Bumper central bank session review

Thursday was quite a session.

Three central banks, the Swiss National Bank (SNB), the Bank of England (BoE) and the European Central Bank (ECB) hiked rates by 50 basis points. This followed the Fed’s decision to hike the Fed Funds rate by 50 basis points on Wednesday, a deceleration that brought the target range to 4.25%-4.50% and ended a run of four consecutive 75 basis-point increases.

Three Central Banks, Three Rate Hikes

Swiss National Bank (SNB)

The SNB put in an appearance at 8:30 am GMT and increased its Policy Rate, serving as the SNB’s third consecutive rate hike this year that raised the benchmark rate to 1.0% and furthered its position north of negative space. This followed September’s surprise 75 basis-point hike and an unexpected rate hike in mid-June—the first in 15 years—taking the central bank rate from -0.75% to -0.25%.

According to the press release from the central bank, further rate hikes are on the table to help counter increased inflationary pressure and a further spread of inflation. The central bank added that to provide appropriate monetary conditions, the SNB is also willing to be active in the foreign exchange market as necessary.

Additional notes from the press release:

- Inflation has declined somewhat in recent months, and stood at 3.0% in November. However, it is still clearly above the range the SNB equates with price stability. Inflation is likely to remain elevated for the time being.

- Global economic growth is likely to be weak in the coming quarters, and inflation will remain elevated for the time being. Over the medium term, however, inflation abroad should return to more moderate levels.

Bank of England (BoE)

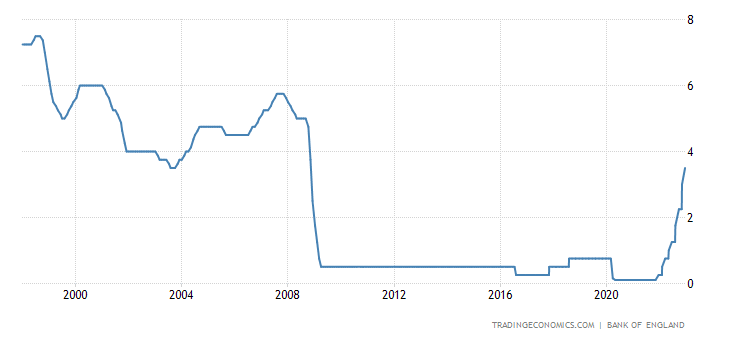

At midday GMT, the BoE, as expected, followed suit and increased the Bank Rate by 50 basis points to 3.5%, and cautioned that further hikes were likely next year. This was the central bank’s 9th consecutive rate hike, raising rates to their highest in 14 years in its attempt to tackle double-digit inflation. Consumer prices in the UK, according to the consumer prices index (CPI), eased to 10.7% in November on a year-over-year basis, following October’s eye-watering 11.1% print. The member committee, which consists of nine MPC members, voted in a 6-3 majority in favour of the 50 basis-point move. Catherine Mann, however, voted for another 75 basis-point hike, while Silvana Tenreyro and Swati Dhingra voted to keep the Bank Rate at 3%.

The question going forward for the central bank, and that of most central banks, is at what point will the Bank Rate hit its peak? This article does a superb job in showing expectations of major desks for the terminal rate going forward.

Sterling immediately dropped against the US dollar following the announcement, though bottomed around $1.2297. Despite temporary support, follow-through downside unfolded in early US trading, pulling the currency pair 1.5% lower at the time of writing. UK government debt also rallied in the immediate aftermath of the release and consequently guided yields southbound.

European Central Bank (ECB)

The ECB at 1:15 pm GMT, alongside the SNB and BoE, kicked their main Refinancing Rate north by 50 basis points, taking it from 1.5% to 2.0%. This marks its 4th successive rate hike in 2022 and follows two consecutive 75 basis-point hikes.

According to the central bank’s press release, the rate hike was due to a substantial upward revision to the inflation outlook. The bank also added that further rate hikes are expected.

The EUR/USD immediately rotated north following the announcement, with additional outperformance unfolding into the US open which subsequently witnessed a rejection after whipsawing north of $1.07. Notably, this forged a daily bearish outside reversal that snapped a three-day winning streak.

What’s Ahead on the Calendar for Friday?

- Month-Over-Month UK Retail Sales for November at 7:00 am GMT (Expected: 0.3%; Previous: 0.6%).

- Eurozone S&P Global Manufacturing Flash PMI for December at 9:00 am GMT (Expected: 47.1; Previous: 47.1).

- UK S&P Global/CIPS Manufacturing Flash PMI for December at 9:30 am GMT (Expected: 46.3; Previous: 46.5).

- US S&P Global Manufacturing Flash PMI for December at 2:45 pm GMT (Expected: 47.7; Previous: 47.7).

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,