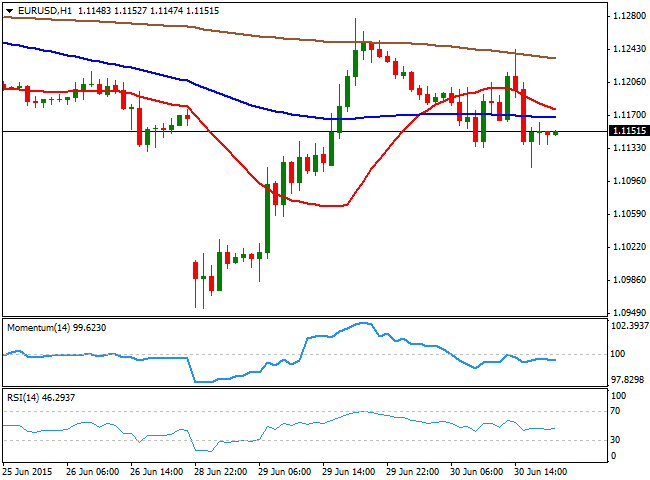

EUR/USD Current price: 1.1149

View Live Chart for the EUR/USD

The common currency gave back part of its Monday's gains, ending the day around the 1.1150 level against the greenback, after another round of speculations and rumors surrounding Greece. The day started with tepid data coming from Europe, as German Retail sales grew 0.5% in May compared to a month before, but the annual reading resulted at -0.4% against expectations of a 2.5% raise. Unemployment in the country fell less than expected in June, whilst annual inflation in the EU matched expectations of 0.2%. Nevertheless, the market was all about the Greek drama, with the default of the country on the IMF driving the pair down to 1.1133 earlier in the day. As the day developed, news shown that Athens submitted a request to the ESM for a two-year agreement to cover the country’s financing needs and including a debt restructuring at the same time, but German Chancellor Angela Merkel opposed talking up a deal before the July 5th referendum.

The pair sunk by London close down to 1.1111, maintaining a heavy tone in the short term, ahead of the Asian opening. The 1 hour chart shows that the intraday recovery was again contained by the 200 SMA, whilst the 20 SMA turned lower above the current price and that the technical indicators present mild bearish slopes below their mid-lines. In the 4 hours chart, however, the price is barely below its 20 SMA, whilst the moving averages continue to hover around their mid-lines, lacking directional strength at the time being.

Support levels: 1.1120 1.1080 1.1050

Resistance levels: 1.1160 1.1210 1.1245

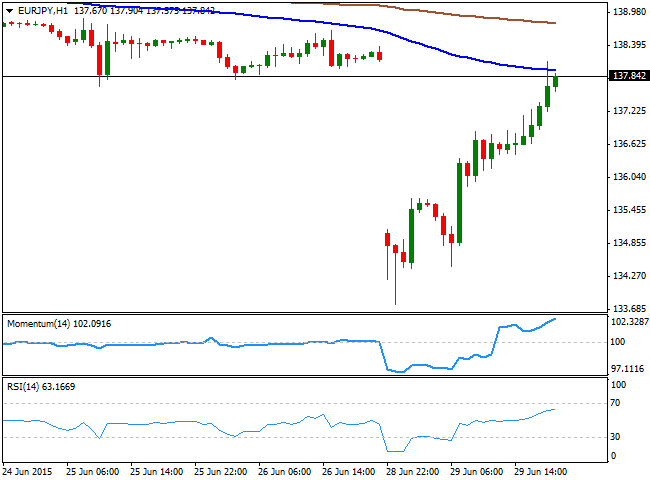

EUR/JPY Current price: 136.36

View Live Chart for the EUR/JPY

The Japanese yen advanced against the common currency, with the EUR/JPY closing the day around 136.30, mostly on EUR weakness. The 1 hour chart shows that the pair found sellers around a bearish 100 SMA, currently around 137.40, while the technical indicators stand below their mid-lines, lacking directional momentum. In the 4 hours chart, the downside is also favored, as the price holds below its moving averages, whilst the RSI indicator anticipated additional declines around 39 and the Momentum indicator holds flat below the 100 level. A break below 135.80, the daily low, is required to confirm a downward continuation in the pair down to the 134.90/135.00 price zone.

Support levels: 135.80 135.35 134.90

Resistance levels: 136.40 136.90 137.50

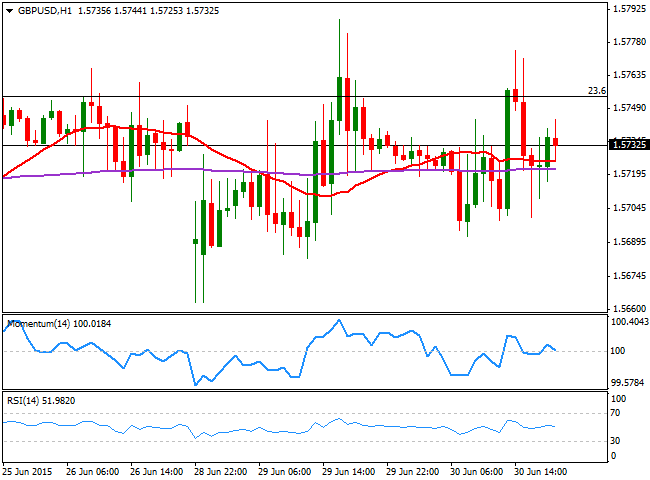

GBP/USD Current price: 1.5732

View Live Chart for the GBP/USD

The British Pound continues to trade range bound against its American data, despite encouraging UK GDP figures: the economy grew more than initially estimated, up to 0.4% from previous 0.3% in the first quarter of this 2015. The pair surged briefly up to 1.5774 on speculation that negotiations resumed in Europe, but was unable to sustain gains above the 1.5750 Fibonacci figure. In fact, the pair has posted a lower high daily basis, suggesting selling interest on advances is still strong. Technically, the 1 hour chart shows that the price hovers around a flat 20 SMA, whilst the technical indicators show no directional momentum in neutral territory. In the 4 hours chart, the technical picture is also neutral, as the technical indicators are unable to move away from their mid-lines. The critical support continues to be 1.5645, the 38.2% retracement of the 1.5189/1.5929 daily run, and it will take a break below it to confirm a new leg lower, towards the 1.5550 price zone, 50% retracement of the same rally.

Support levels: 1.5695 1.5645 1.5610

Resistance levels: 1.5750 1.5795 1.5830

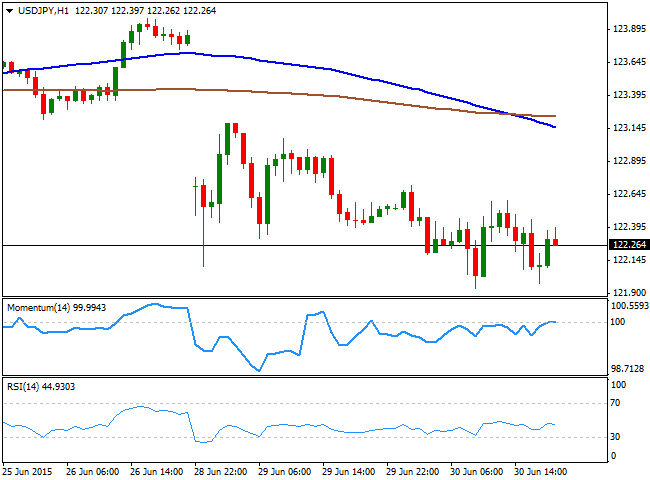

USD/JPY Current price: 122.26

View Live Chart for the USD/JPY

The USD/JPY fell down to 122.10 intraday, still under pressure on the yen's safe-haven condition. The pair however, should trade in a more limited range now, ahead of the release of the US Nonfarm Payroll report next Thursday. Anyway, the short term picture favors additional declines, as in the 1 hour chart, the 100 SMA crossed below the 200 SMA well above the current level, whilst the technical indicators are retreating from their mid-lines, after failing to recover above them. In the 4 hours chart, the Momentum indicator heads sharply lower in negative territory, whilst the RSI aims lower around 35 as the price remains below its moving averages, all of which supports the shorter term view. A downward acceleration below the 122.00 level should lead to a quick decline down to 121.60, whilst below this last, 121.20, the 100 DMA comes as the next probable bearish target.

Support levels: 122.00 121.60 121.20

Resistance levels: 122.90 123.30 123.75

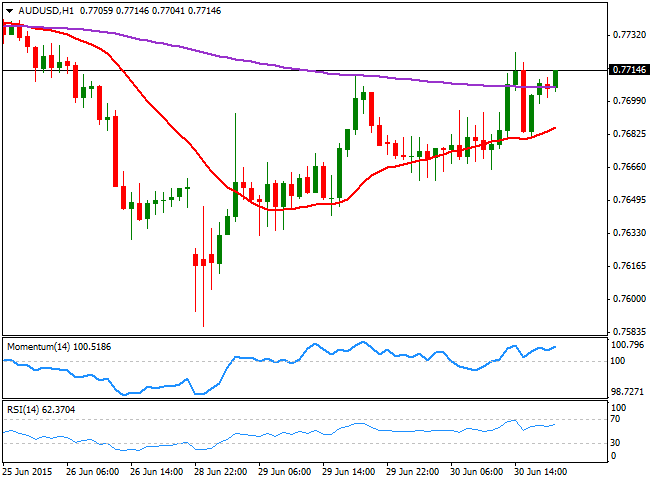

AUD/USD Current price: 0.7710

View Live Chart for the AUD/USD

The Australian dollar advanced for a second day in-a-row against its American rival, and the AUD/USD pair advanced above the 0.7700 figure by the US close. The Aussie was on demand ever since the day started on NZD weakness, although the latest rally needs to survive the upcoming releases of Chinese PMIs during the Asian session. If the figures result disappointing the AUD will likely give back its latest gains. Technically, the 1 hour chart shows that the price has found support in a mild bullish 20 SMA, currently around 0.7690, while the technical indicators are losing their upward strength near overbought levels. In the 4 hours chart, the price advanced well above a still bearish 20 SMA, whilst the technical indicators are also losing their upward strength above their mid-lines. In this last time frame, the 200 EMA stands at 0.7750, offering a strong dynamic resistance in the case of a new leg up.

Support levels: 0.7690 0.7640 0.7590

Resistance levels: 0.7720 0.7750 0.7780

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 ahead of US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The US Dollar holds its ground following the Fed-inspired decline as market focus shifts to mid-tier US data releases.

GBP/USD holds steady above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside ahead of Unit Labor Costs and Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.