours. Should the price extend beyond last week high of 123.56, the pair has room to extend its advance up to 124.40, in route to the 125.80 year high.

Support levels: 122.80 122.30 122.00

Resistance levels: 123.55 123.90 124.40

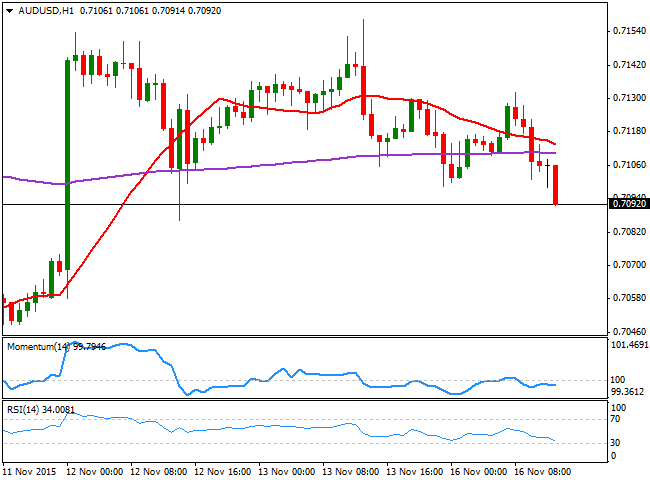

AUD/USD Current price: 0.7092

View Live Chart for the AUD/USD

The Australian dollar is breaking lower against the greenback ahead of the US opening, somehow weighed by a plunging NZD and an easing gold. The AUD/USD pair trades below the 0.7100 level, and the 1 hour chart shows that the 20 SMA is gaining bearish strength above the current level, while the technical indicators present a neutral-to-bearish stance, turning lower in negative territory. In the 4 hours chart, the price is now below a bullish 20 SMA, whilst the technical indicators head south below their mid-lines, in line with a continued decline, particularly on a break below 0.7070, the immediate support.

Support levels: 0.7070 0.7030 0.6990

Resistance levels: 0.7150 0.7190 0.7240

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.