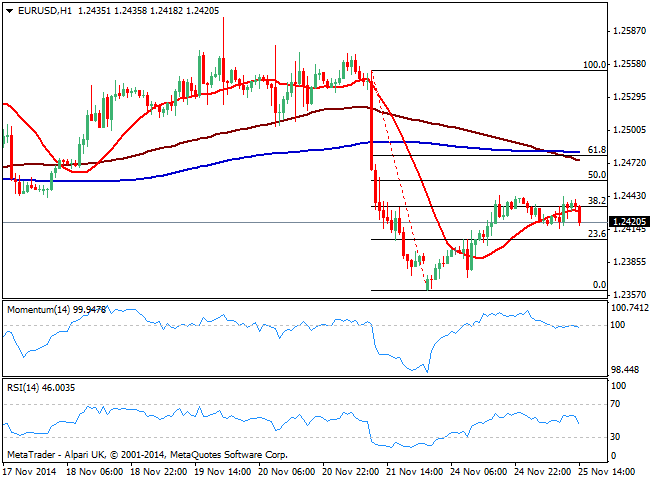

EUR/USD Current price: 1.2423

View Live Chart for the EUR/USD

The EUR/USD pair eases some ahead of US GDP readings, having been trading in a tight range for most of the day, unable to extend beyond the 1.2440 price zone. Mild positive German GDP readings helped the pair earlier on the day, but not enough to trigger stops above afore mentioned level. Short term, the 1 hour chart shows price easing below its 20 SMA and indicators turning lower in neutral territory, while the 4 hours chart presents a stronger bearish momentum, whilst 20 SMA offers resistance around 1.2455. Upcoming direction will be defined by US data, not just GDP as the country will also release consumer confidence and housing and manufacturing numbers in the next few hours. Either a price acceleration above 1.2455 or below 1.2400 will likely set the tone for the rest of the day.

Support levels: 1.2400 1.2360 1.2325

Resistance levels: 1.2455 1.2490 1.2520

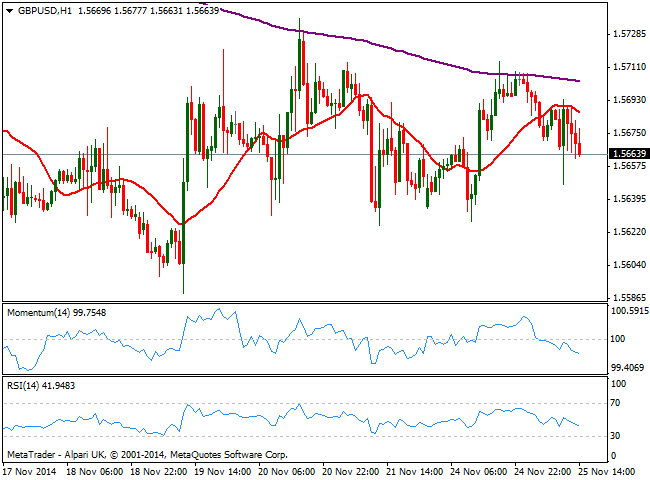

GBP/USD Current price: 1.5663

View Live Chart for the GBP/USD

The GBP/USD pair eases within range after another round of BOE’s inflation hearings brought nothing new to the table. Mild dovish wording was not a surprise and Pound regains the downside with discretion ahead of US news. Technically, the 1 hour chart shows price extending below a bearish 20 SMA while indicators head south into negative territory. In the 4 hours chart the technical picture is neutral to bearish, with price moving back and forth around a flat 20 SMA as indicators enter negative territory. Price needs to break below 1.5620 to confirm further declines, expecting them a break to fresh year lows near the 1.5550 price zone.

Support levels: 1.5620 1.5585 1.5550

Resistance levels: 1.5700 1.5740 1.5770

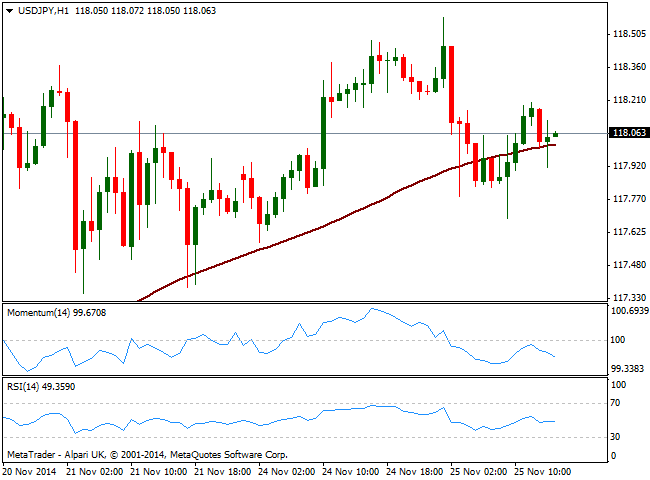

USD/JPY Current price: 118.05

View Live Chart for the USD/JPY

Yen advanced overnight against most of its majors, after BOJ Minutes showed some policymakers are concerned about the speed of yen depreciation and the costs of QE. The pair fell as low as 117.68 intraday before bouncing some, now struggling around the 118.00 figure. The 1 hour chart shows price aiming to break below 100 SMA as indicators gain bearish slope below their midlines. In the 4 hours chart however, indicators maintain a more neutral stance, with momentum hovering around its midline and RSI steady above 50. The dominant bullish trend does not exempt the pair from intraday declines, with deeps down to 117.00 being seen as just corrective and buying opportunities.

Support levels: 117.70 117.45 117.00

Resistance levels: 118.20 118.60 119.00

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.