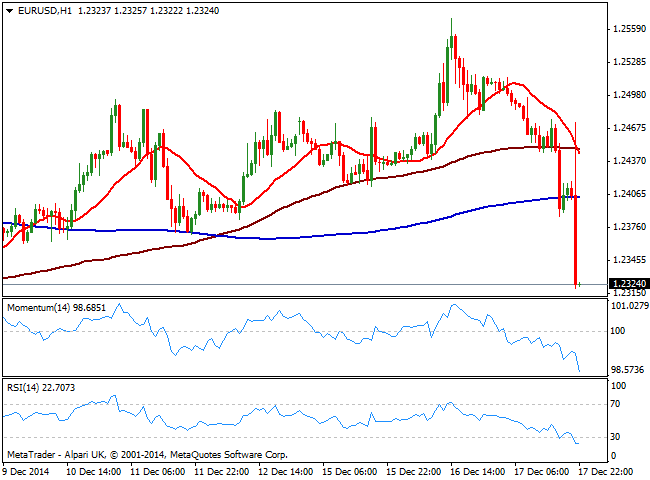

EUR/USD Current price: 1.2333

View Live Chart for the EUR/USD

Janet Yellen held her final press conference of the year following the Fed's last policy announcement on Wednesday, after switching “considerable time” for “patient” in the press release. The marked spiked 30 pips both sides of the board back and forth before the press conference, not sure of where to go. But as Yellen kept talking, the picture became more USD bullish, as the FED not only upgraded the assessment of the labor market, but also tiptoed a rate hike for 2015. Following an initial spike to 1.2473, the EUR/USD pair suddenly changed course and dropped to a fresh 7-day high of 1.2320 in less than an hour.

The short term picture shows that the price made a brief spike above a bearish 20 SMA that did not held before moving again well below its 100 and 200 SMAs. Indicators in the same time frame present a strong bearish tone in oversold territory after the 150 pips drop, with no signs of turning north at the time being. In the 4 hours chart the price was also rejected from its 20 SMA whilst indicators present a strong bearish momentum and supporting further declines. The immediate short term resistance stands now at 1.2360, followed by the 1.2400 level, while a break below 1.2310 will likely push the pair to fresh year lows.

Support levels: 1.2310 1.2270 1.2240

Resistance levels: 1.2360 1.2400 1.2445

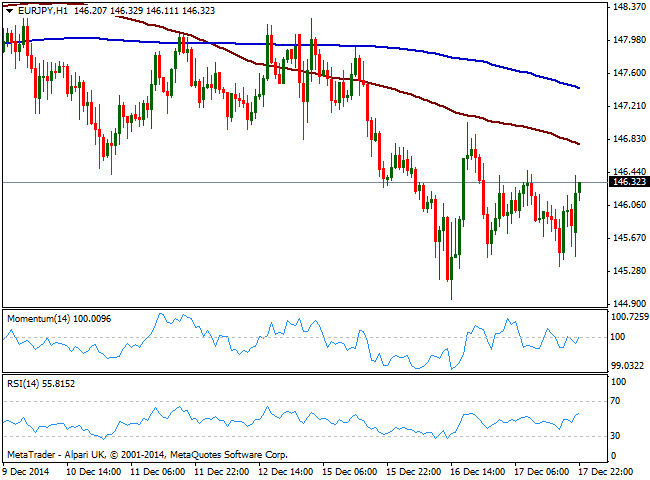

EUR/JPY Current price: 146.23

View Live Chart for the EUR/JPY

The EUR/JPY cross surged after the news, as yen gets hit by rising stocks and 10Y US yields up to 2.12% in the day. Trading within recent range, the EUR/JPY remains limited as per EUR weakness, with the 1 hour chart showing that the price is still well below its 100 SMA currently offering dynamic resistance at 146.70, while indicators aim slightly higher in neutral territory. In the 4 hours chart indicators bounced from oversold levels but remain well below their midlines and far from anticipating an upward move. Nevertheless, yen gains will likely remain limited with local share markets on the run, with scope to advance up to 147.45 during the upcoming Asian session.

Support levels: 145.90 145.50 145.10

Resistance levels: 146.35 146.80 147.45

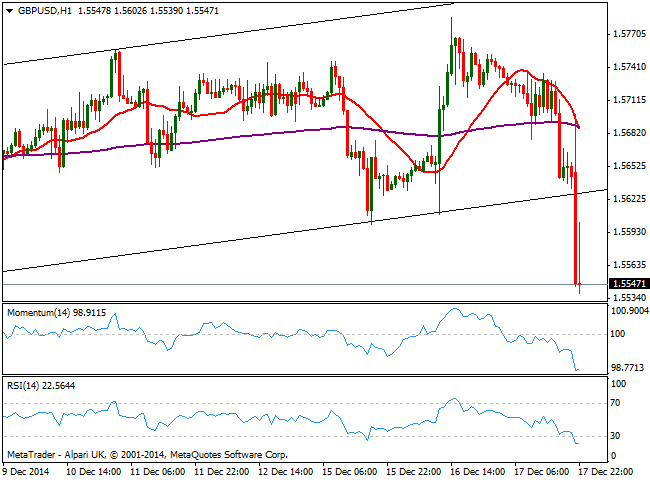

GBP/USD Current price: 1.5546

View Live Chart for the GBP/USD

The UK released its latest BOE Minutes and its monthly employment data early European morning, but it seems like it was a century ago. The unemployment rate remained steady at 6.0%, slightly above expectations of a 5.9%, while wages grew more than inflation in October, which is a positive sign for the still struggling economy. Minutes of the latest meeting on the other hand, offer no news as the Central Bank decided to keep its economic policy unchanged and there was no change in the votes either. When it comes to the technical picture, the GBP/USD pair has broken to the downside with the FED’s decision, reaching 1.5539, 1 pip below the year low set earlier this month. In the 1 hour chart indicators halted in extreme oversold levels, but a spike up to 1.5600 quickly reversed suggesting bears remain in control. In the 4 hours chart technical readings are biased lower well into negative territory, supporting further declines if the 1.5540 area finally gives up.

Support levels: 1.5540 1.5490 1.5450

Resistance levels: 1.5590 1.5630 1.5665

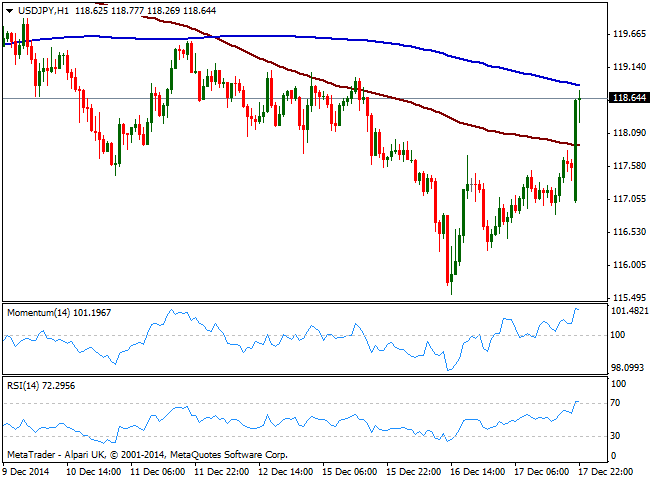

USD/JPY Current price: 118.63

View Live Chart for the USD/JPY

The American dollar finally surged against its Japanese rival, with the USD/JPY pair jumping to 118.78 and erasing these last 2 days losses. The pair recovers alongside with stocks, and seems positioned to continue advancing over Asian hours, as Nikkei futures also trade higher. From a technical point of view, the 1 hour chart shows indicators are losing some of the upward momentum in overbought territory but are far from suggesting a reversal, with price advances towards it 200 SMA, a few pips above the current level and immediate resistance at 118.90. In the 4 hours chart technical readings also present a positive tone, with indicators crossing their midlines to the upside, and supporting the shorter term view, moreover if mentioned resistance is broken.

Support levels: 118.20 117.75 117.30

Resistance levels: 118.90 119.45 119.90

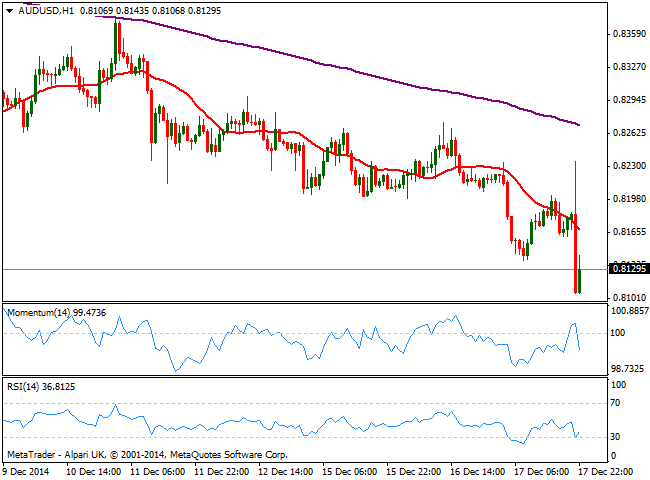

AUD/USD Current price: 0.8125

View Live Chart of the AUD/USD

The AUD/USD pair broke below the 0.8200 figure early Wednesday, reaching 0.8138 before bouncing back towards the 0.8200 area. The early move lower was due stops getting triggered below the mentioned level, with no precise catalyst behind it. With the FED, the pair initially surged to 0.8235 before nose-diving to 0.8106, levels not seen since early June 2010. Despite whatever fundamentals may offer, in the particular case of this pair is the dominant bearish long term trend what leads, and selling higher is the name of the game still. In the short term, the 1 hour chart shows 20 SMA extending its decline above current levels whilst momentum heads lower below 100 and RSI bounces from the 30 level up now at 35. In the 4 hours chart indicators maintain their bearish slopes whilst 20 SMA capped the upside now around 0.8215, supporting the shorter term view. A multi-year Fibonacci support is located at 0.7940, 61.8% of the 0.6291/1.107 rally, and seems likely the pair will continue its slide at least towards that level next big bearish target for the upcoming days.

Support levels: 0.8105 0.8060 0.8020

Resistance levels: 0.8140 0.8200 0.8230

Recommended Content

Editors’ Picks

AUD/USD stays defensive below 0.6500 ahead of Fed

AUD/USD is on the back foot below 0.6500, consolidating the previous decline early Wednesday. China's holiday-led thin conditions and pre-Fed policy decision caution trading leave Aussie traders on the edge.

USD/JPY holds higher ground near 158.00, Fed in focus

USD/JPY holds the rebound near 158.00 in Asian trading on Wednesday. The US Dollar remains on the bid amid a risk-off market environment, underpinning the major. The interest rate differential between Japan and the US is likely to maintain a bullish pressure on the pair ahead of the Fed decision.

Gold snaps two-day losing streak above $2,280 ahead of Fed rate decision

Gold price posts modest gains around $2,288 on Wednesday during the Asian session. The precious metal edges higher as markets turn to a cautious mood ahead of the Federal Reserve's monetary policy meeting on Wednesday.

Bitcoin price dips into $60K range as spot traders flock to Coinbase Lightning Network

Bitcoin price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area. It comes as markets continue to digest the performance of Hong exchange-traded funds after their first day of issuance.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.