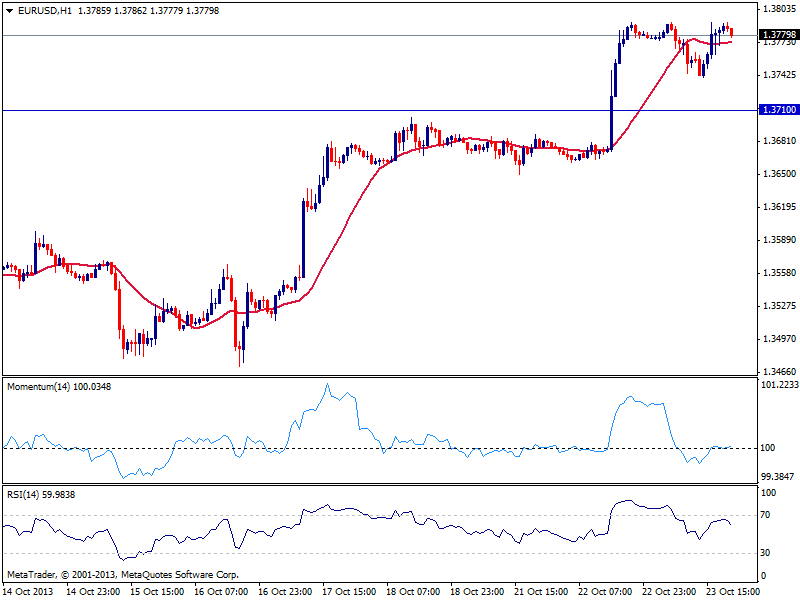

EUR/USD Current price: 1.3779

View Live Chart for the EUR/USD

The EUR/USD continued pressuring the 1.3800 figure during most of this Wednesday, with dollar temporal gains on risk sentiment attracting buyers on the pair around 1.3740. The hourly chart shows momentum around 100 and price above a flat 20 SMA, with all of the overbought readings already gone. In the 4 hours chart indicators also corrected some, while price held near the fresh yearly highs, which reflects the strength of the buyers. Further gains in the short term however, are subjected to local share markets behavior, as another round of selling in stocks may limited the ability of the pair to break beyond 1.3790 highs.

Support levels: 1.3740 1.3710 1.3680

Resistance levels: 1.3790 1.3835 1.3860

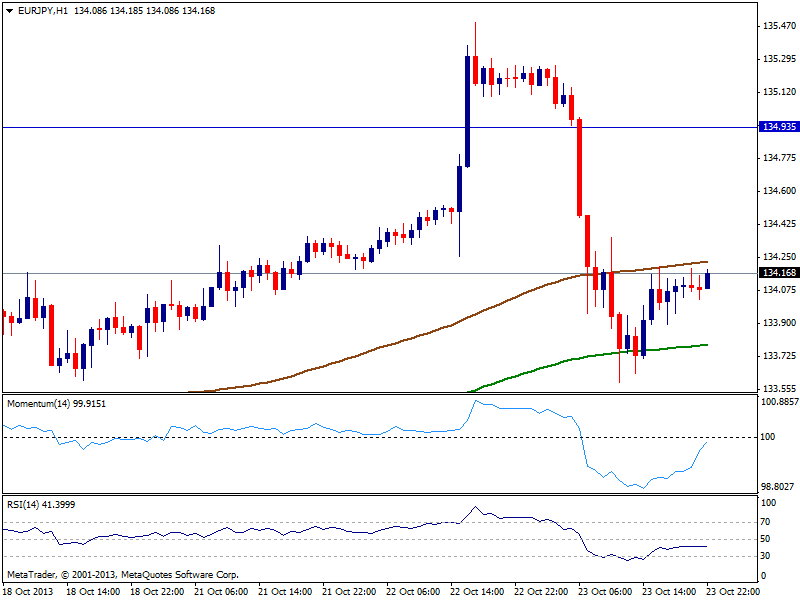

EUR/JPY Current price: 134.18

View Live Chart for the EUR/JPY

Yen strength extended towards the European session, although the currency crosses saw some recovery during US trading hours. Nevertheless the EUR/JPY lost over 100 pips, and the hourly chart shows indicators aiming higher, but still in negative territory as 100 SMA caps the upside around 134.30. The 4 hours chart shows indicators flat in neutral territory, suggesting the pair may have bottomed in the short term. However, steady gains above 134.40 are required to confirm an upward continuation for today.

Support levels: 133.90 133.55 133.10

Resistance levels: 134.40 134.90 135.60

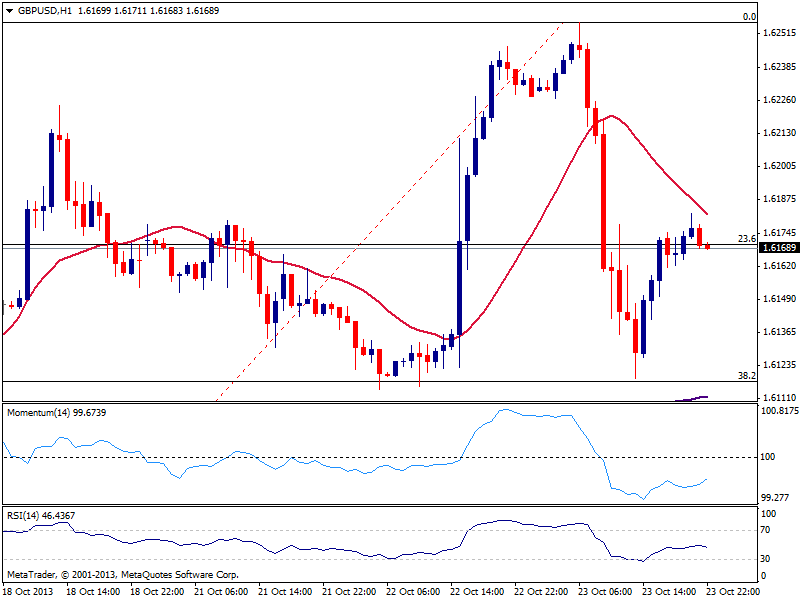

GBP/USD Current price: 1.6169

View Live Chart for the GBP/USD

The GBP/USD managed to recover some ground after dollar advance past Asian session, although maintaining a weaker stance at least from a technical point of view: the hourly chart shows price retracing some from a bearish 20 SMA while indicators stand flat in negative territory. In the 4 hours chart price struggles around a flat 20 SMA unable to firm up above it, while indicators stand flat around their midlines. The daily low of 1.6118 converges with the 38.2% retracement of the latest daily run from 1.5892 to 1.6255, so only a clear break below it should lead to a deeper slide while steady gains above 1.6225 are required to confirm a new leg up.

Support levels: 1.6120 1.6090 1.6050

Resistance levels: 1.6170 1.6225 1.6260

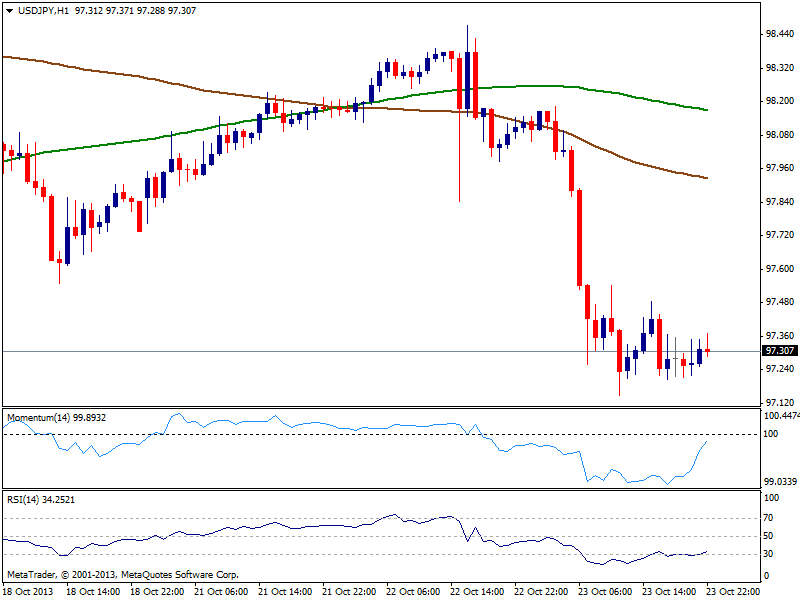

USD/JPY Current price: 97.30

View Live Chart for the USD/JPY

The USD/JPY shown little progress since latest update, trading in a tight 30 pips range for most of the US session. The hourly chart leaves little room for recoveries with 100 and 200 SMAs heading lower well above current price and indicators still in negative territory. In the 4 hours chart, technical readings maintain a strong bearish tone, helping keep the upside limited.

Support levels: 97.20 96.80 96.50

Resistance levels: 97.50 97.90 98.40

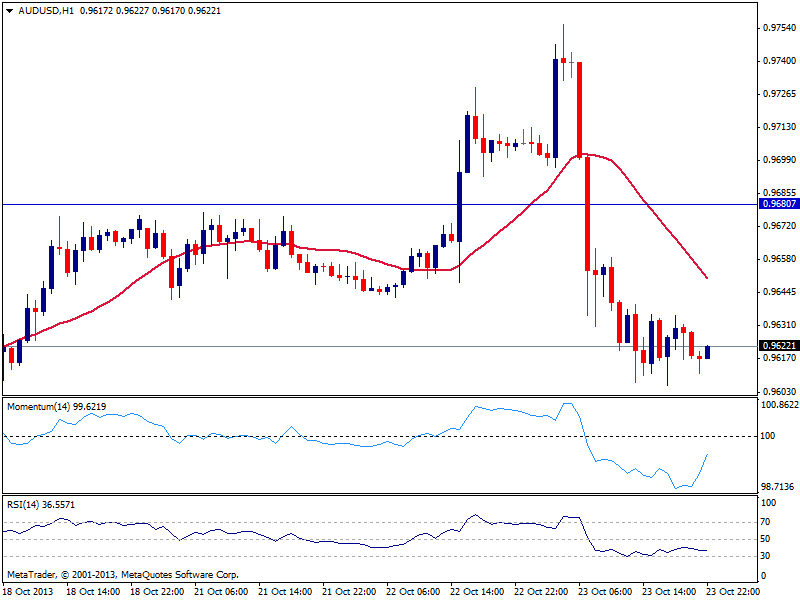

AUD/USD Current price: 0.9622

View Live Chart for the AUD/USD

The AUD/USD trades near its daily low of 0.9606 having been unable to recover ground all through the day. The hourly chart shows a strongly bearish 20 SMA above current price keeping the pressure to the downside. In the 4 hours chart technical readings maintain a bearish tone pointing for a test of 0.9520/40 area on a break below mentioned low.

Support levels: 0.9600 0.9570 0.9520

Resistance levels: 0.9680 0.9720 0.9755

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

Bitcoin price reclaims $59K as Fed leaves rates unchanged

The market was at the edge of its seat on Wednesday to see whether the US Federal Reserve (Fed) would cut interest rates during the Federal Open Market Committee (FOMC) meeting.

The market welcomes the Fed's statement

The market has welcomed the Fed statement, and the S&P 500 is higher in its aftermath, the dollar is lower and Treasury yields are falling. There is still only one cut priced in by the Fed.