Catalyst and the “X” factor for gold

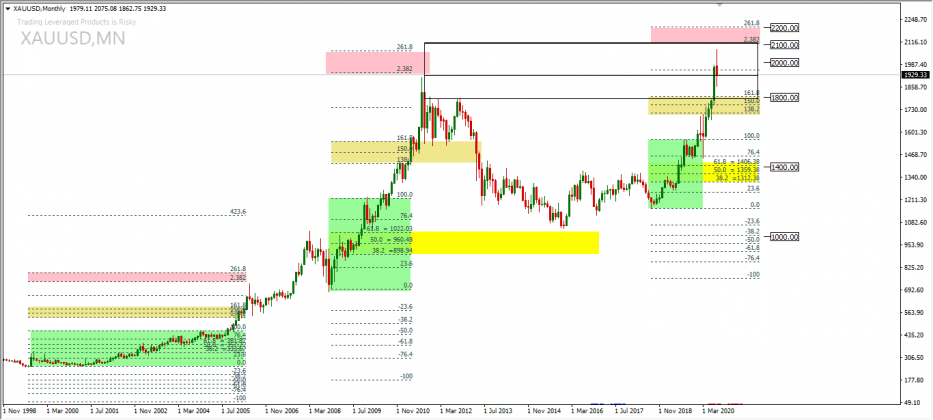

Probably a lot of gold investors are losing money after Tuesday's massive price drop. Some of our articles have warned of the vulnerability of buying that has exceeded the annual highs of 1920.90 and 2000 prices.

Some analysts and banks have put the likely high projection of $2000 to $2100 gold, but the problem with trying to predict a major correction is a risky challenge and before that happens you have to be prepared to lose a lot of profits. Gold's annual upward trend is 8% since leaving the standard gold in the early 1970s was very similar to the 10% + yearly return of the stock market that was relentless over the same range.

With equity at record-price sales ratio, GDP price-to-economic output and cycle-adjusted price-to-income ratio (a valuation measure typically applied to the S&P500 equity market, defined as price divided by ten-year average income and adjusted for inflation), precious metals are still attractive offer assets, as a hedge against the regular devaluation of the currency.

Based on its price relative to the Dollar in circulation, M-1 money supply, Treasury debt and stock market value, the average price of gold over the past 5 decades has been close to $ 2,300 an ounce. Using historical price benchmarks and adjustments for world money printing, today's price is around $ 1900 per ounce, gold remains undervalued in the long run. However, this is a basis for calculating the data, in fact political risks, stimulus in the face of the inevitable recession, geopolitical tensions are also factors that raise the price of gold.

The decline in the value of the paper dollar against other fiat currencies was a catalyst for gold. Historically, the Dollar Index has fallen 15-20% in 3-4 months. And today we have witnessed a decline of 11.05% starting from March high price of 103.93 weakening to low price of 92.45 in August, 5 months apart. Large moves in gold are usually a function of the decline in the local currency. Lower dollar is very supportive of rising gold prices.