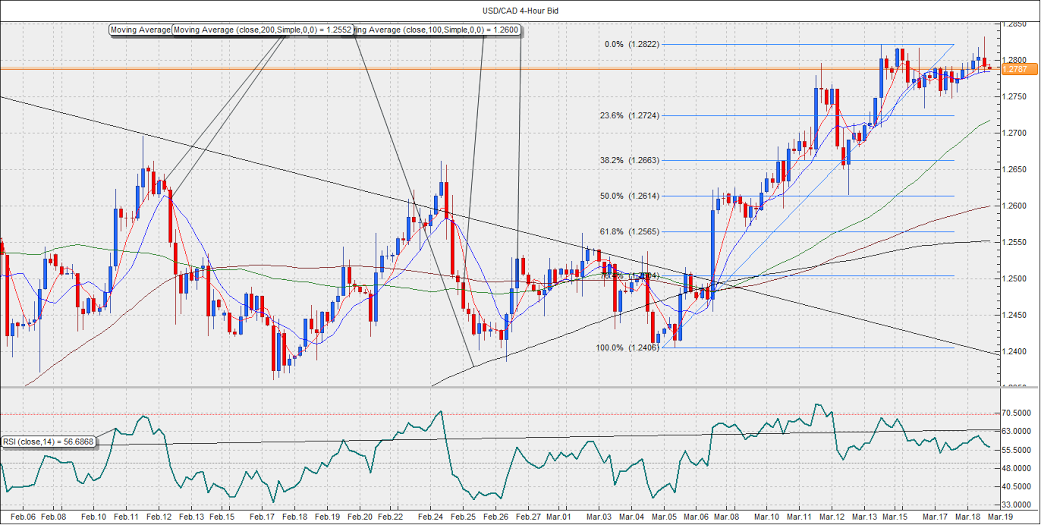

USD/CAD Forecast: Technicals favor correction to 1.27 levels

The sharp decline in the Crude prices in the last seven sessions pushed the USD/CAD to a fresh multi year high of 1.2832 levels today. Ahead of the FOMC meeting, the Canadian dollar is under pressure due to weak Crude prices. If the Fed statement today bolsters the expectations of a rate hike in June, we could see the USD/CAD pair rise towards 1.3 levels. On the other hand, an outright dovish policy statement, though a highly unlikely event, could result in the sharp appreciation in CAD.

However, charts indicate the pair could correct to 1.27-1.2680 levels today. The pair has been struggling to extend gains above 1.2820-1.2830 since Friday, which contradicts the fall in WTI Crude from USD 47.00 on Friday to USD 42.00/barrel today. The USD/CAD pair also shows a bearish price-RSI divergence on the 4-hour charts. Meanwhile, the hourly RSI has dipped below 50.00 levels, indicating weakness in the pair.

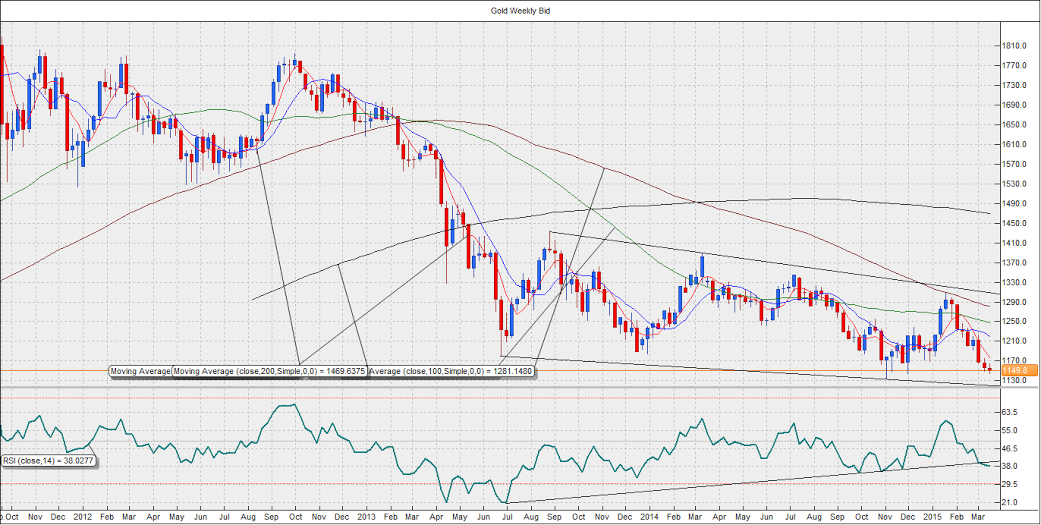

Gold Forecast: Expected range USD 1120/Oz-USD 1175/Oz

Gold prices are trading marginally lower at USD 1148.1/Oz levels ahead of the FOMC policy statement. The metal failed to strengthen despite the downward revision of the growth forecasts by the rating agency Fitch earlier today. Losses in the US equity markets have also failed to support the yellow metal. Moreover, the metal has been restricted largely in the range of USD 1145-1160/Oz levels despite most of the US data except jobs report repeatedly disappointing expectations.

The persistent weakness despite of the weakness in the US equities today indicates the markets believe the Fed would drop the word “patience” today, thereby opening doors for a rate hike in June or September. The markets also expect the Fed to revise its GDP and inflation forecasts lower, while the interest rate DOT chart is likely to indicate a slower rise in rates.

Gold prices are likely to dip to USD 1120-1100 levels if the Fed drops the word”patience”. However, fresh demand for the yellow metal could be seen at USD 1120-1100 levels as the dropping of the word patience is likely to be accompanied by a downward revision of the growth forecasts and a indication of slower rate hikes. On the other hand, the metal could rise to its 5-WMA at USD 1175 in case the Fed surprises markets by retaining the word “patience” in its forward guidance. However, gains are likely to be capped at the same as equities could rally in this case.

On weekly charts, the metal is moving in a channel, with prices about to test the lower end of the channel at USD 1120 levels. The weekly RSI too has breached the trend line support. Meanwhile, the hourly chart shows, the gains are being capped at the 50-MA, currently at USD 1151.6, since the beginning of the week. The hourly and the 4-hour RSI also favors further downside in the metal.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.