EUR/USD Current price: 1.3378

View Live Chart for the EUR/USD

Market is dollar bullish, and that’s a lot to say these days: after ignoring a weak ADP number, investors jumped into the greenback on better than expected second quarter GDP numbers: an outstanding 4.0% and a revision of previous one from -2.9% to -2.1%. The EUR/USD fell as low as 1.3370 so far today, with selling interest now probably surging around 1.3400. The hourly chart shows price extending below a bearish 20 SMA and indicators heading south in negative territory, while the 4 hours chart presents also a bearish technical tone. With the FED schedule for the American afternoon, the pair may see no follow through in the short term, but as long as below 1.3400/10 the downside is favored, towards 1.3295 strong static support area, November 2013 monthly low.

Support levels: 1.3370 1.3335 1.3295

Resistance levels: 1.3405 1.3440 1.3475

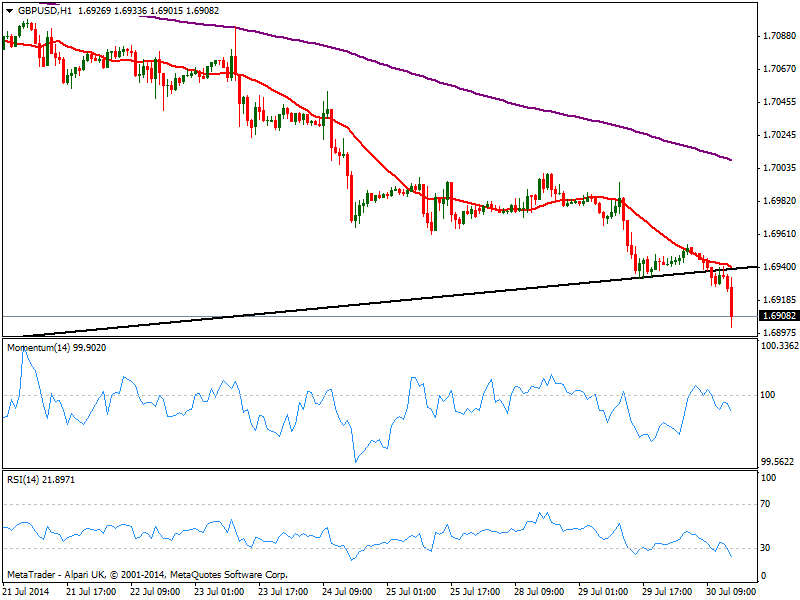

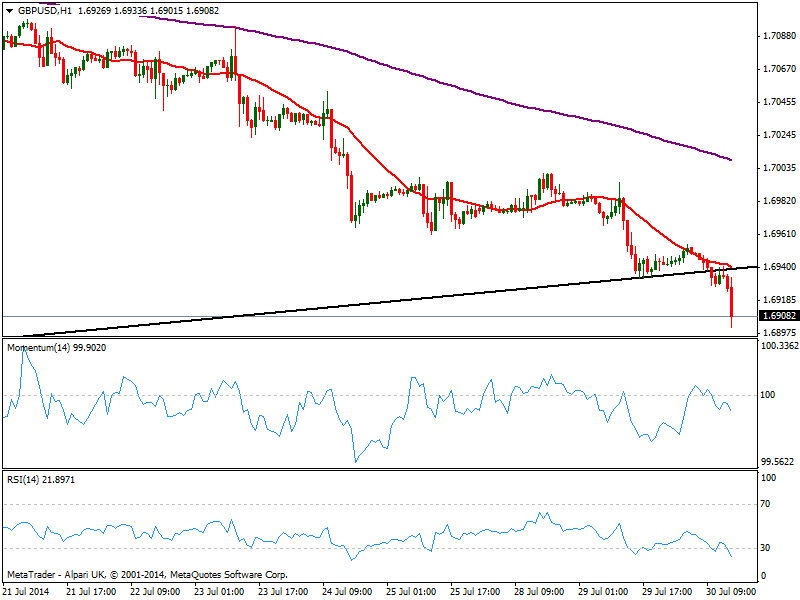

GBP/USD Current price: 1.6908

View Live Chart for the GBP/USD

The GBP/USD holds so far above the 1.6900 figure, with the downside limited despite general dollar strength. Nevertheless, the pair has broke below a daily ascendant trend line coming from October last year, and the hourly chart presents a strong bearish tone, with 20 SMA heading lower and converging with the broken trend line at 1.6950, and indicators heading strongly south near oversold levels. The 4 hours chart also presents a bearish bias, although the movements are expected to remain limited.

Support levels: 1.6900 1.6850 1.6815

Resistance levels: 1.6950 1.7000 1.7045

USD/JPY Current price: 102.60

View Live Chart for the USD/JPY

The USD/JPY accelerates higher breaking above 102.35 former resistance, with a strong upward momentum in the hourly chart, ready to test the 102.80/103.00 area. In the 4 hours chart indicators extend higher in overbought levels, but far from suggesting a pullback in the short term. More interesting, the daily chart shows 100 and 200 SMAs both converging in the 102.05 area, level that contained the downside earlier today.

Support levels: 101.95 101.60 101.20

Resistance levels: 102.35 102.80 103.10

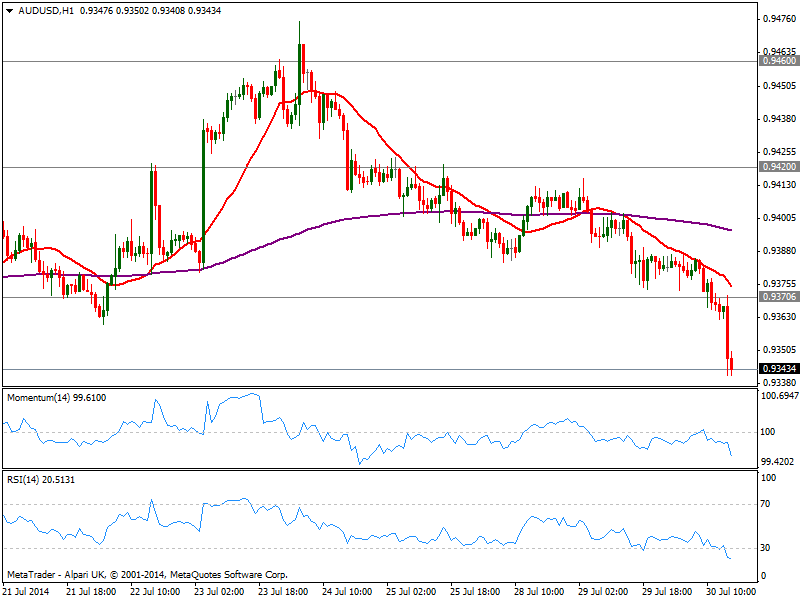

AUD/USD Current price: 0.9343

View Live Chart for the AUD/USD

The AUD/USD broke below 0.9370 before the news, but accelerated south afterwards, steadily approaching critical 0.9330 support. The hourly chart shows indicators with a strong bearish slope despite in oversold levels, while the 4 hours chart shows a quite similar picture, all of which supports at least a test of the mentioned level. A break below seems unlikely until FED, but once below, the pair is exposed to a downward continuation towards 0.9260 midterm strong support.

Support levels: 0.9330 0.9300 0.9260

Resistance levels: 0.9370 0.9420 0.9460

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750 area as USD recovers

EUR/USD stays under modest bearish pressure and trades slightly below 1.0750 in the European session on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD drops below 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold stays near $2,310 as US yields edge higher

Following a quiet Asian session, Gold retreated slightly to the $2,310 area. Hawkish tone of Fed policymakers help the US Treasury bond yields edge higher and make it difficult for XAU/USD to gather bullish momentum.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.