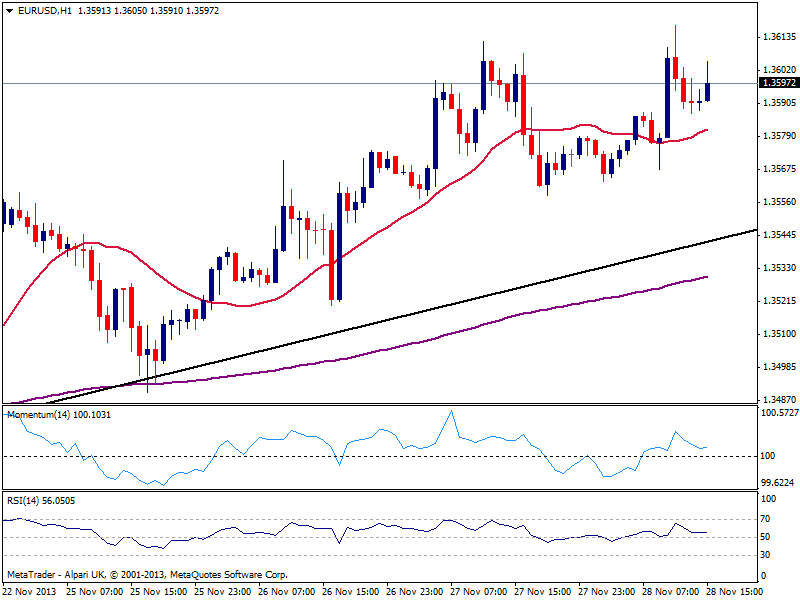

EUR/USD Current price: 1.3600

View Live Chart for the EUR/USD

The EUR/USD hovers around the 1.3600 area, in a quite thin trading session as per US markets closed on Thanksgiving. The dollar however, maintains a quite negative tone particularly against its European rivals, with the EUR/USD having reached a higher high of 1.3617 so far today. Technically, the hourly chart shows a quite neutral stance albeit positive, with indicators flat above their midlines and 20 SMA flat below current price. In the 4 hours chart a slightly positive tone prevails, yet 1.3660 will likely keep the upside limited today.

Support levels: 1.3530 1.3490 1.3440

Resistance levels: 1.3620 1.3660 1.3710

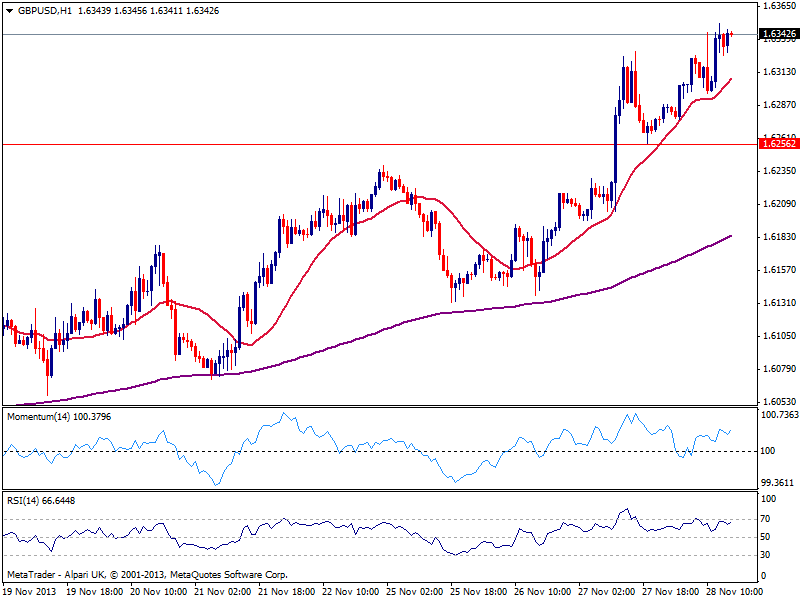

GBP/USD Current price: 1.6342

View Live Chart for the GBP/USD

The GBP/USD holds near fresh highs of 1.6345 having found buyers late Wednesday around key midterm support of 1.6250. The hourly chart shows 20 SMA maintaining a strong upward slope, offering dynamic support now around 1.6300 as indicators head higher in positive territory. In the 4 hours chart technical readings present a strong upward momentum despite overbought conditions, still supporting a test of the year high of 1.3680 posted early January.

Support levels: 1.6300 1.6250 1.6215

Resistance levels: 1.6380 1.6420 1.6450

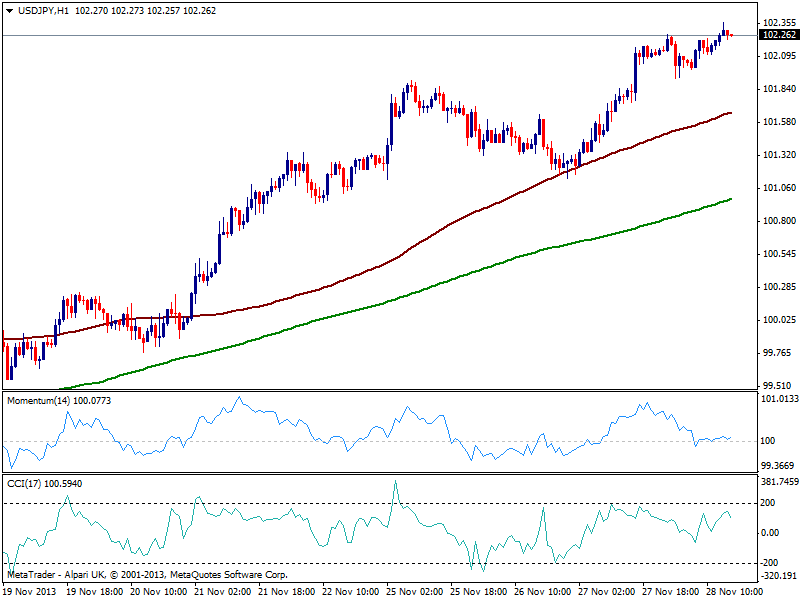

USD/JPY Current price: 102.26

View Live Chart for the USD/JPY

The USD/JPY advanced some this Thursday, although trades in a tight quiet range. Holding above 102.00, the hourly chart shows momentum horizontal above its 100 level, while moving averages continue advancing below current price, and supporting the bullish tone of the pair. In the 4 hours chart momentum also heads north in positive territory, supporting further gains in the short term.

Support levels: 101.90 101.60 101.15

Resistance levels: 102.50 102.90 103.30

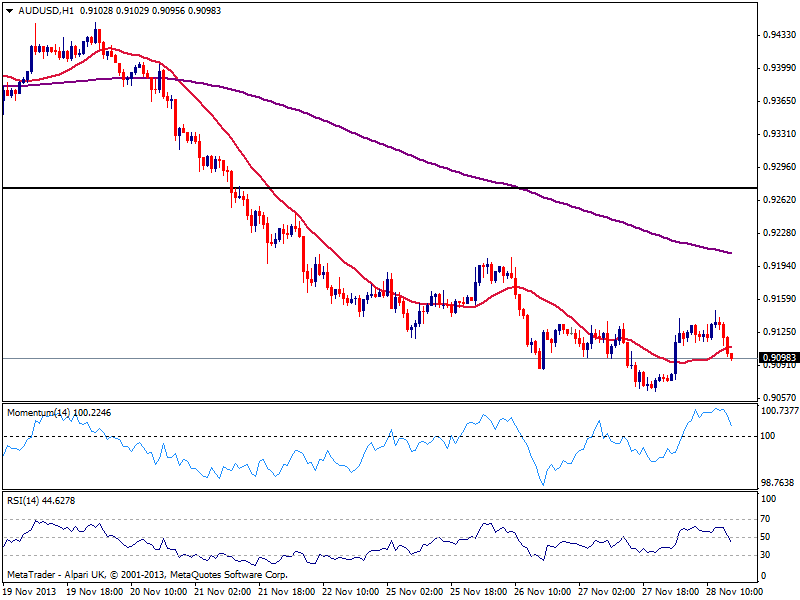

AUD/USD Current price: 0.9098

View Live Chart for the AUD/USD

Aussie found some buyers due positive local data during Asian hours, yet sellers surged again around 0.9160 still strong resistance level. The dominant bearish trend remains pretty much intact with the hourly chart showing indicators turning south and current candle opening below 20 SMA. In the 4 hours chart technical indicators also head south in negative territory, supporting a break below 0.9060 immediate support.

Support levels: 0.9060 0.9020 0.8980

Resistance levels: 0.9120 0.9160 0.9210

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.