With the exception of Hungarian forint that strengthened quite sharply already on Tuesday, the Central European currencies posted solid gains against the euro yesterday. The EURCZK pair therefore again approached its threshold set by the Czech National Bank (CNB), i.e. EURCZK 27.0.

Regarding the koruna, its recent appreciation already induced some reaction from the CNB. Specifically, Tomas Holub, the Chief of CNB’s Monetary Department, official, said in an extensive interview that he could imagine – if necessary with respect to reaching its inflation target – yet another extension of the intervention regime. Apart from that, he said that although it was not the most imminent question at the moment, the bank does not exclude possibility to use other “unconventional” policy tools. What did he mean?

The next unconventional instrument that the CNB could use to mitigate pressures on further appreciation of the koruna is cutting official interest rates below zero. Let us recall that the CNB base rate is currently at 0.05%. Mr. Holub however indicated that the discussion has so far been held rather on a theoretical level and that the primary ‘monetary policy’ instrument remains the exchange rate. He added that while talking about negative rates, the board members agree that they should keep the possibility to cut (repo and depo) rates below zero if necessary.

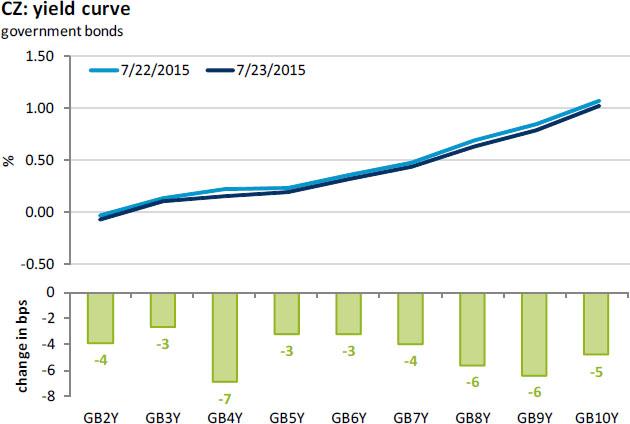

Despite the overall dovish tone of the interview, the koruna remains in sight of EUR/CZK 27.0. On the other hand, the reaction of the Czech bond market was quite visible – the yield of 2Y government bond has fallen well below zero today in early trading (see the chart below).

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD holds steadily as traders anticipate Australian Retail Sales, Fed’s decision

The Aussie Dollar registered solid gains against the US Dollar on Monday, edged up by 0.55% on an improvement in risk appetite, while the Greenback was crushed by Japanese authorities' intervention. As Tuesday’s Asian session begins, the AUD/USD trades at 0.6564.

EUR/USD finds support near 1.0720 after slow grind on Monday

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settled in for the wait US Fed outing. Investors broadly expect US rates to hold steady this week, but traders will look for an uptick in Fed guidance for when rate cuts could be coming.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Relief wave on altcoins likely as BTC shows a $5,000 range

Bitcoin price has recorded lower highs over the past seven days, with a similar outlook witnessed among altcoins. Meanwhile, while altcoins display a rather disturbing outlook amid a broader market bleed, there could be some relief soon as fundamentals show.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.