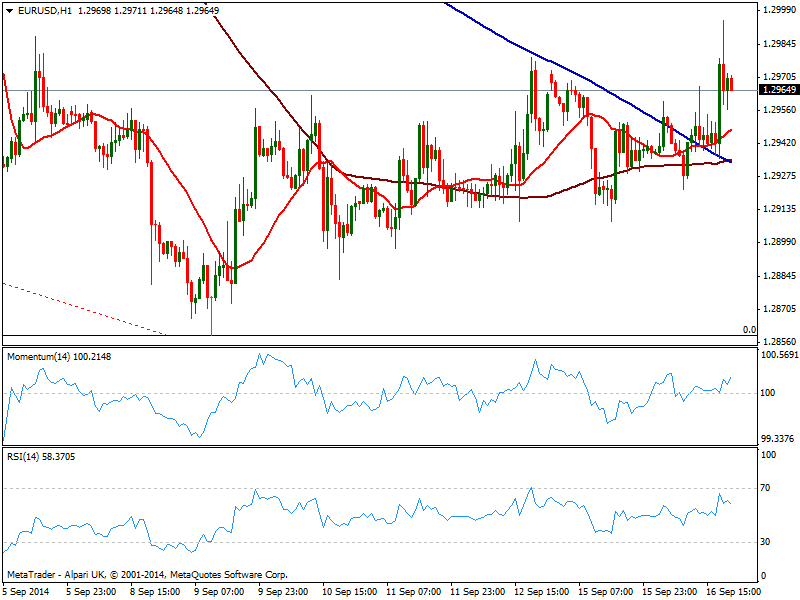

EUR/USD Current price: 1.2964

View Live Chart for the EUR/USD

Market stillness was interrupted mid American afternoon, on news China decided to inject 500 billion Yuan to the country’s largest banks, triggering a strong risk for appetite across all boards: US major indexes are sitting right below all-time highs, while the EUR/USD surge up to 1.2994, posting there a fresh 2 week high, despite quickly retraced back to its comfort zone around 1.2950 to wait for FED outcome this Wednesday. Earlier on the day, German ZEW survey show confidence dropped yet again in the largest economy of Europe, posting its eighth monthly decline in a row.

In the short term, the hourly chart shows price a few pips above its moving averages, with 20, 100 and 200 SMAs converging in a 10 pips range, reflecting the lack of direction the pair has these days, while indicators stand above their midlines. In the 4 hours chart technical readings present a mild positive tone yet right now, upcoming direction depends purely on FED’s wording. Taking a look at bigger time frames, the ongoing range suggest the pair is trying to bottom yet a daily close after FED well into 1.30 is required to confirm so.

Support levels: 1.2950 1.2910 1.2870

Resistance levels: 1.2990 1.3045 1.3080

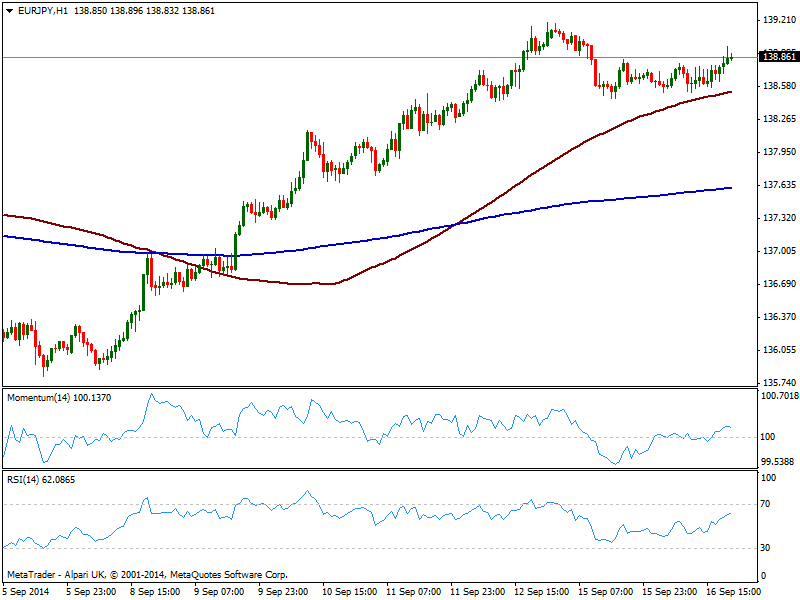

EUR/JPY Current price: 138.85

View Live Chart for the EUR/JPY

The EUR/JPY managed to post a mild recovery surging back towards 138.90, still unable to break above the resistance level, but with the short term picture favoring some further recoveries: price stands above a bullish 20 SMA while indicators grind higher above their midlines. In the 4 hours chart momentum bounces from its 100 level, while RSI turned north after correcting overbought readings, supporting the shorter term view. Nevertheless, the level to take now to confirm more gains is 139.40, where the pair presents multiple highs and lows from these past months.

Support levels: 138.40 138.00 137.65

Resistance levels: 138.90 139.30 139.70

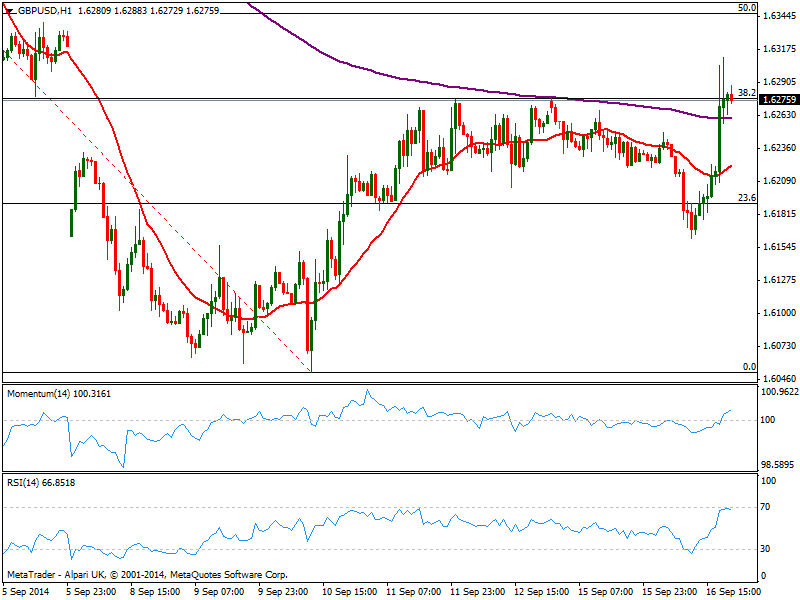

GBP/USD Current price: 1.6276

View Live Chart for the GBP/USD

The GBP/USD was among the most active pair, with investors extremely sensitive this week over Pound: the pair sunk to 1.6160 on early rumors CPI was about to miss expectations early Europe, resulting however 1.5% yearly basis as expected. The poor reading indeed won’t help the BOE in its way to raise rates “sooner than expected” and if employment readings on Wednesday also result weak, chances of a tighter economic policy will reduce even further. But safe haven selloff on Chinese news pushed the pair to a fresh 2 week high of 1.6311, practically filling the weekly opening gap from 2 weeks ago. Early Asian session, the 1 hour chart shows a clear upward momentum with price holding above the 38.2% retracement of this month bearish run at 1.6280 and above its 20 SMA. In the 4 hours chart indicators are also biased higher crossing above their midlines, with some further gains now pointing for a test of 1.6350, 50% retracement of the same rally.

Support levels: 1.6250 1.6220 1.6190

Resistance levels: 1.6315 1.6350 1.6385

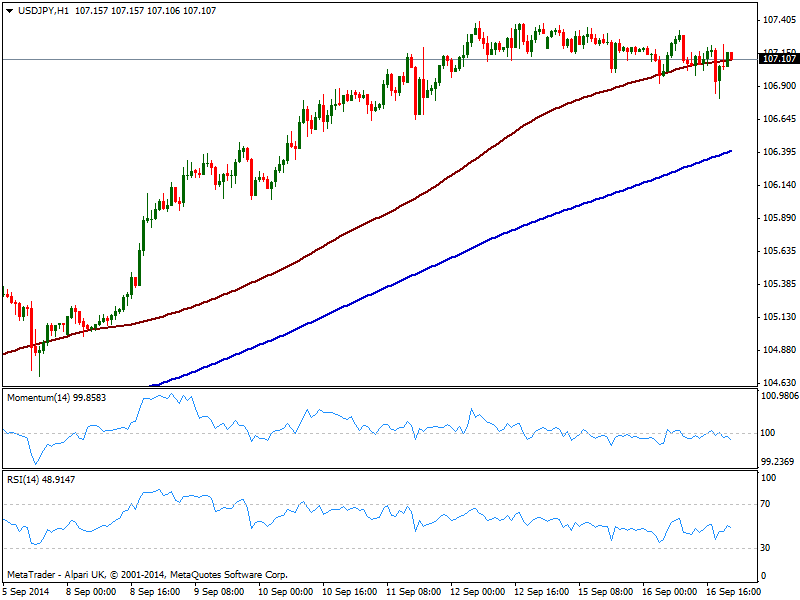

USD/JPY Current price: 107.10

View Live Chart for the USD/JPY

The USD/JPY posted a lower low daily basis, down to 106.80 where the pair finally found some short term buyers, recovering then the 107.00 figure, but closing in the red. The hourly chart however, shows little downward strength as the pair remains limited in a tight range, with price hovering around its 100 SMA and indicators still in neutral territory. In the 4 hours chart indicators had lost the downward potential and attempt a shy recovery around their midlines, suggesting a recovery still to be confirmed. The pair needs to shows some more directional momentum either below 106.80 or above 107.40 to set a clearer directional strength over the upcoming sessions.

Support levels: 106.80 106.50 106.10

Resistance levels: 107.40 107.90 108.20

AUD/USD Current price: 0.9094

View Live Chart of the AUD/USD

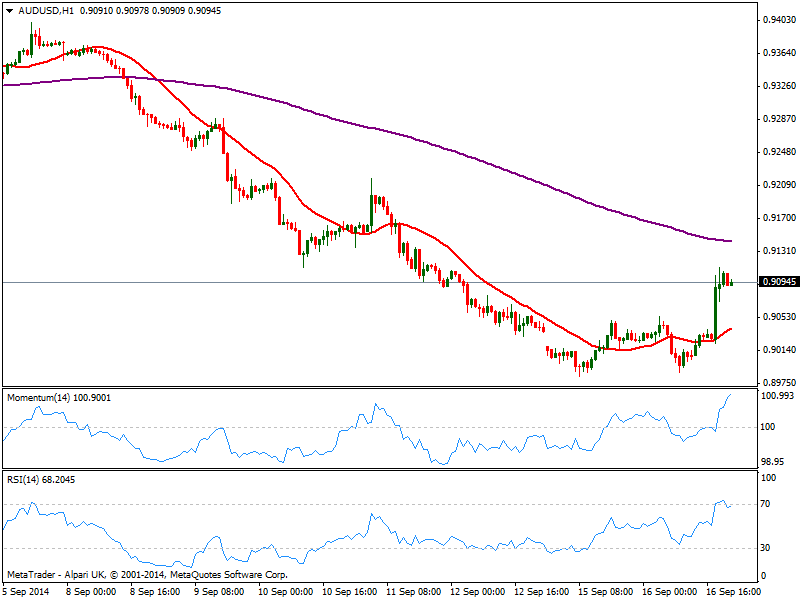

The Aussie was among the most favored with latest news, with the AUD/USD surging up to 0.9111 and holding nearby as a new day starts. The hourly chart shows price firm above its 20 MSA while momentum continues heading higher despite in overbought territory, as RSI begins to give signs of exhaustion. In the 4 hours chart price stands above its 20 SMA first time since Sep 8th, while indicators are still biased higher in positive territory, supporting some further gains ahead. The mentioned high converges with September 10th low, becoming the key resistance level to overcome to confirm such advances, up to 0.9190 price zone of a steady advance.

Support levels: 0.9075 0.9040 0.8990

Resistance levels: 0.9110 0.9150 0.9190

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.