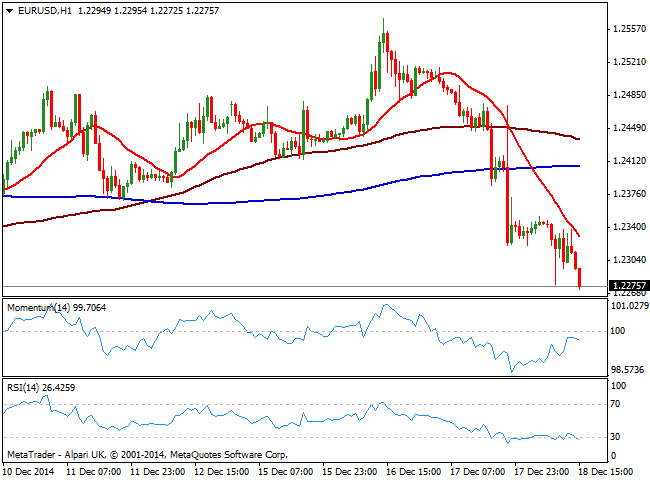

EUR/USD Current price: 1.2275

View Live Chart for the EUR/USD

The EUR/USD pair remains subdued this Thursday, weighted by the surprise decision of the SNB to turn its Libor rate negative, down to -0.25% to defend EUR/CHF peg. Better than expected US weekly unemployment claims helped the pair extend its decline ahead of US opening below the 1.2270 level. The 1 hour chart presents a strong bearish tone, with price capped below a 20 SMA and indicators heading south below their midlines. In the 4 hours chart indicators also present a strong bearish momentum despite in extreme over sold territory, as price approaches this year low of 1.2240. A break below it should lead to a continued selloff, down to 1.2190 as immediate bearish target.

Support levels: 1.2270 1.2240 1.2190

Resistance levels: 1.2315 1.2360 1.2400

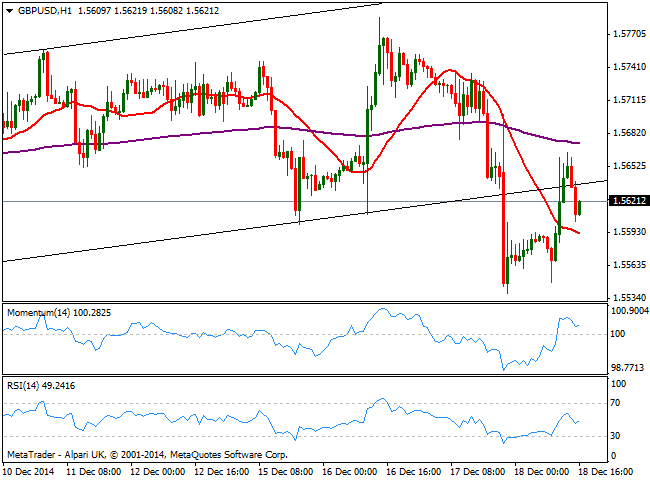

GBP/USD Current price: 1.5625

View Live Chart for the GBP/USD

The GBP/USD pair trades slightly higher on the day, supported by strong Retail Sales readings in the UK, well above expectations. News had helped the pair to surge up to 1.5665, from where it quickly retraced back to current levels, weighted by general dollar strength. Nevertheless, the 1 hour chart shows that the price is developing above its 20 SMA while indicators head higher above their midlines after a limited pullback. In the 4 hours chart however, the technical picture is clearly bearish, as 20 SMA capped price around mentioned high whilst indicators head lower below their midlines. The downside seems limited at the time being, and a break below 1.5590 is required to confirm a bearish continuation.

Support levels: 1.5590 1.5540 1.5490

Resistance levels: 1.5630 1.5665 1.5700

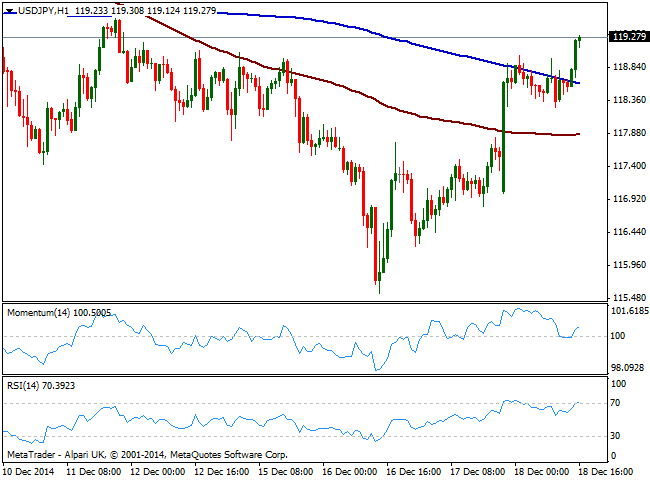

USD/JPY Current price: 119.27

View Live Chart for the USD/JPY

After a consolidative phase during the last 2 sessions, the USD/JPY pair broke above the 119.00 on US positive data, finding support also in rising stocks. The pair trades at a fresh 5-day high and the 1 hour chart shows it finally advanced above its 200 SMA, while momentum heads higher above 100 and RSI stands near 70. In the 4 hours chart technical readings present a strong upward momentum which supports further advances on a break above 119.45 immediate short term resistance.

Support levels: 118.90 118.50 118.20

Resistance levels: 119.45 119.90 120.30

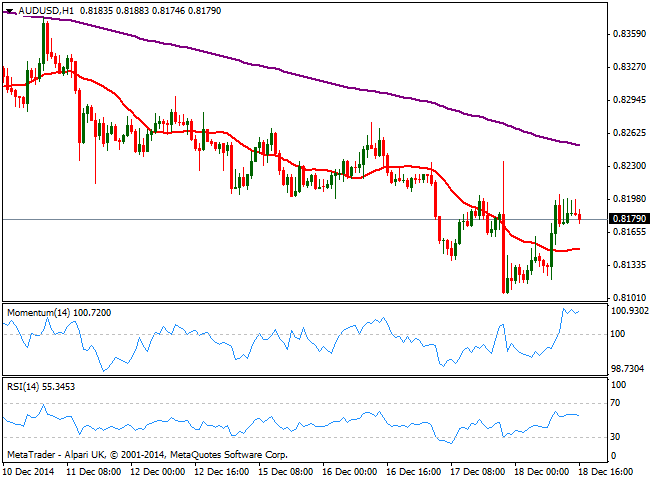

AUD/USD Current price: 0.8179

View Live Chart of the AUD/USD

The AUD/USD recovered ground this Thursday, up to 0.8200 were sellers once again halted the advance. Consolidating below it, the 1 hour chart shows price above its 20 SMA that stands flat around 0.8145 while indicators hold directionless well into positive territory. In the 4 hours chart the price remains capped below a bearish 20 SMA while indicators remain in negative territory, showing little aims to extend the latest advance. Above 0.8200 there should be some stops and if they got trigger, the rally may extend up to 0.8270, while a break below 0.8145 on the other hand should expose the pair to a decline to fresh year lows below 0.8105.

Support levels: 0.8145 0.8105 0.8060

Resistance levels: 0.8200 0.8230 0.8270

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY recovers 156.00 after testing 155.50 on likely Japanese intervention

USD/JPY has recovered some ground above 156.00 after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.