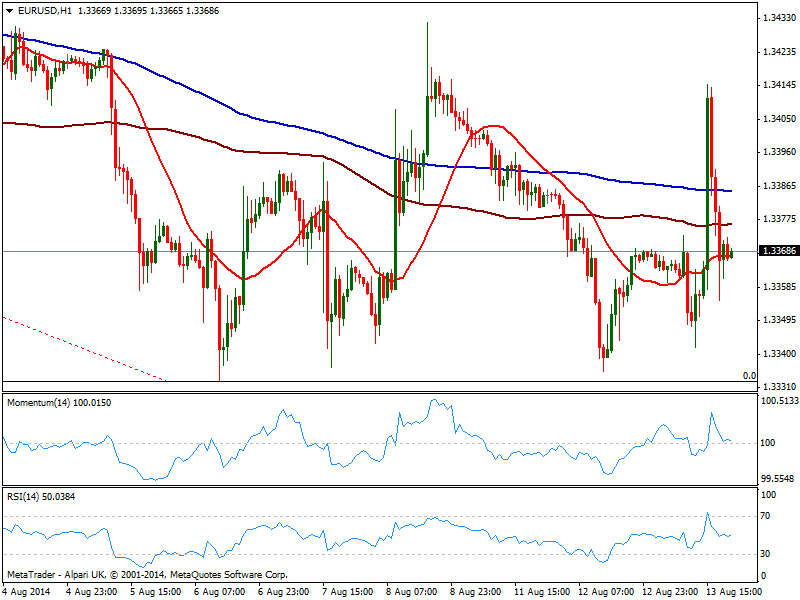

EUR/USD Current price: 1.3368

View Live Chart for the EUR/USD

The EUR/USD traded within a 70 pips range this Wednesday, down to 1.3342 early Europe on the back of weak EZ industrial production data, advancing suddenly up to 1.3414 on disappointing US Retail Sales, fat on July. But at the end of the day the pair stands right where it started, with investors now setting aside ahead of European GDP final readings early Thursday. Technically, the strong intraday advance has barely affected the wider picture, as price stalled below 1.3430/40 area, level that capped the upside for almost 3 weeks already.

The hourly chart shows price closing the day below its moving averages, while indicators approach their midlines, having erased all of their overbought readings. In the 4 hours chart indicators retrace from their midlines extending into bearish territory, as latest candle opened below a flat 20 SMA. As long as below mentioned 1.3430/40 area, the upside will remain limited, while a break below 1.3330 lows should trigger stops and therefore fuel the dominant bearish trend.

Support levels: 1.3330 1.3295 1.3250

Resistance levels: 1.3400 1.3440 1.3485

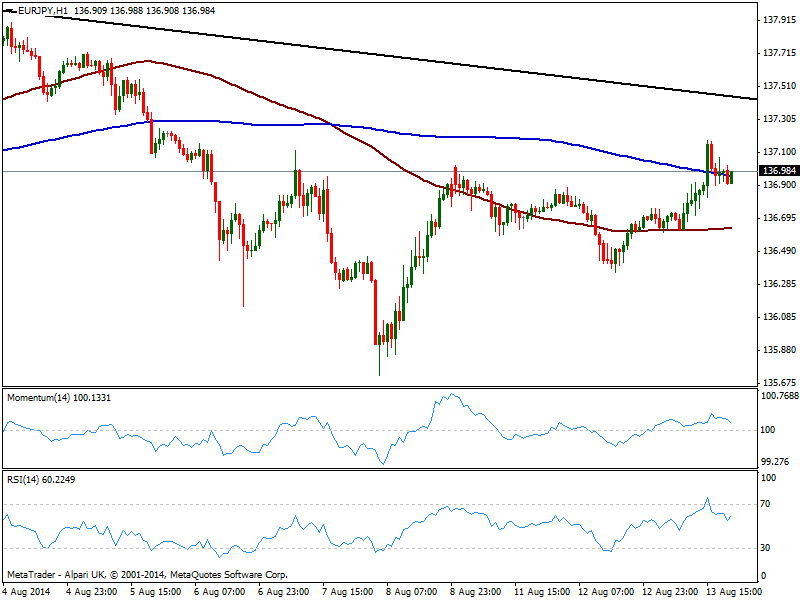

EUR/JPY Current price: 136.98

View Live Chart for the EUR/JPY

The Japanese yen suffered all through this Wednesday, down on weak Japanese GDP readings, and helped by recovering stocks across the world. The EUR/JPY advanced up to 137.18 before pulling back below the 137.00 figure, with the hourly chart showing indicators losing upward strength but holding in positive territory, as price struggles around a bearish 200 SMA. In the 4 hours chart the upside seems more constructive, yet the bullish momentum also eases some. A daily descendant trend line coming from May high of 142.36 stands today in the 137.50 area and it would take a recovery above it to support a continued advance towards 138.00/20 price zone.

Support levels: 136.60 136.20 135.70

Resistance levels: 137.10 137.50 137.90

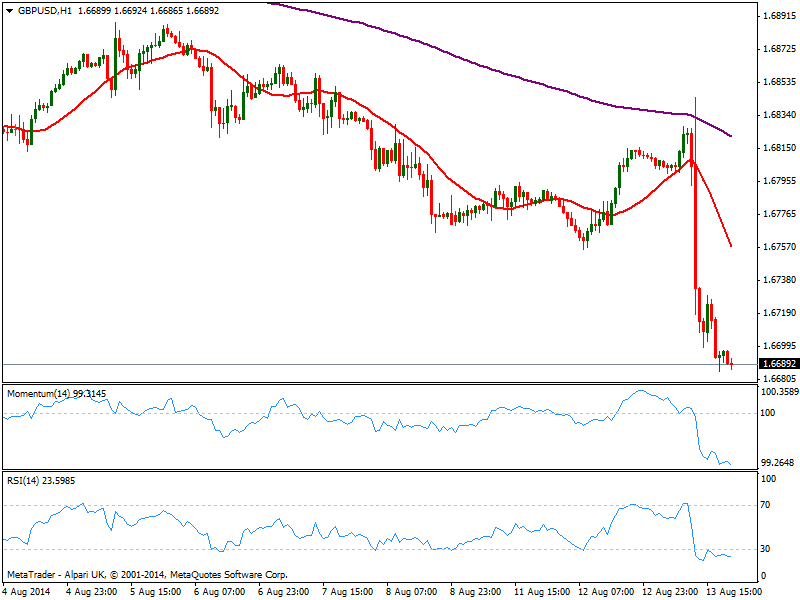

GBP/USD Current price: 1.6689

View Live Chart for the GBP/USD

Pound had one of its worse days of the year, shedding near 150 pips against the dollar on UK fundamental data: employment figures missed expectations with wages down, while quarterly inflation report ended up with a dovish BOE’s governor Carney, concerned about the slack economy and diminishing chances of a sooner rate hike: the GBP/USD fell down to 1.6700 with the news, finally breaking below 1.6695 area where it stands. The hourly chart shows indicators still heading lower despite in extreme oversold levels, while 20 SMA turned strongly south, offering now dynamic resistance in the 1.6760 price zone. In the 4 hours chart the picture is also strongly bearish, supporting fresh lows ahead as long as mentioned resistance holds.

Support levels: 1.6650 1.6620 1.6580

Resistance levels: 1.6695 1.6730 1.6760

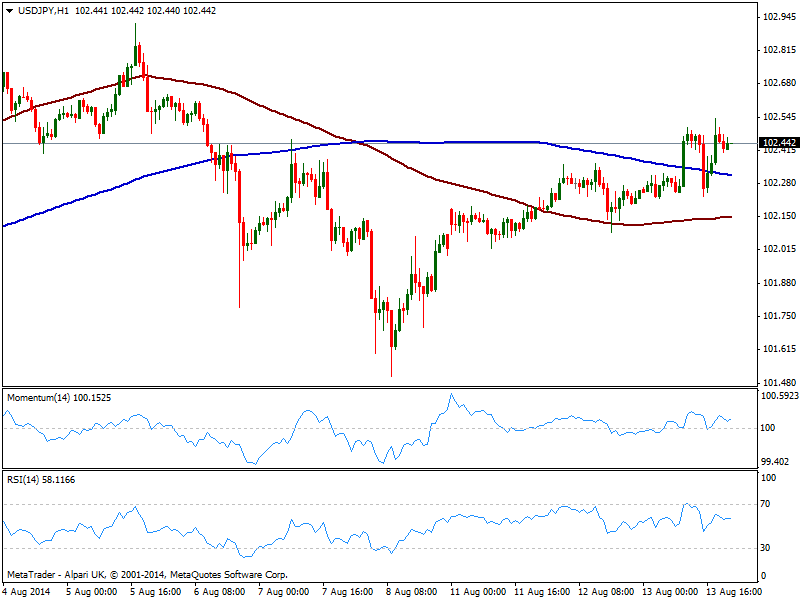

USD/JPY Current price: 102.44

View Live Chart for the USD/JPY

The USD/JPY holds near its daily high of 102.54, slightly firmer on the day, but showing no actual strength at the time being. The hourly chart shows price standing above 100 and 200 SMAs with this last now offering dynamic support around 102.30; indicators in the same time frame had lost their upward tone but hold above their midlines, while the 4 hours chart presents a positive tone coming from technical readings, that supports a test of 102.80 immediate resistance.

Support levels: 102.30 101.95 101.60

Resistance levels: 102.80 103.10 103.45

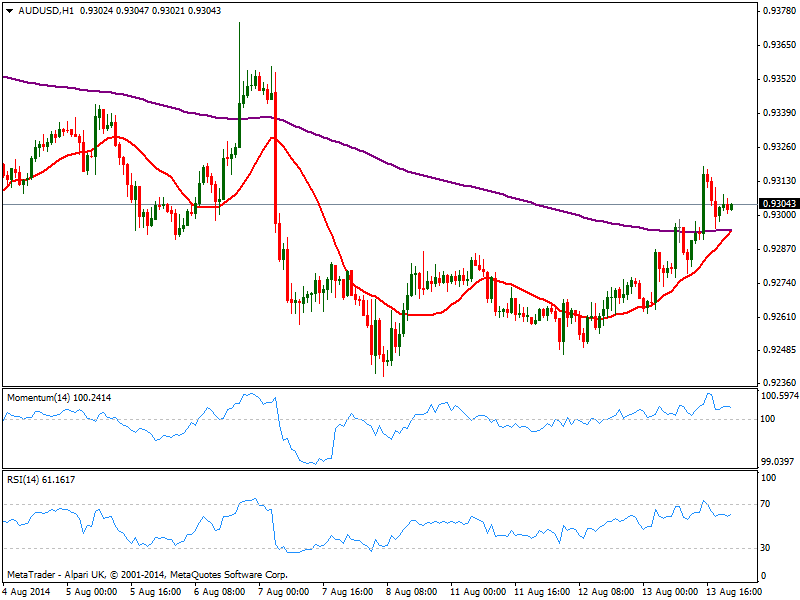

AUD/USD Current price: 0.9304

View Live Chart for the AUD/USD

The AUD/USD stands above the 0.9300 figure, boosted by negative US data. Having advanced up to 0.9318, the critical resistance remains at 0.9330, and further advances will depend on the ability of price to break above it. Technically the hourly chart shows 20 SMA heading strongly up below current level, while indicators turned flat in positive territory due to the latest short term range. In the 4 hours chart the pair maintains a positive tone with risk of a downward movement increasing on a break below 0.9290 immediate short term support.

Support levels: 0.9290 0.9260 0.9220

Resistance levels: 0.9330 0.9370 0.9410

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades slightly near 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD struggles to hold above 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold fluctuates in narrow range below $2,320

After retreating to the $2,310 area early Wednesday, Gold regained its traction and rose toward $2,320. Hawkish tone of Fed policymakers help the US Treasury bond yields edge higher and make it difficult for XAU/USD to gather bullish momentum.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.