Bottoms are a process not an event, this is probably one in both stocks and bonds

Nobody said trading was easy

Traditional well-diversified investors are feeling a historic amount of pain. Ironically, this is exactly what the Fed is hoping for. Just as the stimulus was intended to inflate asset prices and stabilize the economy, the current policy comes with a goal of wealth destruction. Sadly, financial disruptions to the average household budget are precisely what is needed to thwart inflation.

The Fed has two goals in its fight against inflation; the first is to crush the wealth effect. In 2020 and 2021 the economy was flush with bitcoin and meme-stock millionaires throwing money at assets as worthless as glorified .jpeg image files. Even more pervasive in the economy was pent-up consumer spending from the Covid shutdowns and the extreme wealth effect giving the green light for splurging. The party is over and the pauper must be paid.

The second goal, in our speculative view, is likely to lure bodies back to work. There is a significant sector of the workforce that opted to retire early due to their new-found investment wealth; if they feel the pinch they might look to get back on steady payroll. This is because increasing wages is putting pressure on inflation, but a larger pool of employees would likely slow down the ship on wage gains (and, therefore, inflation).

Treasury futures markets

30-year Treasury Bond Futures

Is the Fed overshooting?

We have no idea if the Fed has gone too far, or not enough. There are a lot of strong opinions out there on this topic but the reality is we won't know until we know. Because there is a lag between interest rate hikes and their impact on the economy, we are of the view the Fed should take a step back and see what they've done rather than relentlessly pushing households and economies around the world to the brink.

A good friend of mine pointed out the danger in relying on academic scholars to drive prices in markets where they've never had real risk exposure. In other words, the smartest and most well-educated economists in the world aren't equipped to account for the emotional human response to shock and awe policy. Things can, and do, on rare occasions, break.

Treasury futures market consensus

There has been no let-up on the Treasury liquidation. We didn't think it would come to this, but the monthly downtrend line is in play. It is now or never for Treasury bulls.

Technical Support: 125'11 and 124'0 ZN: 111'03 and 110'17.

Technical Resistance: ZB: 128'28, 130'27, 132'06, 135'0, 136'30, 137'23, 142'15, and 145'11 ZN: 115'10, 116'27, 118'07, 120'16, and 122'02.

Stock index futures

We wish 3550/3575 would come so we could move on

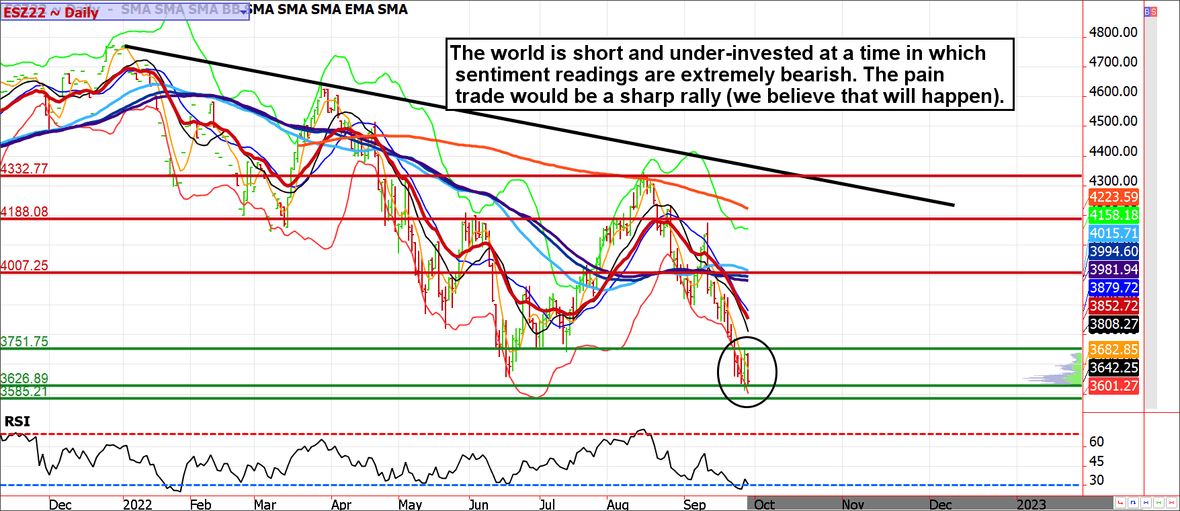

It might not seem like it after looking at today's painful tape but there is a high probability the equity markets will find a reliable bottom somewhere between here and 3550. The two important levels we are looking at are 3575 and 3550; in this type of volatility, the difference between the two is nothing more than market noise. That said, even a temporary probe to 3500 would be drawing within the lines; with the VIX over 30, things get messy.

There are quite a few gurus out there looking for the S&P to move to 3000 or lower. We are not in that camp unless the UK pension crisis becomes the next Lehman Brothers (not impossible but not likely). Nevertheless, we can see where the 3000 figure is coming from, it is a prominant uptrend line on a monthly chart. For reference, the reason we feel good about the 3500ish area holding is it represents the original breakout of the post-lockdown rally in late 2020.

Stock index futures market consensus

There are a lot of reasons 3550/3575 should hold and turn selling into buying, but there is one reason not to trust it (UK chaos contagion).

Technical Support: 3575, 3550, 3400, 3250, 3000

Technical Resistance: 3750, 3810, 3930, 4010, 4190, 4330 4425, 4380, and 4425

E-mini S&P Futures swing/day trading levels

These are counter-trend entry ideas, the more distant the level the more reliable but the less likely it is to get filled

ES Day Trade Sell Levels: 3785 (minor), 3820, 3930, 3995, 4075, 4155, 4236, 4360, 4380, 4450, and 4560

ES Day Trade Buy Levels: 3620/3600, 3570, 3510

In other commodity futures and options markets

July 5 - Buy December corn $7.00 calls at about 17 cents.

July 6 - November bean bull call spread with a naked leg using the 13.40/14.40 call spread and a short $12.00 put.

July 7 - Aggressive gold option play, buy December $1800 call, sell December $1900 call, and sell a December $1625 put.

July 7 - Aggressive silver option play, buy the October silver $20 call, sell the October $22 call, and sell an October $17.50 put.

July 11 - Limited risk 10-year note play, buy the September 118.5/120.5 call spread.

July 11 - Buy October cattle 145 calls for about 1.50.

July 12 - Cheap and long-dated euro call options, buy the December euro $1.10 call for about 35 ticks.

July 14 - Buy the October oil 90/100 call spread with a naked short 77 put.

July 15 - Buy December coffee 200/220 put spread and sell a 1.65 put

July 22 - Bullish December corn spreads, buy the 600/700 call spread and sell a 520 put to pay for it.

July 28 - Bearish November soybean put spreads, buy the November 14.00 put, sell the 13.00 put and sell the 16.00 call.

August 4 - Re-buy December corn $7.00 call.

August 5 - Bullish oil spreads, buy the November $90 call, sell the $100 call and sell the $77 put.

August 16 - Buy the December 10-year 119.5 call, sell the 121.50 call and sell the 116 put for a total cost of about 11 ticks ($171).

August 19 - Buy October sugar 18.25 call near 29 ticks.

August 25 - Buy December corn $6.00 put

August 29 - Buy January gold 1800 call sell the 1900 call and sell a 1650 put.

September 6 - Buy December S&P 500 4100 call, sell the 4300 call and sell a 3450 put.

September 7 - Buy January crude oil $85 call, sell the $95 call, and sell a $68 put.

September 8 - Buy March 2023 Yen 7800 calls near 50 ticks.

September 16 - Buy March Cocoa 2350 call.

September 20 - Buy March sugar 18.00 call.

September 29 - Buy 77/82 December lean hog call spread and sell the 68 put.

Author

Carley Garner

DeCarley Trading

Carley Garner is an experienced commodity broker with DeCarley Trading, a division of Zaner, in Las Vegas, Nevada. She is also the author of multiple books including, “Higher Probability Commodity Trading” and “A Trader's First Book on Commodities”.