The coffee price has held up at a critical juncture and is now set to explode higher. Let’s take a look at the charts.

COFFEE DAILY CHART

We can see price looks to have made a “three strikes and you’re out” low formation consisting of three consecutive lower lows.

This third low was also accompanied by triple bullish divergences in the Relative Strength Indicator (RSI) and Moving Average Convergence Divergence (MACD) indicator. Nice. This generally leads to a significant rise in price and I expect no less here.

The Parabolic Stop and Reverse (PSAR) indicator shows price has just busted the dots on the upside so a bullish bias is now in force.

COFFEE MONTHLY CHART

The major support I have been looking at stems from the PSAR indicator which pertains to the dots on the chart. Monthly PSAR support stands at US$156.89 for the month of February and the recent low at US$158.40 came in above. Nice.

It looks like an ABC corrective pattern is playing out with the recent low the end of wave B.

As for predicting where the wave C high may be I have added Fibonacci retracement levels of the move down from 2011 high to 2013 low. The two scenarios I fancy are price putting in a top just above the 61.8% level at US$229.46 or at the 76.4% level at US$259.82. I favour the latter.

The wave A high shows a bearish divergence with the April 2014 high and I’d really like to see a triple bearish divergence set up on the wave C high. Let’s see.

Let’s finish it off with the weekly chart which shows a very bearish pattern in the making.

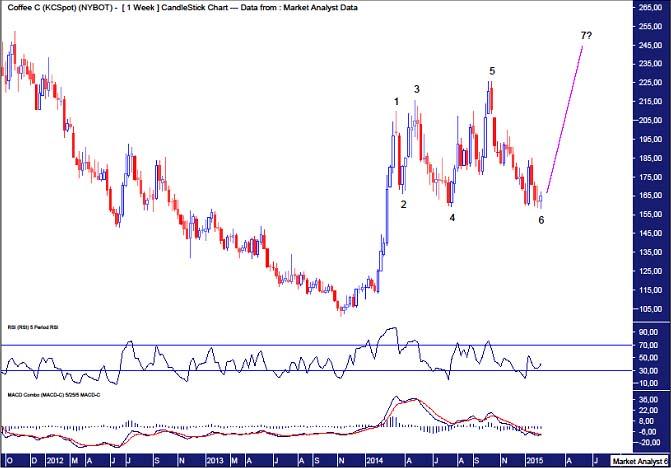

COFFEE WEEKLY CHART

Firstly, the RSI looks to have turned back up with bullish divergences in place while the MACD indicator looks to be threatening a bullish crossover. So, higher prices seem likely according to these lower indicators.

Finally, a very bearish 7 point broadening top looks to be in play denoted by the numbers 1 to 7. This pattern is much rarer than its 5 point cousin and even more bearish.

So, coffee drinkers look like they will be forking out a bit more over the coming months.

The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors. Put simply, it is JUST MY OPINION.

Recommended Content

Editors’ Picks

AUD/USD stays defensive below 0.6500 ahead of Fed

AUD/USD is on the back foot below 0.6500, consolidating the previous decline early Wednesday. China's holiday-led thin conditions and pre-Fed policy decision caution trading leave Aussie traders on the edge.

USD/JPY holds higher ground near 158.00, Fed in focus

USD/JPY holds the rebound near 158.00 in Asian trading on Wednesday. The US Dollar remains on the bid amid a risk-off market environment, underpinning the major. The interest rate differential between Japan and the US is likely to maintain a bullish pressure on the pair ahead of the Fed decision.

Gold snaps two-day losing streak above $2,280 ahead of Fed rate decision

Gold price posts modest gains around $2,288 on Wednesday during the Asian session. The precious metal edges higher as markets turn to a cautious mood ahead of the Federal Reserve's monetary policy meeting on Wednesday.

Bitcoin price dips into $60K range as spot traders flock to Coinbase Lightning Network

Bitcoin price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area. It comes as markets continue to digest the performance of Hong exchange-traded funds after their first day of issuance.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.