China’s Gold gambit: Outfoxing America on the world stage?

Unless you live under a rock (and some days I wish I did), all eyes are on which bank will fail next.

We knew this was coming. Decades of Zero Interest Rate Policy, QE, and risky fractional reserve practices have consequences.

Superpowers like Russia and China are eyeing America’s financial vulnerabilities while the Fed, Congress, Treasury, and Wall Street play musical chairs and trip over each other like Keystone cops.

Recently the U.S. and NATO have discussed sanctioning China if it supplies arms to Russia. This would backfire.

U.S. sanctions on Russia appear to have failed (if not backfired). Likewise, sanctions against China may be disastrous for these reasons:

-

China is the second largest foreign holder of U.S. debt ($900 billion in Treasuries while Japan has $1.1 trillion).

-

In 2021, China's GDP was roughly 10 times larger than Russia's.

-

Chinese banks had more than 30 times as many assets as Russian banks.

-

Total foreign investment in China was more than six times the amount that had flowed into Russia.

-

China is the world's top trading economy and the number one exporter of manufactured goods by a wide margin.

-

China is the largest lender to emerging market economies.

China and Gold

The “Belt and Road” project includes 65% of the world. And who is left outside looking in?

The answer is UNCLE SAM.

China has been busy connecting Asia, Africa, and Europe.

Chinese officials admit they are stockpiling gold as their powerful magnet to attract allies in their economic war against Team West.

-

Beijing says it has signed cooperation documents with 149 countries and 32 international organizations while taking on 3,000 projects.

-

China states its goal is to expand to over 200 countries and has spent $1 trillion as part of Beijing's Belt and Road Initiative to open cross- border trade routes.

-

Honduras recently stated plans to open diplomatic relations with China.

-

Mexico has also signed on. Mexico is the 2nd most robust economy in Latin America. Brazil is #1, and they're already on board.

The Belt and Road initiative is nicknamed "the golden road."

It is the largest infrastructure project in human history, connecting 65% of the world's population and 50% of the global GDP. Moreover, it links these countries through bridges, roads, railways, and maritime channels.

Now think about the demand for silver

Building out new physical and digital infrastructure for 65% of the world requires metals, including silver. This is huge for silver and equally significant for de-dollarization.

And it's all settling on a potential Chinese gold-backed digital yuan. Countries increasingly do not trust each other's fiat currencies.

However, they do trust gold and silver.

Gold plays a vital role in the financial reserves for China and these emerging economies. Below are some gold-centered talking points on how China influences new countries to sign on to their trade union.

-

China targets emerging markets incentivized to accumulate gold as part of their reserves. This manages risk from currency holdings while also promoting stability during economic turmoil.

-

Gold offers a hedge against the eroding purchasing power of currencies (mainly the U.S. dollar) due to inflation.

-

Gold has an inverse correlation with the US dollar. Gold prices tend to rise when the dollar falls in value, protecting central banks from volatility.

The Chinese are speaking to over 149 countries about joining a gold- backed currency to take down the U.S. being the global reserve currency.

They conduct their business proposals in business suits using face-to- face old-school diplomacy methods.

In the past three weeks, while the domestic media has been saying nothing is wrong with the economy and your bank deposits are safe, China has been brokering deals with Russia, Iran, and Saudi Arabia.

The Biden administration is weaponizing the U.S. dollar via sanctions. In response, more countries are moving to escape.

Dollar depreciation (inflation) is a direct consequence of ZIRP, financing endless wars, and a wave of bail-outs within a system that privatized profits and socialized losses.

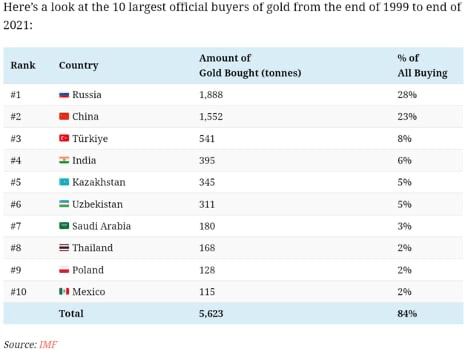

In closing, look at who has bought gold over the past twenty years.

How many Western nations do you see on the list below?

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Jon Forrest Little

Money Metals Exchange

Jon Forrest Little graduated from the University of New Mexico and attended Georgetown University's Institute for Comparative Political and Economic Systems.