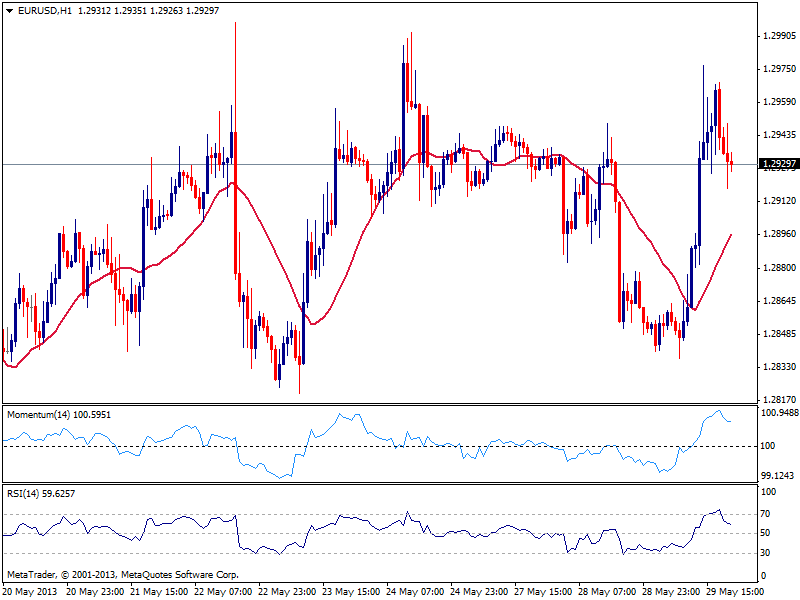

EUR/USD Current price: 1.2930

View Live Chart for the EUR/USD

Lots of volatility but little definition was seen in markets today, with majors surging strongly against the greenback early US session with not much behind the movement but yen accelerating against most rivals on falling stocks. US indexes traded in red most of the day, until mid American afternoon FED’s Rosengren talked about maintaining an accommodative police, noticing that with current unemployment and low inflation, tapering is not on the immediate agenda: stocks recovered, and so did the greenback, still closing negatively against most rivals.

The EUR/USD has traded near both of its range extremes, having been as low as 1.2836 and as high as 1.2976 this Wednesday. Stuck in the 1.2920/1.2950 area for most of the American session, the hourly chart presents a positive tone as momentum heads higher after correcting extreme overbought readings, yet as stated earlier, the 1.2840/1.3000 range will likely hold until next week Central Banks and NFP news.

Support levels: 1.2920 1.2885 1.2840

Resistance levels: 1.2950 1.2990 1.3030

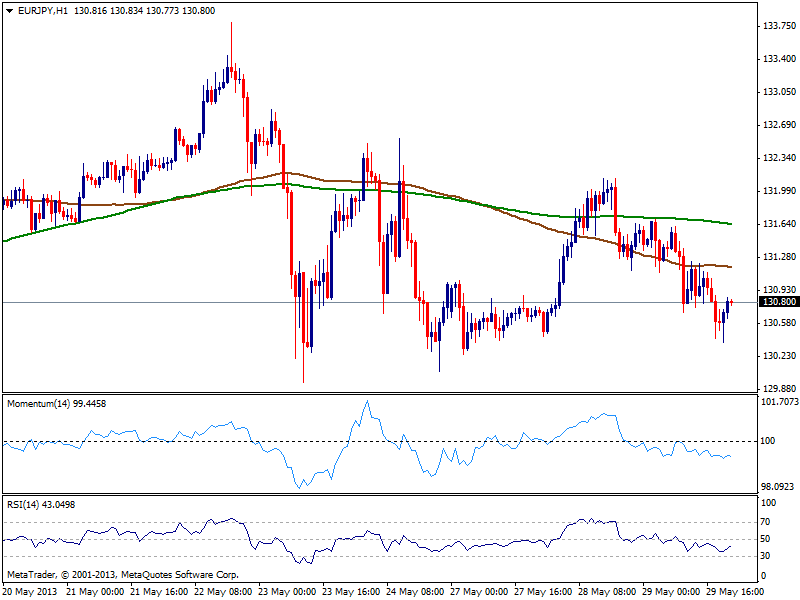

EUR/JPY Current price: 130.80

View Live Chart for the EUR/JPY (select the currency)

Yen recovered its strength across the board, with the EUR/JPY falling as low as 130.37 before bouncing some with US stocks late recovery. However, the bearish potential has increased after latest failure to regain the upside. The hourly chart shows price developing below 100 and 200 SMAs, while the distance in between both widens, pointing for more downward moves. Technical indicators stand in negative territory, showing not much strength at the time being, but also supporting the downside: 130.20 is the support to watch as once below, the pair has scope to extend its slide towards 128.80 price zone.

Support levels: 130.60 130.20 129.60

Resistance levels: 131.20 131.70 132.10

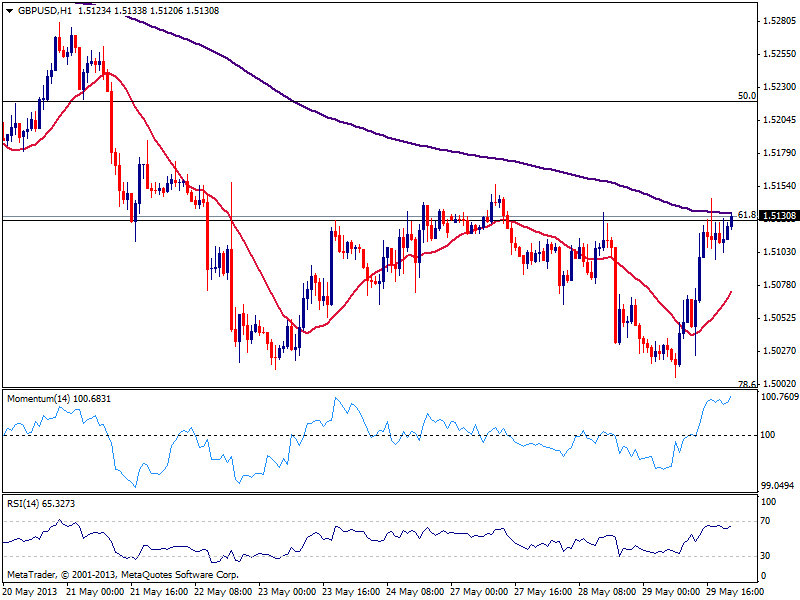

GBP/USD Current price: 1.5130

View Live Chart for the GBP/USD (select the currency)

The GBP/USD holds to its daily gains, stuck around 1.5130, strong Fibonacci level, 61.8% retracement of its latest daily run. The hourly chart shows a strong upward momentum coming from indicators after a limited correction, but as long as price does not shows a clear break above this area, the picture remains unclear. Pullbacks should found support around 1.5050/60 area, while only below this last the intraday bias will turn negative.

Support levels: 1.5070 1.5045 1.5010

Resistance levels: 1.5130 1.5175 1.5210

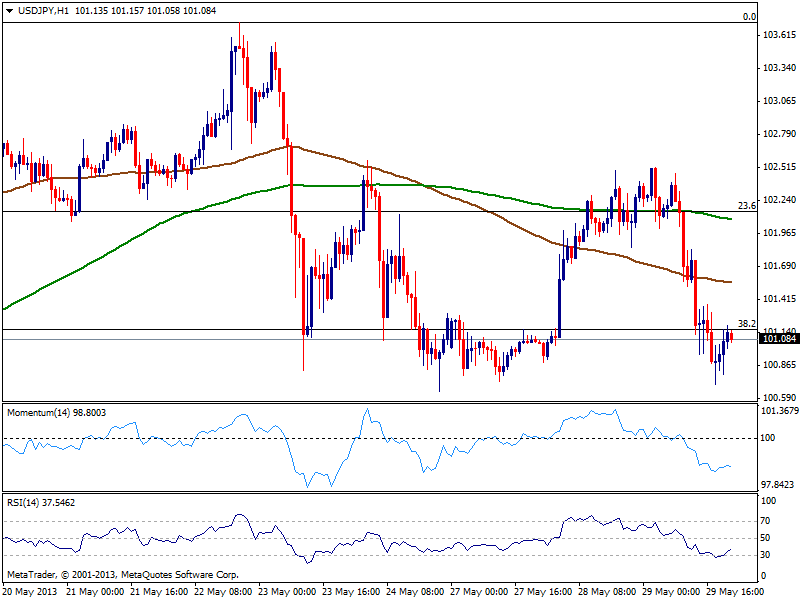

USD/JPY Current price: 101.08

View Live Chart for the USD/JPY (select the currency)

USD/JPY trades again below key 101.20 area, 38.2% retracement of May bullish run. Investors may continue buying dips, but are now rushing to take profits out of the table. And while the long term bullish trend remains in place and there are no much signs of a top underway, downside potential continues to increase. As for the technical picture, the hourly chart shows price back below 100 and 200 SMAs, with the distance between both widening, supporting the bearish bias in the pair. Technical indicators stand in negative territory while bigger time frames show technical indicators turning south, supporting the shorter term view. Break below 100.65, this week low should anticipate further slides with 99.70, former high, then at sight.

Support levels: 101.00 100.65 100.20

Resistance levels 101.25 101.60 101.95

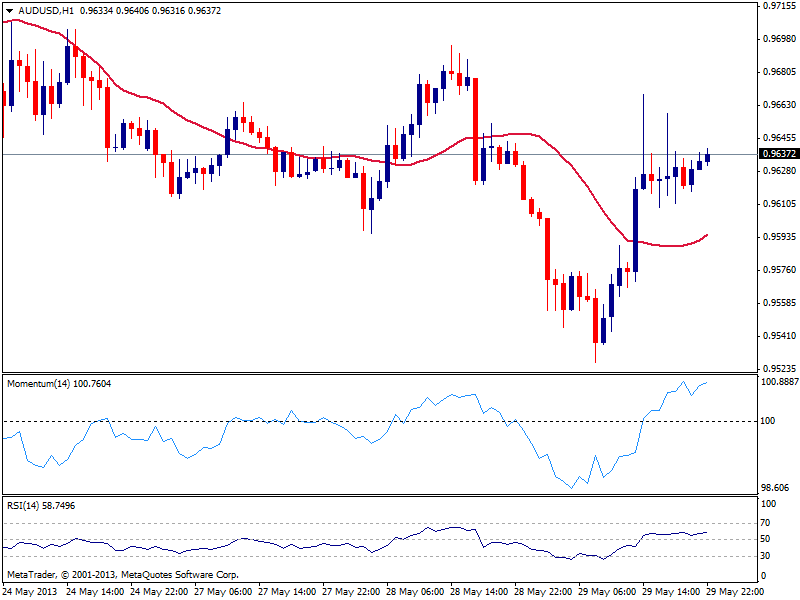

AUD/USD: Current price: 0.9637

View Live Chart for the AUD/USD (select the currency)

Australian dollar posted a fresh low of 0.9527, and despite late recovery, the daily candle continues with the lower low, lower high routine seen over the past few weeks that supports the dominant bearish trend. The hourly chart shows a positive stance ahead of Asian opening, with indicators heading higher in positive territory and price developing above its 20 SMA, although price seems unable to regain the 0.9660 immediate resistance area. In the 4 hours chart, technical picture is still bearish, helping maintain the upside limited.

Support levels: 0.9590 0.9540 0.9500

Resistance levels: 0.9660 0.9700 0.9740

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.