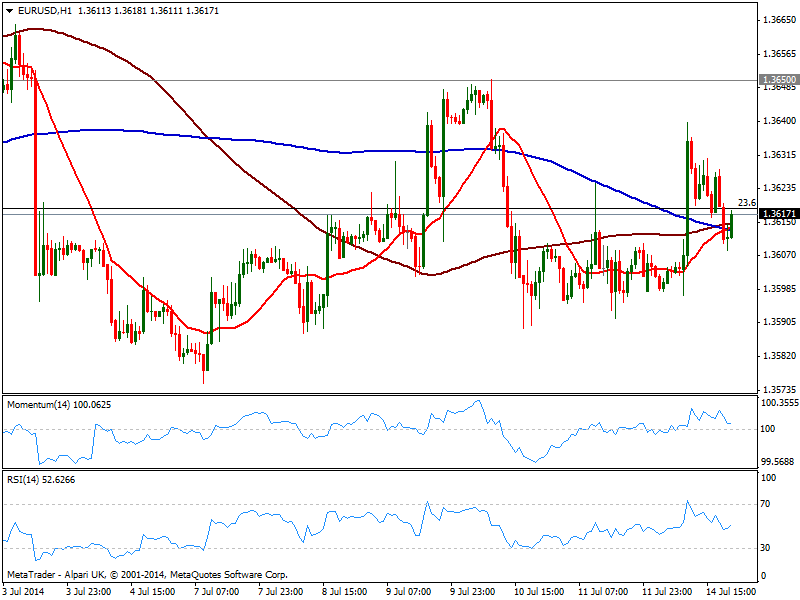

EUR/USD Current price: 1.3621

View Live Chart for the EUR/USD

A couple things outstood in markets on Monday, and they were not certainly currency related: stocks edged higher in Europe and the US, with DJIA at fresh all time highs and gold nosedived near $1300/oz, on the back of easing concerns over Portugal banking woes. However, problems are not over in that front, as on Tuesday, $1 billion lent to troubled Espirito Santo group should be repair. If not, default will sound loud, yet not as loud as risk aversion across the boards.

As for the EUR/USD early positive sentiment help the pair reach a daily high of 1.3640, but lack of self strength push the common currency back down against its American rival. In the short term, the pair continues to lack direction with the hourly chart showing price hovering around 20, 100 and 200 SMAs all together at current price zone, a clear reflection of the absence of trend. In the 4 hours chart the picture repeats, with moving averages in a 20 pips range also around current levels. The immediate range is 1.3570/1.3650 and unless a clear break of any of such extremes, the pair will hardly see any directional move over the upcoming days.

Support levels: 1.3570 1.3530 1.3500

Resistance levels: 1.3650 1.3680 1.3725

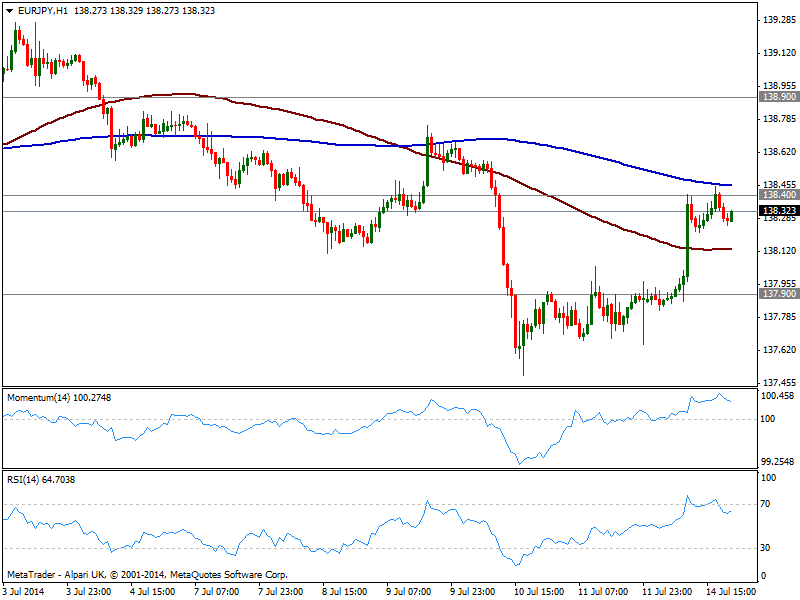

EUR/JPY Current price: 138.32

View Live Chart for the EUR/JPY

Yen gave back most of the ground added late past week as stocks advanced: all American indexes advanced strongly albeit Dow Jones fresh high took center stage, helping EUR/JPY returning 138.40 price zone. The pair however, halted around the strong static resistance, and the hourly chart shows price was also rejected from its 200 SMA, while indicators correct their overbought readings. In the 4 hours chart however, technical readings maintain the positive tone, with a break above mentioned resistance probably signaling a continuation towards 138.90 price zone.

Support levels: 137.90 137.50 137.00

Resistance levels: 138.40 138.90 139.35

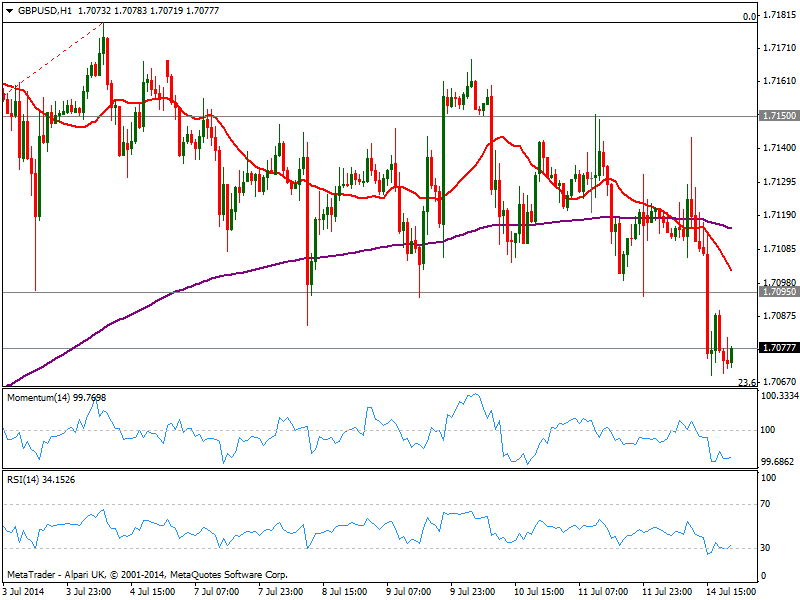

GBP/USD Current price: 1.7077

View Live Chart for the GBP/USD

The GBP/USD tripped stops below 1.7095 with little behind, extending down to 1.7068 on the day. Having bounced some, the overall tone is still bearish in the short term, as per 20 SMA presenting a strong bearish slope above current price while indicators turn flat in oversold levels, far from suggesting an upward correction. In the 4 hours chart a mild bearish tone is also present, although a break below 1.7060, 23.6% retracement of the latest bullish run, is required to confirm a downward continuation.

Support levels: 1.7060 1.7020 1.6990

Resistance levels: 1.7095 1.7150 1.7180

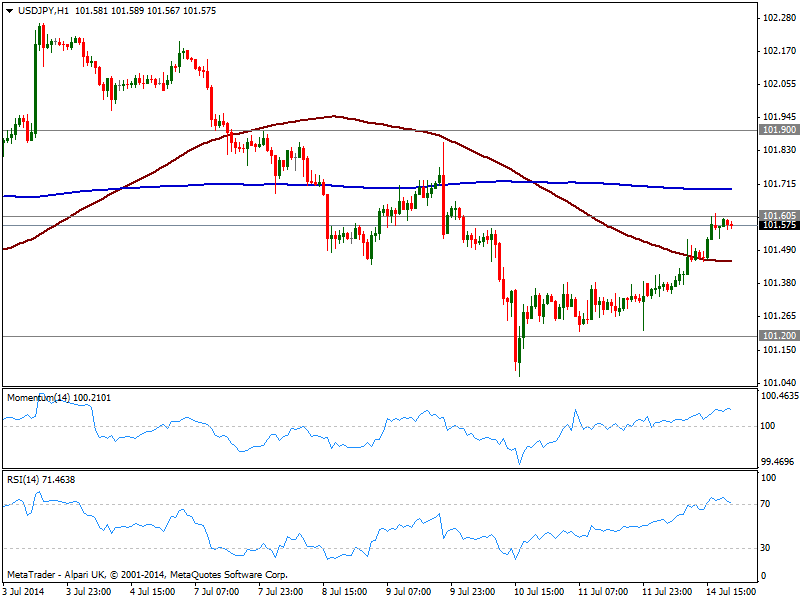

USD/JPY Current price: 101.57

View Live Chart for the USD/JPY

The USD/JPY advanced on yen weakness, with the pair stalling at 101.60 strong static resistance zone. Consolidating right below early Asia, the BOJ will have an economic policy statement with a press conference included, which may bring some action to the pair, albeit chances are limited as no news are expected there. Technically, the short term picture shows indicators losing upward strength in positive territory, with 100 SMA now offering some intraday support around 101.40. In the 4 hours chart however, the pair presents a strong upward momentum, which supports an upward continuation in the pair on a break above mentioned resistance.

Support levels: 101.40 101.20 100.70

Resistance levels: 101.60 101.95 102.35

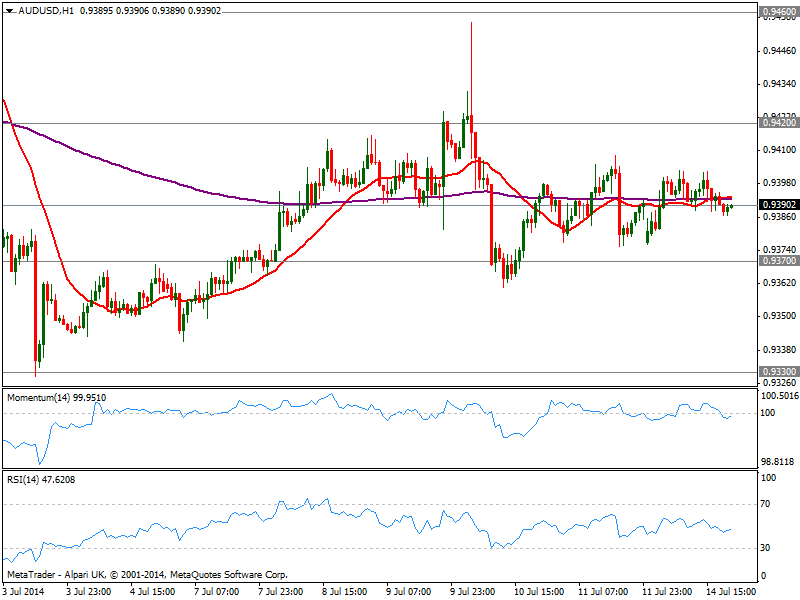

AUD/USD Current price: 0.9390

View Live Chart for the AUD/USD

With no changes, the AUD/USD stands right below the 0.9400 figure, having shown little progress all through the day, confined to a tight 30 pips range. Technical readings in the hourly chart are neutral, with moving averages horizontal right above current price, reflecting the lack of direction in the pair, while the 4 hours chart shows a slightly bullish tone coming from indicators, still quite weak. As commented on previous updates, either a break above 0.9420 or below 0.9370 is required to set a more directional move in the pair.

Support levels: 0.9370 0.9330 0.9300

Resistance levels: 0.9420 0.9460 0.9500

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750 as USD recovers

EUR/USD stays under modest bearish pressure and trades slightly below 1.0750 in the European session on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD drops below 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold price trades with mild positive bias, despite a firmer US Dollar

Gold price attracts some buyers during the Asian trading hours on Wednesday. Safe-haven demand, fueled by geopolitical tensions and uncertainty, as well as ongoing central bank purchases, might contribute to a rally in gold.

Ethereum resume sideways move as Grayscale files to withdraw Ethereum futures ETF application with the SEC

Ethereum is hinting at a resumption of a sideways movement on Tuesday after seeing inflows for the first time in seven weeks. Grayscale withdrew its application for an Ethereum futures ETF, and the SEC’s Chair Gary Gensler has also called most crypto assets securities.

No obvious macro catalysts to steer the bus

The US data calendar remains relatively light, with initial jobless claims and the University of Michigan survey being the key focus. However, these releases may not provide a significant catalyst for the next directional move in the US Dollar.