Chinese GDP Preview: How first corona contraction data will rock markets, regardless of reliability

- Economists expect China to report the economy squeezed by 6% yearly in Q1 2020.

- The world's second-largest economy is the first to provide coronavirus-related GDP figures.

- Markets' reaction to Chinese trade figures shows the figures matter, regardless of doubts.

Well before the world knew where Wuhan is on the map, investors suspected statistics from China – especially when it comes to Gross Domestic Product. Nevertheless, the publication early on April 17 will likely be watched closely and impact all markets.

Reasons to be doubtful

Li Keqiang, then the Party Committee Secretary of Liaoning, told the US ambassador that GDP figures in his region were unreliable. That was in 2007 before Keqiang was promoted to Prime Minister. He offered alternative measures for assessing the size of the economy, such as electricity consumption, railway cargo, and other indicators that The Economist later turned it into the Keqiang index.

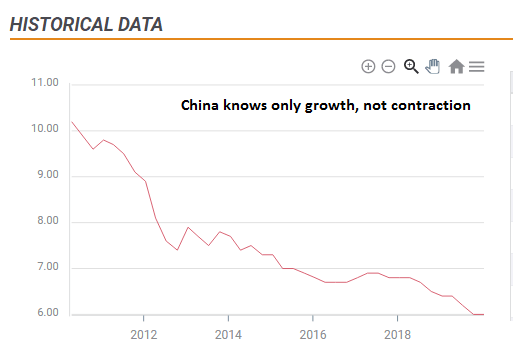

Governors and the state had reasons to report rosier figures than reality suggested. Moreover, Beijing's targets were normally met with incredible precision, also raising eyebrows. China's orchestration of a "smooth landing" from quick growth seemed to be smoothed by official statistics.

Moreover, China compiles and publishes GDP data less than three weeks after the related quarter concludes and refrains from revisions. Western countries need more time and modify the data as time goes by.

COVID-19 also added to doubts. Authorities initially sought to play down the cluster of pneumonia cases in Wuhan, punishing whistleblower doctors before changing its approach. The number of mortalities from the disease is also seen as too low by many, amid anecdotal reports of crematoriums working non-stop in Hubei province, where Wuhan is situated.

Why it matters to markets

Having said all that, why should traders await China's first-quarter growth figures? The main reason is the virus. So far, higher frequency data has provided up-to-date – yet partial – data about COVID-19's damage. China will be the first major economy to provide an overview of the impact on the economy. The world's second-largest economy was also the first to suffer from coronavirus and lockdown citizens.

Another reason to expect market movement is the impact of the figures on policy in China and in other places. If Beijing publishes upbeat figures, it may provide for other countries – expecting less damage and more demand from China. On the other hand, weak figures may further depress the global economy.

The third motive to expect a meaningful reaction is viewing the response to China´s trade balance figures for March. The better-than-expected outcome in both exports and imports improved the market mood on Tuesday, sending stocks higher and the dollar down, with the impact lasting long hours. Commerce figures are less significant than GDP statistics, so traders may expect a substantial move when the data comes out.

Expectations and reactions

Economists foresee an outright contraction of 6% in the first quarter of 2020, mirroring the growth rate of 6% seen in the last quarter of 2019. That would be the worst in modern memory. Even in the 2008-2009 crisis, the economy kept expanding.

The projected market reaction is straightforward. If Beijing reports slower contraction than expected – a figure closer to 0% – markets would cheer, sending shares higher and the safe-haven dollar and yen lower. The Australian dollar may be one of the biggest beneficiaries as Australia depends on China more than other developed economies. Oil prices could rise on hopes for higher demand, boosting the Canadian dollar.

On the other hand, deeper damage to the economy – over 6% contraction – would weigh on equities, boost the safe-haven currencies and drive commodity currencies lower.

Conclusion

China's first-quarter GDP figures will be the first broad economic report on the impact of coronavirus on a major economy with a contraction of 6% on the cards. Better figures may boost markets and weigh on the dollar while weaker statistics could trigger a sell-off and gains for the greenback.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.