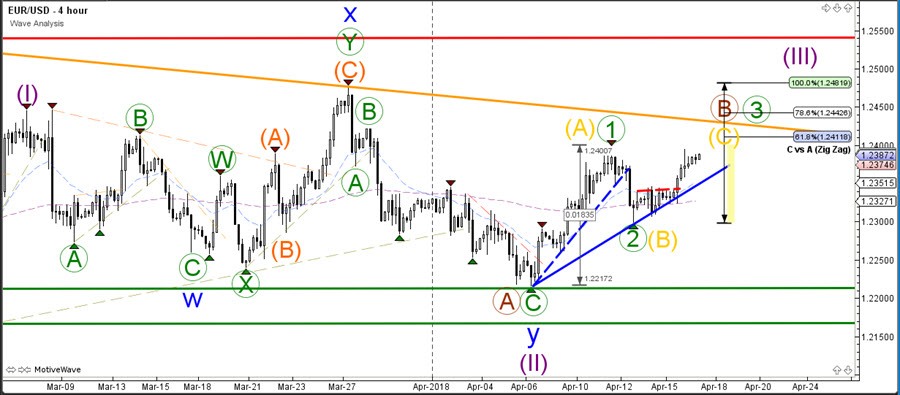

Meta description: EUR/USD made a bullish bounce, which could either be part of a larger ABC correction (gold) within a wave B (brown) or the start of an uptrend in wave 3 (green). The key level for determining whether it’s a 123 or ABC are the Fibonacci target levels.

EUR/USD

4hour

The EUR/USD made a bullish bounce, which could either be part of a larger ABC correction (gold) within a wave B (brown) or the start of an uptrend in wave 3 (green). The key level for determining whether it’s a 123 or ABC are the Fibonacci target levels. A bullish breakout above the 100% Fib level when comparing wave C versus A makes a wave 3 more likely.

1 hour

The EUR/USDbroke above the resistance trend line (dotted red) and is now challenging the previous high (orange). A bullish breakout could expand the bullish momentum but the Fib levels remain key. A bearish breakout below the support trend lines could indicate weakness and a bearish reversal.

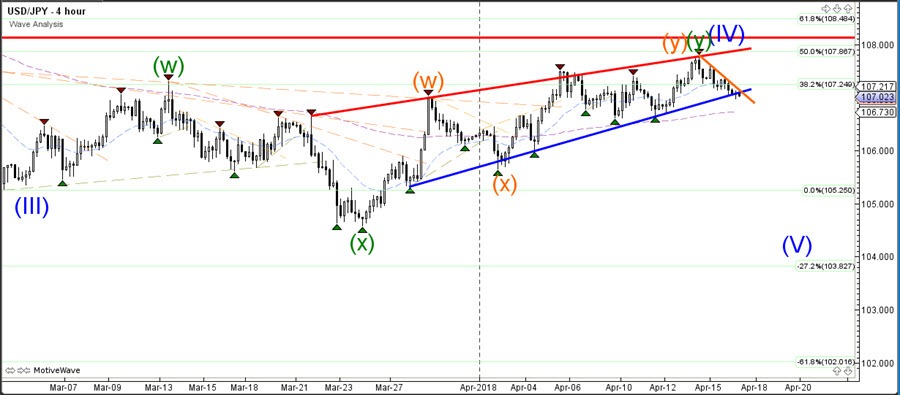

USD/JPY

4 hour

The USD/JPY has made a bearish reversal at the key 50% Fibonacci resistance level and price is now challenging and breaking below the support trend line (blue). The support is part of a rising wedge chart pattern and the bearish breakout could indicate a trend change.

1 hour

The USD/JPY is pushing below support (dotted blue) but price will need to reach at least the 161.8% Fibonacci target of wave 3 v1 before the wave 3 pattern becomes more likely. A bear flag chart pattern that appears after price hits this target could indicate a potential continuation setup.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.