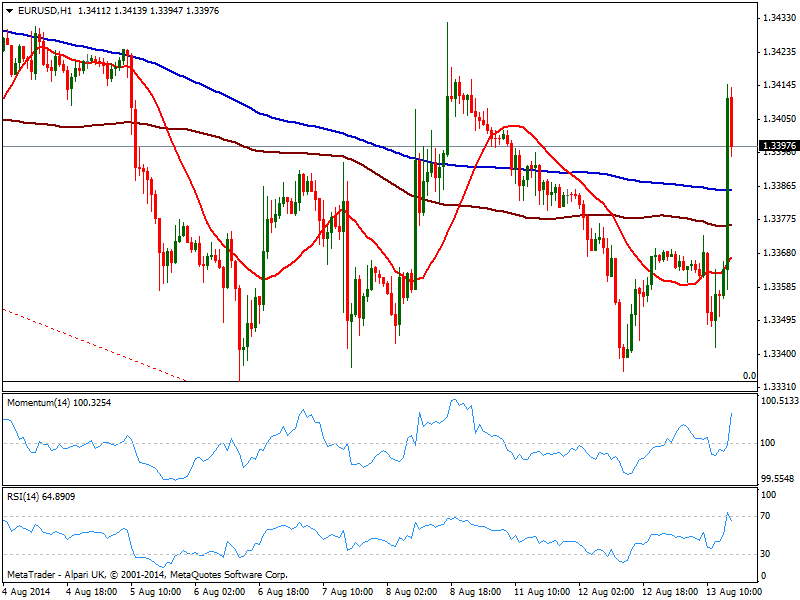

EUR/USD Current price: 1.3397

View Live Chart for the EUR/USD

Dollar turned strongly south against most rivals after the release of US Retail Sales, resulting flat for the month of July against an expected rise of 0.2%. Core reading also came below expectations, triggering EUR/USD demand with the pair advancing above 1.3400 early US session. The hourly chart shows retracing some from daily high posted at 1.3414 with a strong upward momentum coming from technical readings, and price above moving averages. In the 4 hours chart price stalled at a bearish 100 SMA, with indicators also aiming higher above their midlines: immediate support stands at 1.3370, and as long as above it, the pair has scope to extend its rally up to 1.3430/40 area, level that capped the upside for the last 3 weeks.

Support levels: 1.3370 1.3330 1.3295

Resistance levels: 1.3440 1.3485 1.3520

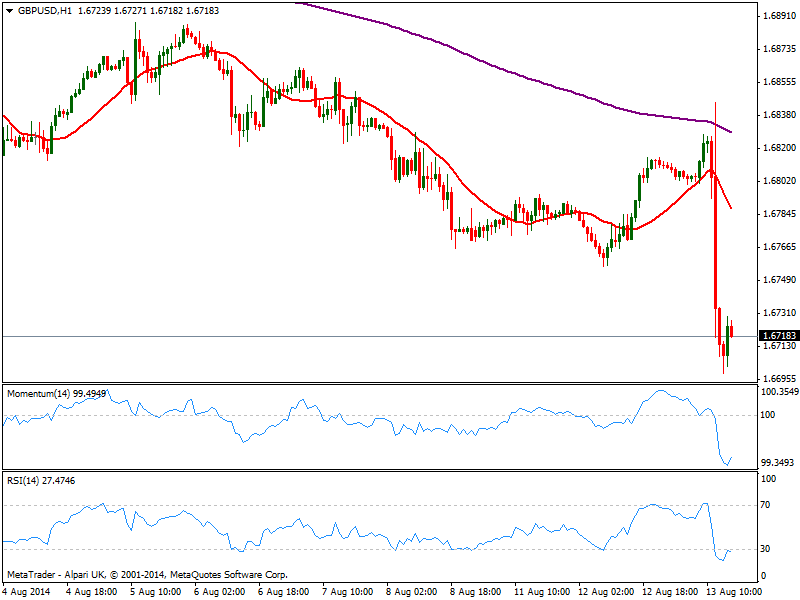

GBP/USD Current price: 1.6718

View Live Chart for the GBP/USD

The GBP/USD sunk to a 2 month low of 1.6699 after Mark Carney changed course with a dovish stance regarding rates on the quarterly inflation report. Despite latest intraday dollar weakness, the bounce in the pair has been pretty shallow so far, keeping the pressure to the downside. The hourly chart shows indicators still in extreme oversold levels with no aims of turning north, while 20 SMA gains bearish slope far away above current price. In the 4 hours chart technical readings present a strong bearish momentum, with renewed selling interest below 1.6695 probably fueling the slide towards 1.6650 price zone.

Support levels: 1.6695 1.6650 1.6620

Resistance levels: 1.6730 1.6770 1.6840

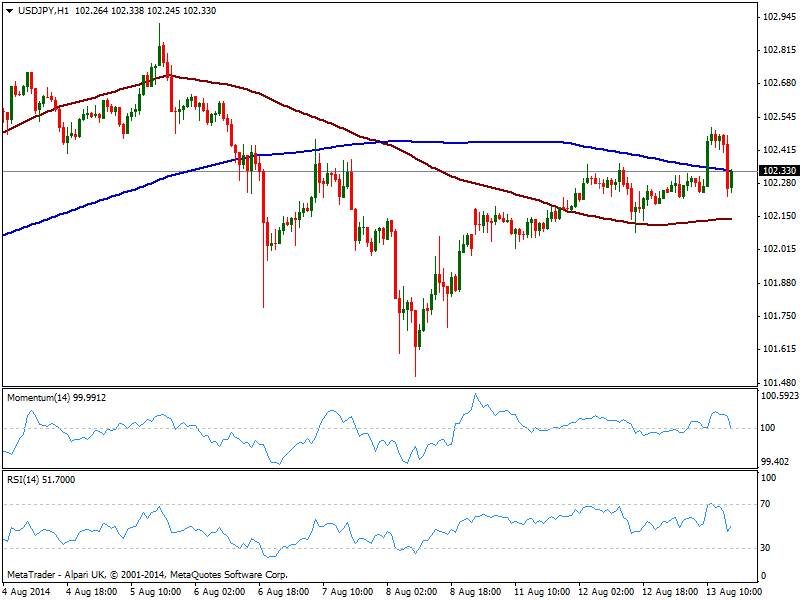

USD/JPY Current price: 102.33

View Live Chart for the USD/JPY

The USD/JPY trades at the top of its recent range, having extended a few pips higher, up to 102.51 before easing. The hourly chart shows however indicators turning lower near their midlines, and price stuck around its 200 SMA. In the 4 hours chart price stands above moving averages, albeit indicators also head lower above their midlines.

Support levels: 101.95 101.60 101.20

Resistance levels: 102.35 102.80 103.10

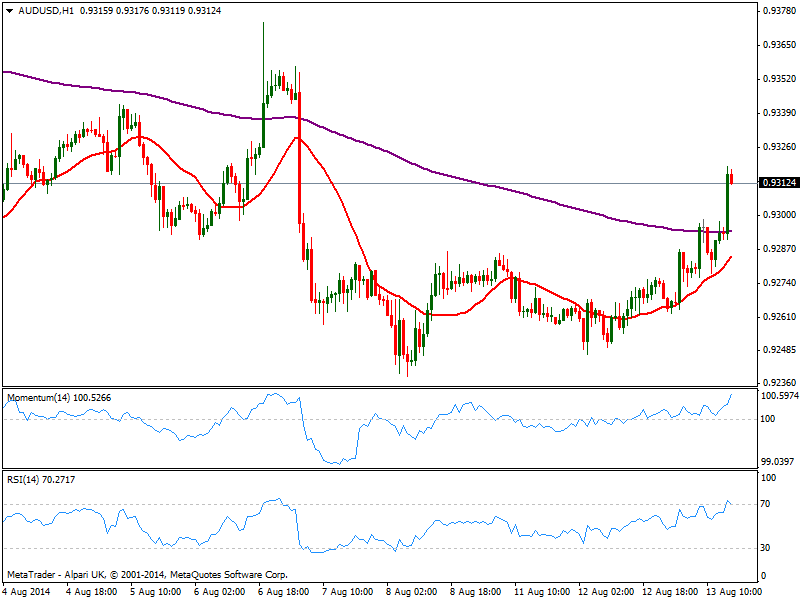

AUD/USD Current price: 0.9313

View Live Chart for the AUD/USD

The AUD/USD regained the 0.9300 level consolidating now its latest intraday gains. Technically, the short term picture has turned bullish, with indicators heading north in positive territory and 20 SMA gaining bearish slope well below current price. In the 4 hours chart indicators also head higher above their midlines, with immediate resistance now at critical 0.9330 static level.

Support levels: 0.9290 0.9260 0.9220

Resistance levels: 0.9330 0.9370 0.9410

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD trades on a stronger note 1.2530, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The United States Employment report will be released by the Bureau of Labor Statistics at 12:30 GMT. The US Dollar looks to employment data after the Fed signaled its intention to hold rates higher for longer on Wednesday.