Canadian Dollar strengthens against partners after statements from Central Bank

On Wednesday, the Canadian Central Bank advised that it will begin lowering the value of its weekly asset purchases. The downgrade is in response to the economy making progress in its recovery. The Bank had previously committed to spending C$4 billion per week. Moving forward, the Bank will spend C$3 billion, starting from next week.

Additionally, the Canadian Central Bank left the nominal interest rate unchanged at 0.25%. However, the Bank noted that it expected to lift the rate sooner than expected following the improved economic outlook. Late 2022 is being targeted as the time that the economy will return to an inflation rate of 2%. The Bank predicts that economic growth for 2021 will be 6.5%, revised up from the previous prediction of 4.0%.

How this news has filtered into the forex market?

USD/CAD

USD/CAD closed down 1.05% within the first 4 hours of the Central Banks announcement.

Moving in for a closer look, we see that the Bearish sentiment has subsided. At the 1 hour, a back and forth has cultivated. However, the Bulls have made some headway in correcting the drop.

As I write, the USD/CAD is currently trading at 1.24982

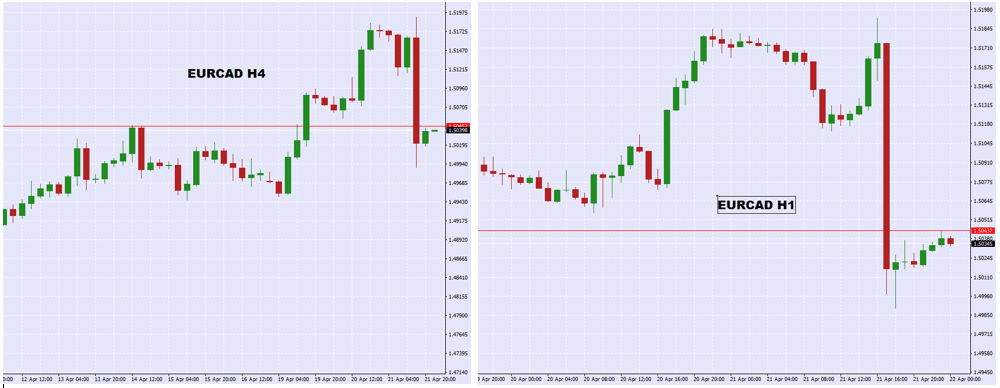

EUR/CAD

The story is similar over on the EUR/CAD. The CAD weakened by 1.02% immediately after the Central Banks announcement but has since begun to correct itself. Where analysis of the EUR differs from the USD is the presence of a historical point of resistance to indicate that the correction might peter out at 1.504. This level may be the appropriate level for the EUR after the CAD announcement.

As I write, the EUR/CAD is currently trading at 1.50437.

Author

Mark O’Donnell

Blackbull Markets Limited

Mark O’Donnell is a Research Analyst with BlackBull Markets in Auckland, New Zealand.