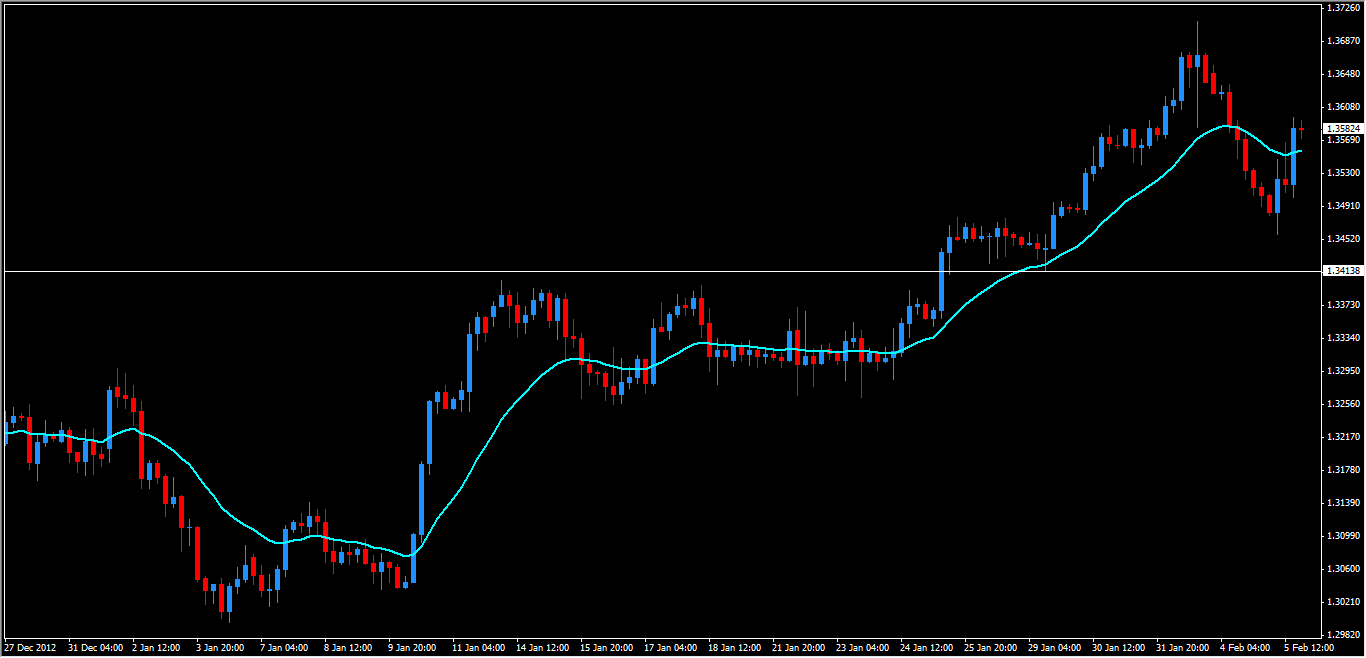

EUR/USD Current price: 1.3526

View Live Chart for the EUR/USD

The Euro is back on track, technically well positioned to launch another attack towards recent trend highs. The vigorous rebound off lows has been nothing short of astounding, and with such bullish momentum hard to fade - pause and consolidation in Asia possible -, the pair should be well supported on shallow dips. One hint over the current commitment of buyers was seen thru Tuesday's American session, when a pullback to 1.35 was graciously welcomed by value hunters. Clean break above 1.36 allows retest of 1.37. Break higher may have to wait until ECB's outcome later this week.

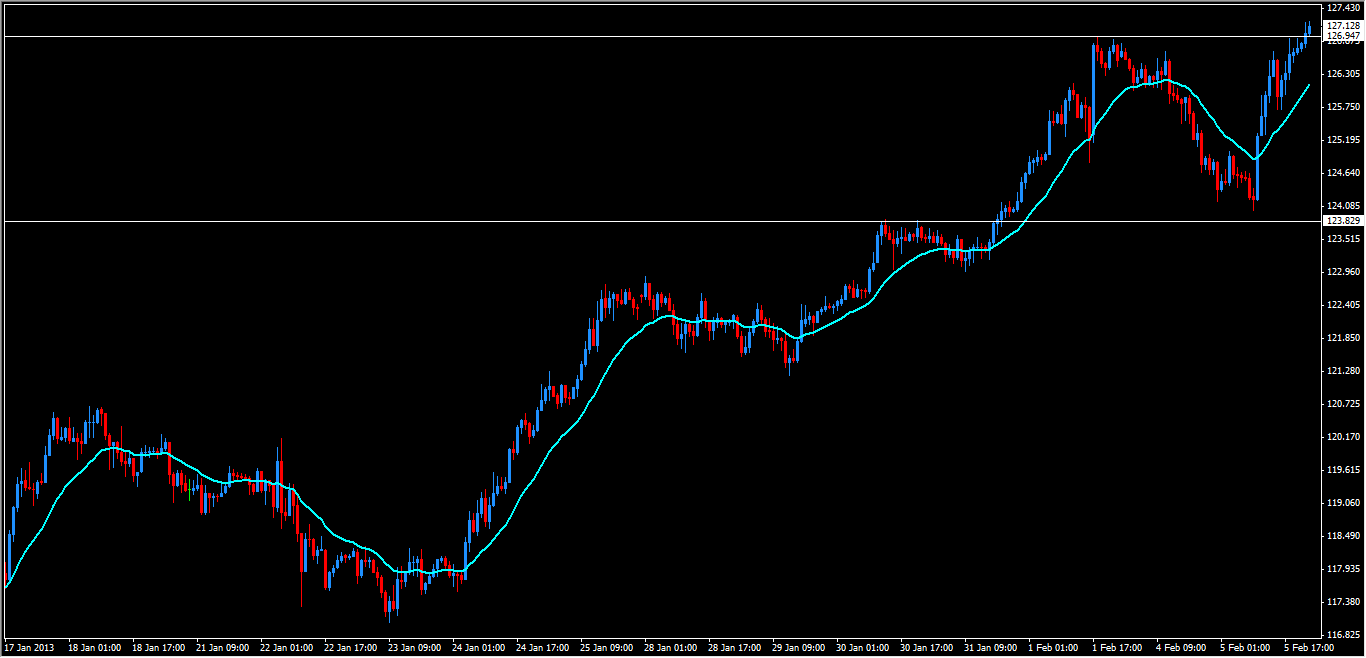

EUR/JPY Current price: 127.15

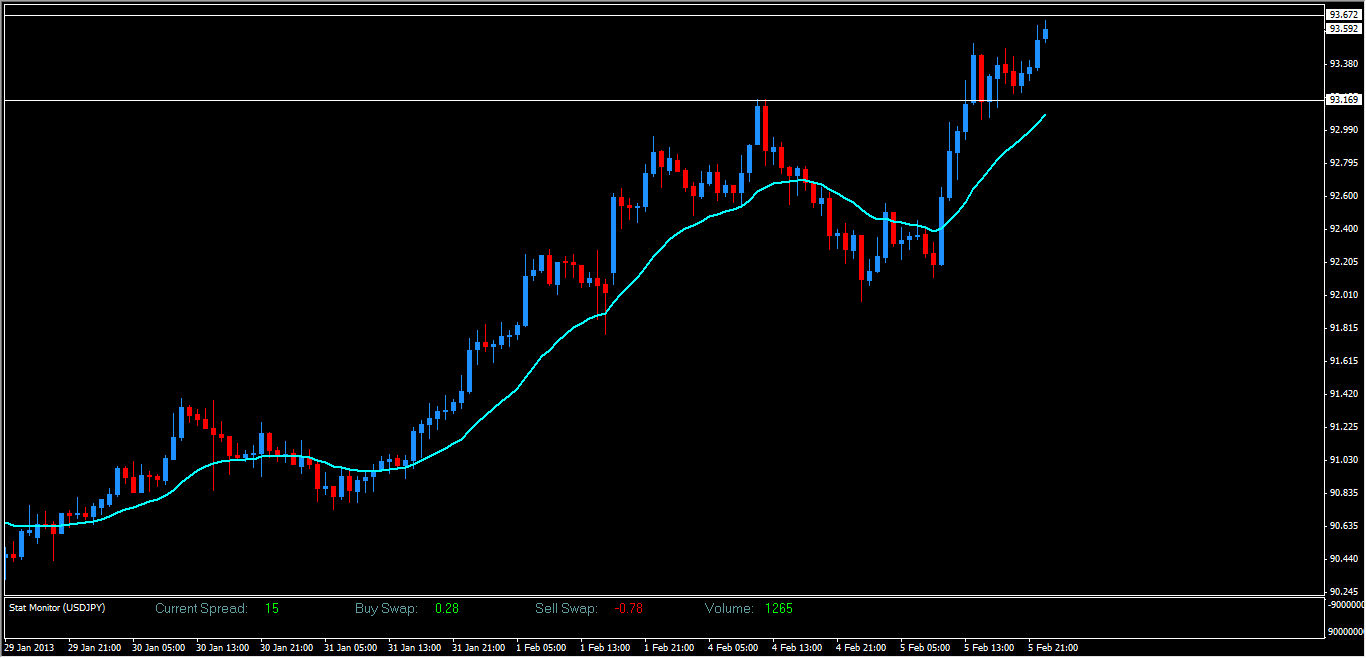

View Live Chart for the EUR/JPY (select the currency)USD/JPY Current price: 93.65

View Live Chart for the USD/JPY (select the currency)

The upside resolution into new trend highs with the subsequent 8 hours+ consolidation above the breakout level is a positive sign for further appreciation. Any pullback to retest the broken-resitance-turned support enjoys now the confluence of a rising 20-EMA on the hourly chart. The market continues to show clear impulsive moves followed by retracements corrective in nature. The next upside target is located at 94.70 - April 2010 highs-. Bear will have a hell of a job if they are to regain control, with first mission to regain the downside of a 45º angled 20-EMA on the H4, which continues to command prices higher, a pattern observed during last Asian session.

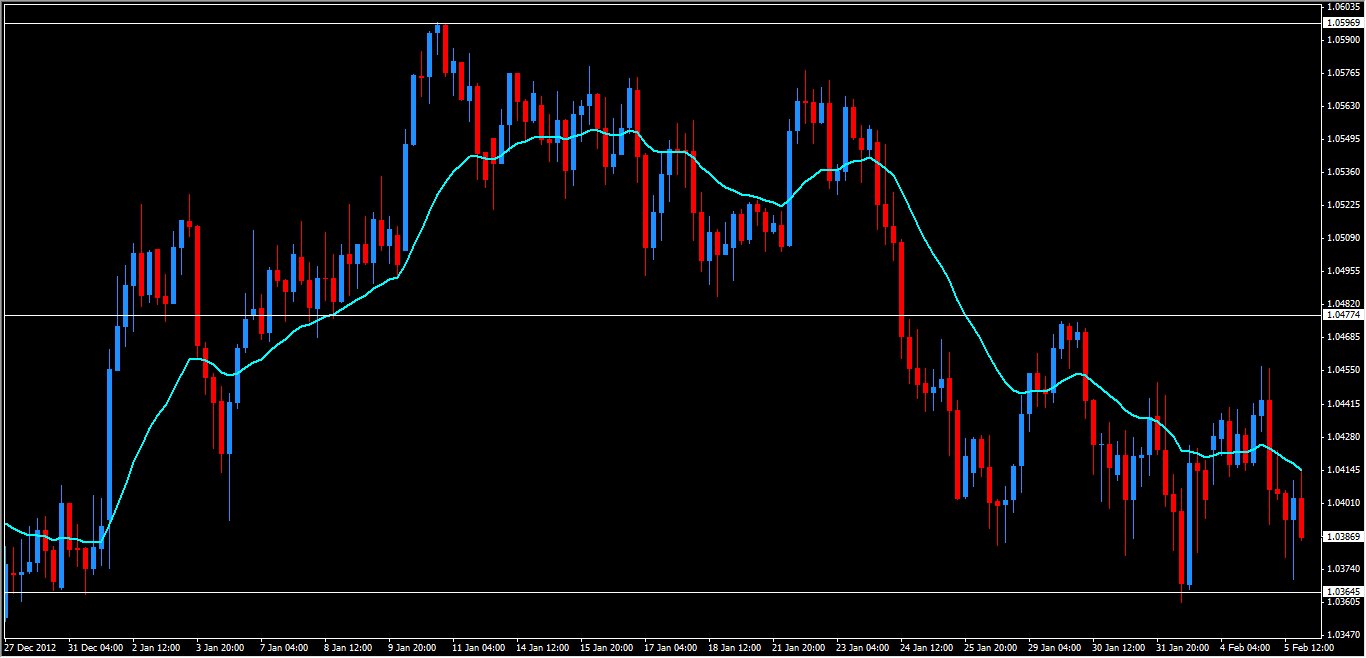

AUD/USD: Current price: 1.0382

View Live Chart for the AUD/USD (select the currency)

Within the context of a daily range with well defined parameters between 1.0480 and 1.0350, the risk continues to be skewed to the downside as per recent squeeze of longs. Price is making lower highs and lower lows since yesterday's RBA dovish meeting, an early indication of a pre-breakout scenario. A bounce back above 1.0415 - last swing high - would negates the structure, potentially forcing sellers to admit temporary defeat and abort the mission south, which would result in in erratic choppy conditions forming again.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades at around 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD struggles to hold above 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold fluctuates in narrow range above $2,300

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.