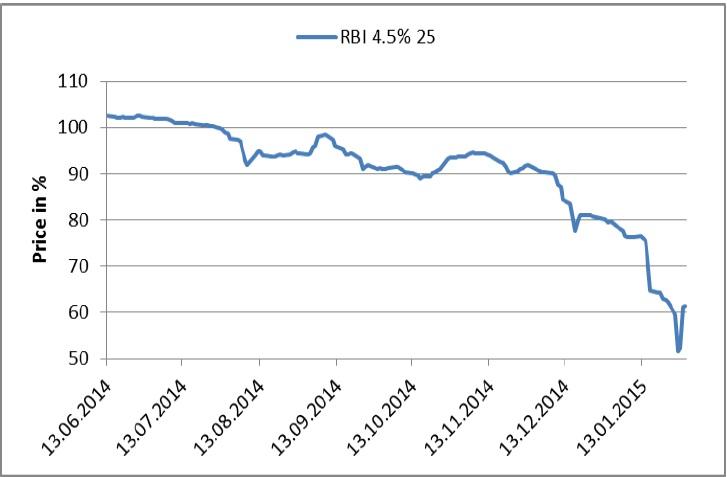

Chart of the Day:

Raiffeisen Bank International Subordinated Debt: Finally, some respite for RBI. The price of sub debt was in freefall as speculation rose that coupon payments would be blocked by regulators. Yesterday’s ad hoc statement gave investors some hope that would not be the case. The board also announced that a divestment programme would supplant any need to raise additional capital.

Analysts’ View:

HR Macro: December industrial production brought a positive surprise, with robust 5.3% y/y growth above both our and market expectations (2.5% and 3%, respectively). While the monthly data revealed a marginal decline of 0.2% (s.a.), strong production in the intermediate goods sector pushed the headline figure into the black y/y. The December output data also displayed the strongest YTD performance in 2014, which concluded a cumulative 2014 industrial rebound of 1.3% y/y. As for the prospective 2015 performance potential, we see a low base effect and external impulses supporting production , balancing out weak domestic demand which is clearly putting downside pressure on the recovery profile. As for our capital market forecasts, we expect them to remain unaffected by this release.

Traders’ Comments:

CEE Fixed income: A meeting between Greek Prime Minister, Alexis Tsipras, and EU Parliament President, Martin Schulz, was conciliatory rather than antagonizing and markets preferred to focus on the positives amid very mixed signals from the Greek government. The jury is out about how things on the debt restructuring front will develop in Greece but in our region debt restructuring is already very real in Ukraine and Belarus. In spite of this, CEE fixed income had a calm day with a bit more two-way flow and both the HUF and PLN gained as tensions eased a little. For the moment, price movements in secondary bond markets can broadly be summed up as directionless but primary markets are still heading in one direction only. Erste Group Bank priced EUR 500 m in 10Y covered bonds at MS +6 bps, down from IPT of +10 bps.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD holds steady above 1.0650, awaits US data and Fed verdict

EUR/USD is trading sideways above 1.0650 amid a softer risk tone and broad US Dollar strength on Wednesday. With European markets closed for Labor Day, the pair awaits the US employment data and the Fed policy announcements for the next directional move.

GBP/USD flatlines below 1.2500 ahead of US data, Fed

GBP/USD is off the lows but stays flatlined below 1.2500 early Wednesday. The US Dollar strength caps the pair's upside amid a cautious mood ahead of the top-tier US employment data and the all-important Fed policy announcements.

Gold price remains on tenterhooks with eyes on Fed policy decision

Gold price hovers below $2,300 as uncertainty ahead of the Fed’s policy announcements improves the appeal of the US Dollar and bond yields. The Fed is expected to support keeping interest rates at their current levels for a longer period.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.

ADP Employment Change Preview: US private sector expected to add 179K new jobs in April

The ADP report is expected to show the US private sector added 179K jobs in April. A tight labour market and sticky inflation support the Fed’s tight stance. The US Dollar seems to have entered a consolidative phase.