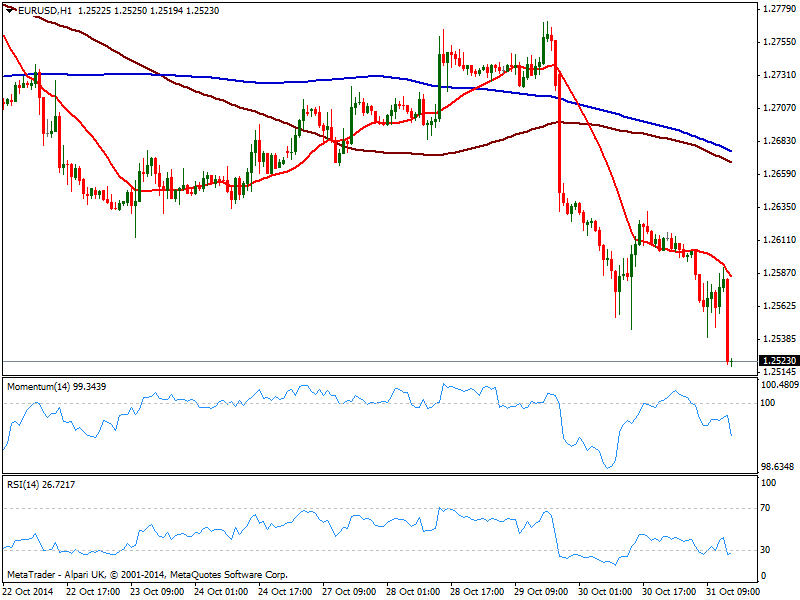

EUR/USD Current price: 1.2522

View Live Chart for the EUR/USD

The EUR/USD approaches quickly to its year low of 1.2501 ahead of US opening, posting a fresh daily low of 1.2521 at the time of writing. The movement came despite US consumer spending fell in September for the first time in eight months, down to -0.2% alongside with a small pullback also in incomes: markets are nothing about data today, but about Central Banks imbalances: as the FED gave a farewell to QE, the Bank of Japan announced an increase its one, while the ECB is expected o launch its ABC program next week.

Technically, the 1 hour chart shows price having found resistance at a bearish 20 SMA while indicators turned south deep in the red. In the 4 hours chart technical readings maintain a strong bearish momentum despite in oversold territory, with a break below 1.2500 probably triggering stop and fueling the slide down to 1.2440 price zone.

Support levels: 1.2500 1.2440 1.2370

Resistance levels: 1.2560 1.2620 1.2660

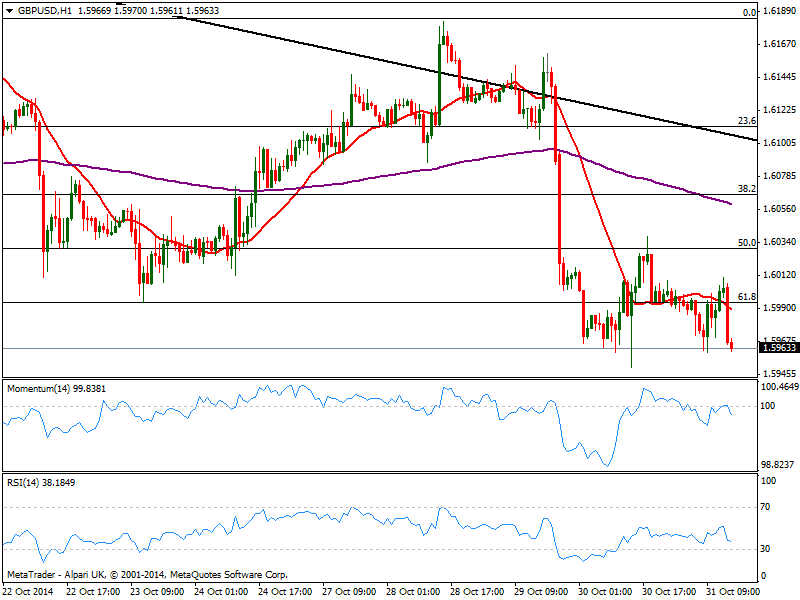

GBP/USD Current price: 1.5962

View Live Chart for the GBP/USD

The GBP/USD also resumed its slide after flirting with the 50.0% retracement of its latest bullish run late Thursday, accelerating south as US players come to join the party. The 1 hour chart shows a strong bearish momentum as per current candle downward acceleration below its 20 SMA, while indicators turned strongly south into negative territory. In the 4 hours chart technical readings also present a bearish bias, suggesting further declines below the weekly low of 1.5950 should accelerate the selloff towards the month low of 1.5874

Support levels: 1.5950 1.5910 1.5875

Resistance levels: 1.6000 1.6035 1.6060

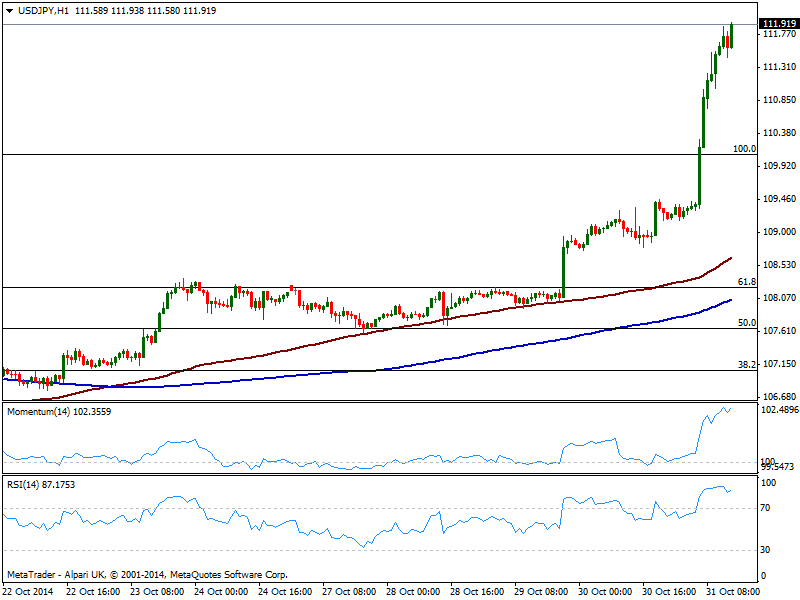

USD/JPY Current price: 111.91

View Live Chart for the USD/JPY

Unstoppable USD/JPY approaches 112.00, having added over 260 pips after BOJ’s decision to increase its monetary easing program, from previous ¥60-70-trillion to a total of¥80-trillion. Technically, the 1 and 4 hours charts shows extreme overbought reading coming from technical indicators, yet price posts higher highs without looking back, far from suggesting exhaustion or a trend change. Trading at levels not seen since 2008, the pair is not known for its ability of making pullbacks: once a trend starts, it doesn’t look back: some steady consolidation above 112.00 should favor further advances, although extreme cautious is recommended at this point.

Support levels: 111.55 111.20 110.80

Resistance levels: 112.00 112.45 112.90

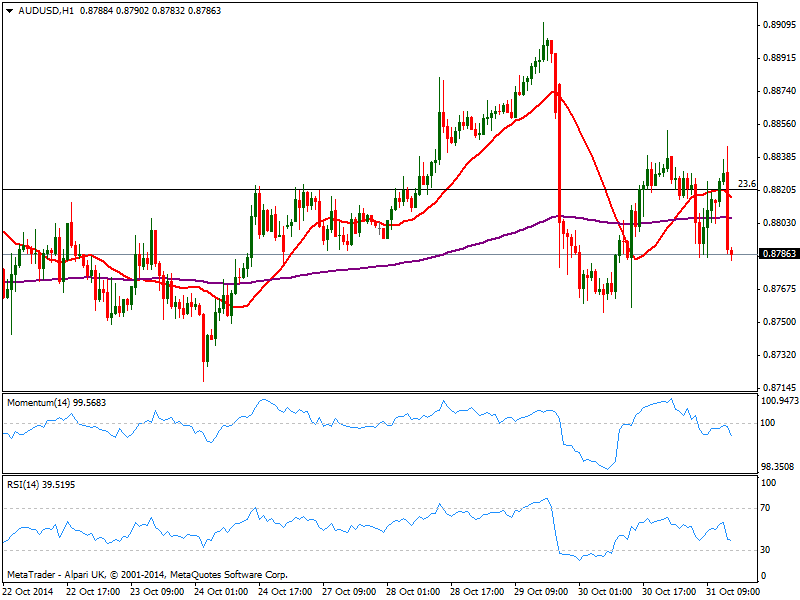

AUD/USD Current price: 0.8785

View Live Chart of the AUD/USD

Despite the strong run in stocks, Aussie also capitulates against the greenback as gold trades at a fresh 4 year low. The 1 hour chart shows another failure attempt to break above 0.8820 as price approaches 0.8870 immediate support, with indicators heading lower below their midlines and 20 SMA capping the upside around mentioned Fibonacci resistance. In the 4 hours chart 20 SMA stands flat also around 0.8820, while indicators turned lower below their midlines, supporting further falls.

Support levels: 0.8770 0.8730 0.8690

Resistance levels: 0.8820 0.8850 0.8890

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.