EUR/USD Current price: 1.0931

View Live Chart for the EUR/USD

Investors are still digesting the latest FED's announcement this Thursday, with most of the major pair consolidating yesterday's move. The dollar has posted limited downward corrective movements during the European morning, but for the most held to its recent gains. In the US, the advanced GDP for the third quarter came out at 1.5%, in line with the 1.6% forecast, whilst weekly unemployment claims were slightly better-than-expected, up to 260K from the 263K expected. In Europe, consumer confidence remained unchanged in October matching previous -7.7, whilst German inflation came out better than expected in October. Nevertheless, the technical picture is still bearish, as the 1 hour chart shows that the price is now struggling around a bearish 20 SMA, whilst the Momentum indicator is now flat around its mid-line and the RSI consolidates around 40. In the 4 hours chart, the price is well below its 20 SMA, whilst the technical indicators have resumed their declines well into negative territory, pointing for some further declines on a break below 1.0880, the immediate support.Support levels: 1.0880 1.0840 1.0800

Resistance levels: 1.0960 1.1000 1.1045

GBP/USD Current price: 1.5245

View Live Chart for the GPB/USD

The UK released its money data early Europe, showing that business lending decreased in October, whist mortgage lending came out at 68.874K against previous 71.03K, but overall strong. The pair however, has extended its decline to fresh lows after the release of US data, challenging the 1.5250 support and with the technical picture in line with a bearish continuation, given that the price is below a bearish 20 SMA, whilst the technical indicators head lower below their mid-lines. In the 4 hours chart, the technical outlook also favors the downside with the 20 SMA heading lower around 1.5300 and the technical indicators lacking directional strength near oversold territory.

Support levels: 1.5210 1.5170 1.5130

Resistance levels: 1.5285 1.5320 1.5355

USD/JPY Current price: 121.04

View Live Chart for the USD/JPY

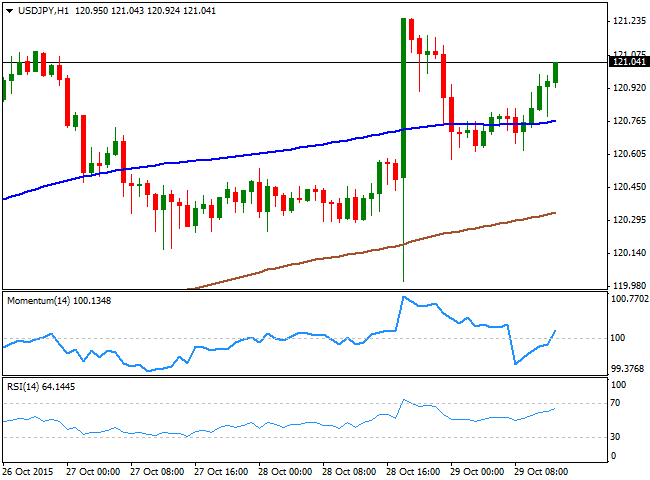

Waiting for the BOJ. The USD/JPY pair holds pretty much unchanged intraday, hovering below the 121.00 and barely reacting to US news, as investors are waiting for the BOJ meeting outcome at the beginning of Friday. Market has been largely expecting an extension of stimulus in Japan, which means the pair will hardly move to far away from the current levels. The technical outlook is bullish in the short term, as the price is advancing above its 100 SMA, whilst the technical indicators head sharply higher above their mid-lines. In the 4 hours chart, the technical picture also favors the upside, albeit selling interest will likely contain rallies around 121.40 ahead of the upcoming Asian session.

Support levels: 121.00 120.70 120.30

Resistance levels: 121.40 121.75 122.10

AUD/USD Current price: 0.7073

View Live Chart for the AUD/USD

The AUD/USD pair trades at fresh weekly lows, as dollar momentum extends despite data. Stocks trading higher and gold under pressure are weighing in the pair, which seems poised to retest the critical 0.7000 figure. Technically, the 1 hour chart shows that the price is accelerating below a strongly bearish 20 SMA, whilst the technical indicators head lower below their mid-lines. In the 4 hours chart, the technical indicators have resumed their declines, despite being in oversold levels, supporting a bearish continuation for this Thursday.

Support levels: 0.7035 0.6990 0.6955

Resistance levels: 0.7125 0.7160 0.7195

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

USD/JPY snaps three-day losing streak above 153.50, Yellen counsels caution on currency intervention

The USD/JPY pair snap a three-day losing streak during the Asian trading hours on Monday. The uptick of the pair is bolstered by the modest rebound of the US Dollar and US Treasury Secretary Janet Yellen’s comments on potential Japanese interventions last week.

Gold holds below $2,300, Fedspeak eyed

Gold price loses its recovery momentum around $2,295 on Monday during the early Asian session. Investors will keep an eye on Fedspeaks this week, along with the first reading of the US Michigan Consumer Sentiment Index for May on Friday.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.