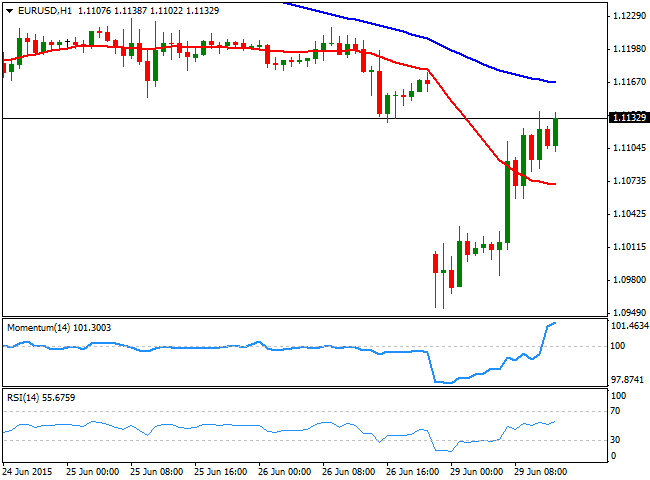

EUR/USD Current price: 1.1132

View Live Chart for the EUR/USD

The EUR/USD pair recovered most of its early day losses, trading above the 1.1100 figure ahead of the US opening, having almost filled the weekly opening gap. A Grexit became real over the weekend, triggering risk-adverse trading in the forex market: the Japanese Yen and the Swiss Franc were on demand, but the latest reverted temporarily its gains as the SNB intervene the market to prevent Swissy strength. Nevertheless, both the EUR and the CHF continue advancing against the greenback, with the EUR/USD pair trading near its daily high. The short term technical picture favors the upside, as the price has extended above its 20 SMA whilst the technical indicators aim higher near overbought levels. In the 4 hours chart, the 20 SMA caps the upside around 1.1160, whilst the technical indicators have corrected extreme oversold readings, and are now turning slightly lower in negative territory, suggesting further advances will likely remain limited.

Support levels: 1.1090 1.1050 1.1010

Resistance levels: 1.1160 1.1200 1.1245

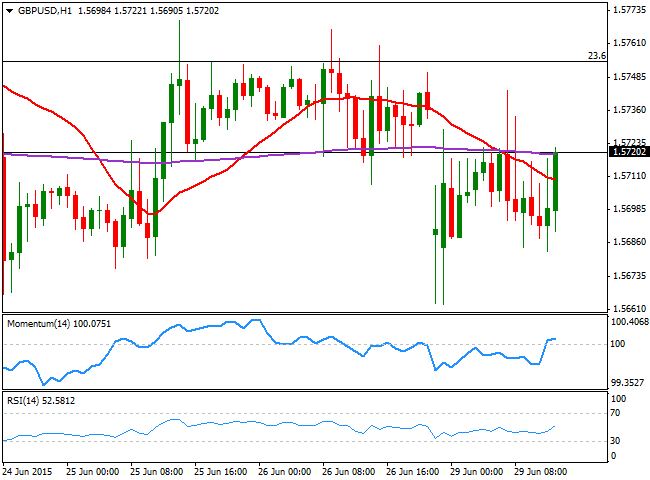

GBP/USD Current price: 1.5719

View Live Chart for the GBP/USD

The GBP/USD pair maintains the neutral technical stance seen over the last days, having recovered from a daily low of 1.5663. The 1 hour chart shows that the price is holding mid-way in between Fibonacci levels, with the 23.6% retracement of the latest bullish run providing resistance at 1.5750 and the 38.2% retracement of the same rally acting as support at 1.5645. In the 1 hour chart, the technical indicators have advanced above their mid-lines but lost the upward potential afterwards, whilst the price continues to hover around a mild bearish 20 SMA. In the 4 hours chart, the price stands around its 20 SMA whilst the Momentum indicator remains stuck around the 100 level, and the RSI indicator aims higher in negative territory.

Support levels: 1.5695 1.5645 1.5610

Resistance levels: 1.5750 1.5795 1.5830

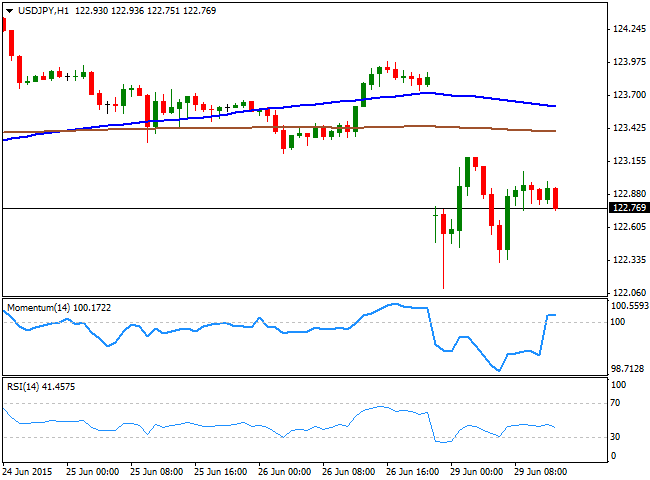

USD/JPY Current price: 122.75

View Live Chart for the USD/JPY

The USD/JPY pair is resuming its decline with the yen still on demand against all of its rivals. The Japanese currency has advanced sharply during the Asian session, gapping higher , and with those gaps still unfilled. As for the USD/JPY technical picture, the 1 hour chart shows that the latest price recovery stalled well below the 100 and 200 SMAs, whilst the Momentum indicator is losing its upward strength after crossing above the 100 level, and the RSI indicator maintains its bearish slope around 41. In the 4 hours chart, the price was unable to advance above its 200 SMA, whilst the technical indicators maintain their bearish strength in negative territory, maintaining the risk towards the downside particularly on a break below 122.45, the immediate support.

Support levels: 122.45 122.00 121.60

Resistance levels: 123.30 123.75 124.10

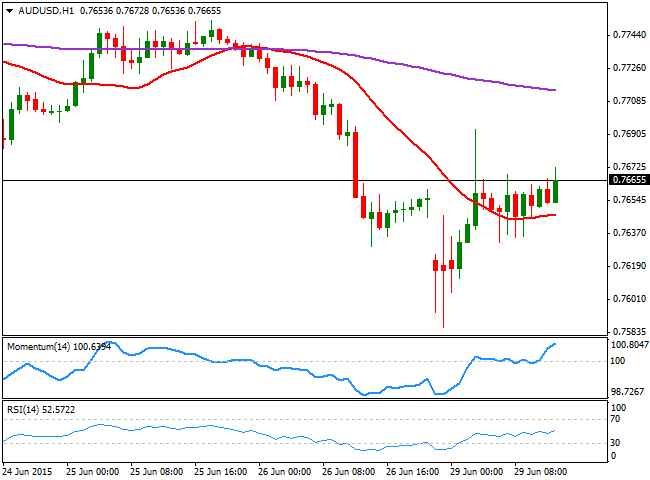

AUD/USD Current price: 0.7665

View Live Chart for the AUD/USD

The AUD/USD pair has surged on the back of the People's Bank of China decision to cut rates on Saturday, neutralizing the effect of the Greek news in the antipodean currency. The pair fell down to 0.7583 before recovering, and maintains a bullish short term tone, as the 1 hour chart shows that the price has stabilized above its 20 SMA, now around 0.764, whilst the technical indicators maintain their tepid bullish slopes above their mid-lines. In the 4 hours chart however, the price remains below a strongly bearish 20 SMA whilst the technical indicators head lower below their mid-lines, limiting chances of a stronger advance during the upcoming hours.

Support levels: 0.7640 0.7590 0.7555

Resistance levels: 0.7685 0.7720 07755

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.