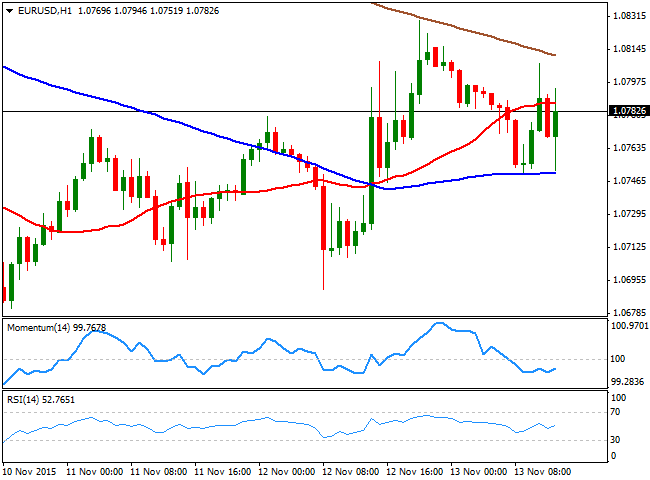

EUR/USD Current price: 1.0787

View Live Chart for the EUR/USD

The American dollar traded generally lower at the beginning of the day, despite European data fail to inspire confidence in the region. The release of the third quarter GDP figures showed that, seasonally adjusted, the EU grew less than expected, up by 0.3% against a forecast of 0.4%. Earlier in the day, German GDP came in line with expectations, for the same period. The EU trade balance recorded a €20.5B surplus in September 2015, improving from the previous reading, and beating expectations. The EUR/USD pair advanced up to 1.0807, but retreated down to its comfort zone around 1.0750/60 ahead of the release of US data. In the world's largest economy, Retail Sales in October missed expectations monthly basis, up by 0.1% compared to expectations of a 0.3% advance. Also, the producer price index declined by 1.6% in the same month and compared to a year before, far worse than expected.The EUR/USD pair spiked after the news, approaching the mentioned daily high ahead of the US opening, although still unable to confirm further gains. In the 1 hour chart, the price is unable to advance above its 20 SMA, while the technical indicators have turned higher below their mid-lines, enough, however, to keep the downside limited. In the 4 hours chart the price is holding above a horizontal 20 SMA, while the technical indicators are holding above their mid-lines, in line with the shorter term picture. Additional gains beyond 1.0810 may see the pair rallying up to 1.0890, particularly if the upcoming US data continues disappointing. Nevertheless, it would take more than a 200 pips recovery to affect the dominant bearish trend.

Support levels: 1.0745 1.0690 1.0650

Resistance levels: 1.0810 1.0850 1.0890

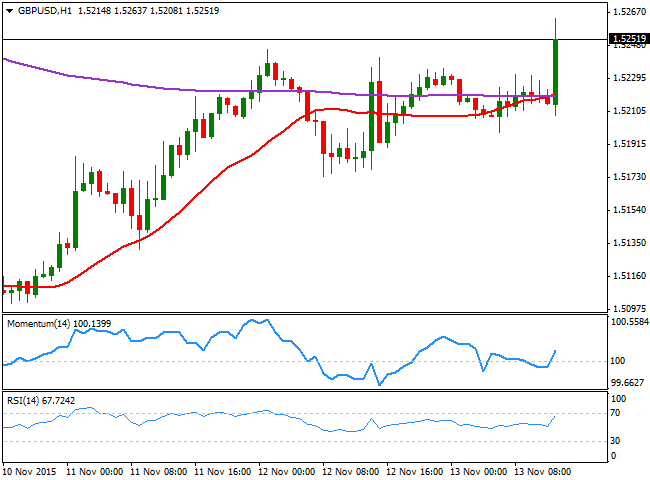

GBP/USD Current price: 1.5253

View Live Chart for the GPB/USD

The GBP/USD pair consolidated its gains in the 1.5220 region for most of the European morning, breaking through its previous weekly high and setting a fresh one at 1.5262 right after the release of soft US inflation and sales data. The pair has been advancing steadily this week, ever since bottoming around 1.5026 last Friday, and the short term technical picture favors the upside, given that in the 1 hour chart, the price has extended above its 20 SMA, whilst the technical indicators head higher around their mid-lines. In the 4 hours chart, the price is advancing above a bullish 20 SMA, whilst the technical indicators are recovering their bullish slopes after a downward corrective movement towards their mid-lines, all of which supports some further gains, particularly on a break above 1.5260, and towards 1.5305, the 200 EMA in this last time frame.

Support levels: 1.5220 1.5195 1.5160

Resistance levels: 1.5260 1.5305 1.5340

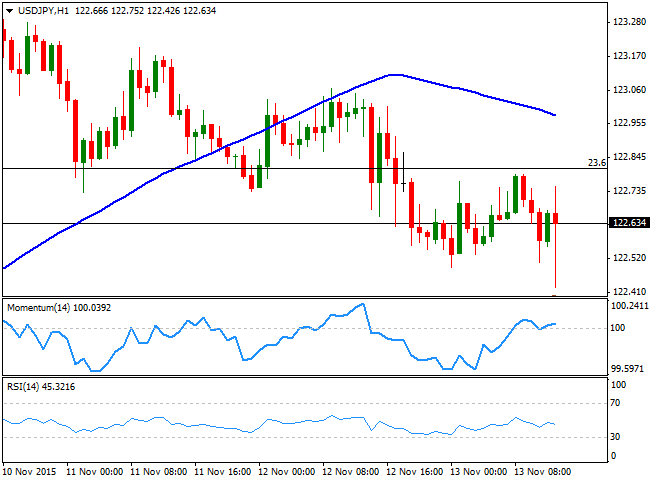

USD/JPY Current price: 122.64

View Live Chart for the USD/JPY

The Japanese yen advanced further during the Asian session, helped by a strong decline in commodities and stocks all across the world. Also, the Economics Minister Akira Amari said on Friday that he is not considering extend the ongoing stimulus to stimulate growth, which may result in further JPY gains should chances of a rate hike in the US diminish somehow, during the upcoming days. The pair fell down to 122.42 following the release of worse-than-expected US Retail Sales and PPI figures, but managed to bounce pretty fast. Anyway, the 1 hour chart shows that the price found some buying interest around its 200 SMA, whilst the technical indicators head in neutral territory, lacking directional strength. in the 4 hours chart, the technical indicators lack directional strength, but stand below their mid-lines, in line with the ongoing bearish tone.

Support levels: 122.40 122.10 121.75

Resistance levels: 122.80 123.10 123.45

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

Ethereum traders show uncertainty following huge whale sale, Robinhood Crypto Wells notice

Ethereum holdings on centralized exchanges continue to decline despite recent whale sales. With Robinhood Crypto as the latest recipient of the SEC's Wells notice, Ethereum spot ETFs look more unlikely.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.