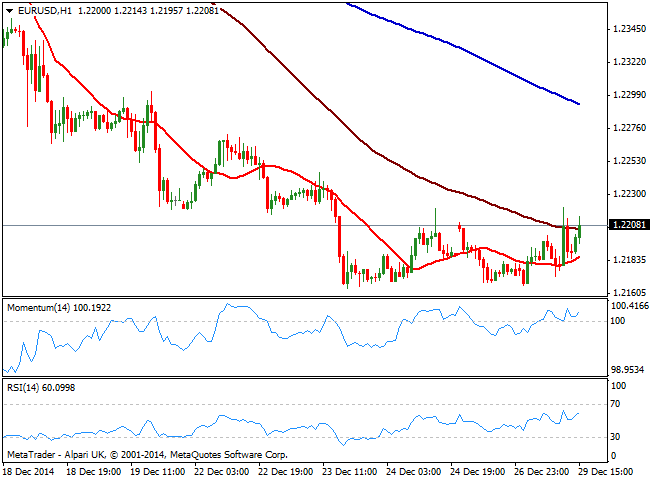

EUR/USD Current price: 1.2208

View Live Chart for the EUR/USD

The EUR/USD pair trades uneventfully around the 1.2200 level, despite increasing turmoil coming from Greece. The ruling party failed to gathered support in the third ballot, triggering snap presidential elections in the country. Year-end holidays keep volumes at their lowest since last August, the main reason of the ongoing lack of action across the forex board. Technically, the 1 hour chart shows that the price trades above its 20 SMA but seems unable to establish above 100 SMA, whilst indicators head higher above their midlines, supporting some further short term advances. In the 4 hours chart technical readings also present a mild positive tone, although without actual momentum at the time being. Further recoveries may extend up to the 1.2275 price zone, albeit further range trading should be expect for this whole week.

Support levels: 1.2165 1.2120 1.2085

Resistance levels: 1.2240 1.2275 1.2300

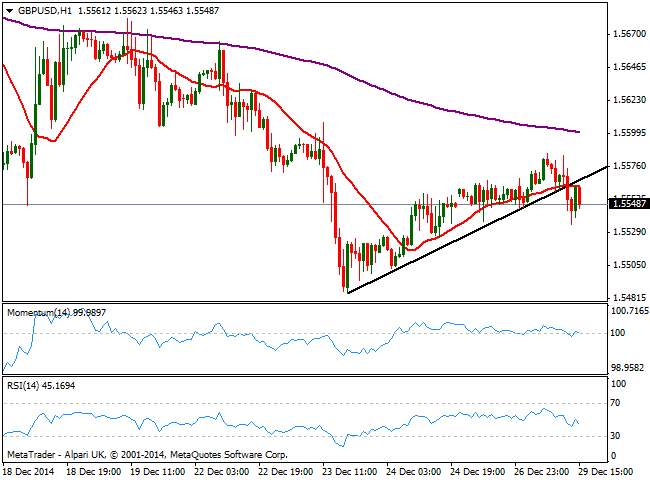

GBP/USD Current price: 1.5549

View Live Chart for the GBP/USD

The GBP/USD pair advanced early Monday up to 1.5585, but turned south mid European morning, breaking below a short term ascendant trend line coming from this year low of 1.5485. The 1 hour chart shows that the 20 SMA is now acting as dynamic resistance around the broken trend line at 1.5560, whilst indicators turned lower around their midlines, maintaining a neutral to bearish technical stance. In the 4 hours chart the price struggles around a bearish 20 SMA while indicators also hold around their midlines, giving no directional clues at the time being.

Support levels: 1.5540 1.5515 1.5485

Resistance levels: 1.5560 1.5590 1.5615

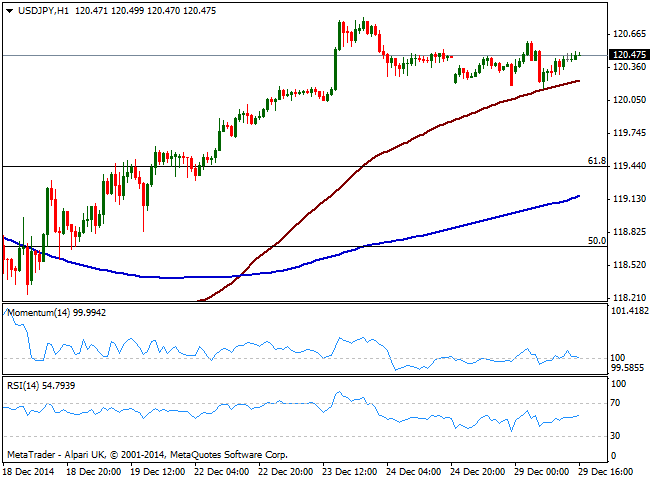

USD/JPY Current price: 120.47

View Live Chart for the USD/JPY

The USD/JPY pair has been trading in a tight 40 pips range since the day started, hovering around current level for most of the European session. Despite Nikkei slide on a suspected case of Ebola in Japan, the pair remains lifeless. Technically the 1 hour chart shows momentum indicator flat around 100, albeit 100 SMA continues to provide intraday support, now around 120.25. In the 4 hours chart indicators present a mild negative tone in neutral territory, whilst the price develops well above moving averages, all of which suggests the downside will remain limited.

Support levels: 120.25 120.00 119.65

Resistance levels: 120.85 121.10 121.55

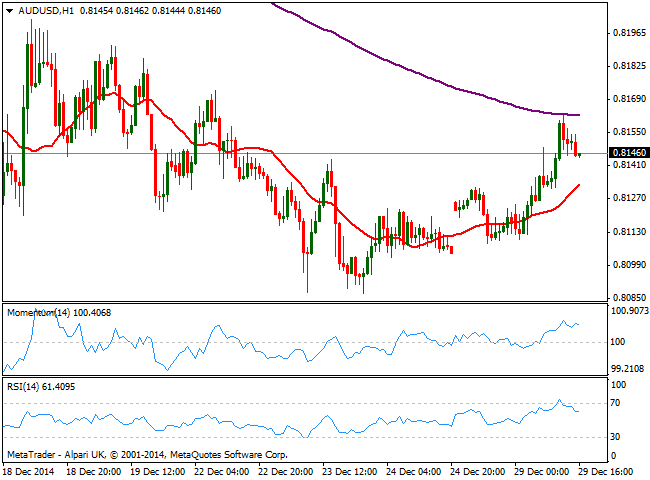

AUD/USD Current price: 0.8146

View Live Chart of the AUD/USD

The Australian dollar got an early boost from China, as the country announced more easing in its monetary policy to fuel growth, sending the AUD/USD pair to an intraday high of 0.8161. Nevertheless, the 1 hour chart shows little upward momentum, as despite the price holds above a bullish 20 SMA, indicators had turned lower in positive territory. In the 4 hours chart technical indicators present a mild positive tone, also lacking strength at the time being. As long as below the 0.8200 mark, chances of an upward move will likely remain limited, whilst a breach of the year low at 0.8087 is required to confirm a new leg south.

Support levels: 0.8085 0.8060 0.8025

Resistance levels: 0.8170 0.8200 0.8240

Recommended Content

Editors’ Picks

AUD/USD holds steadily as traders anticipate Australian Retail Sales, Fed’s decision

The Aussie Dollar registered solid gains against the US Dollar on Monday, edged up by 0.55% on an improvement in risk appetite, while the Greenback was crushed by Japanese authorities' intervention. As Tuesday’s Asian session begins, the AUD/USD trades at 0.6564.

EUR/USD finds support near 1.0720 after slow grind on Monday

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settled in for the wait US Fed outing. Investors broadly expect US rates to hold steady this week, but traders will look for an uptick in Fed guidance for when rate cuts could be coming.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Relief wave on altcoins likely as BTC shows a $5,000 range

Bitcoin price has recorded lower highs over the past seven days, with a similar outlook witnessed among altcoins. Meanwhile, while altcoins display a rather disturbing outlook amid a broader market bleed, there could be some relief soon as fundamentals show.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.