In short: no speculative positions.

We’ve repeatedly written that Bitcoin needs two things to hit off with a wider audience: security and ease of use. Case, a Bitcoin startup, is aiming to bring both of them, we read on TechCrunch:

You shouldn’t trust anyone with your bitcoins, and Case is well aware of that. Over the past few years, Mt.Gox, Bitstamp and countless other centralized services have suffered serious security breaches. But Case is about to put an end to all this, as this startup has built one of the most secure hardware bitcoin wallets in the world. The startup is launching onstage today at Disrupt NY.

“There’s no easy and secure way to use bitcoin. You’re either getting security, or you’re getting ease of use,” co-founder and CEO Melanie Shapiro told me. Case wants to provide both — security and ease of use.

Case is a small credit card-shaped device with a tiny screen, a fingerprint sensor, a camera, a built-in GSM chip and a few buttons. Any time you want to make a bitcoin transaction, you press the bitcoin button, scan the QR code with the camera, swipe your finger and you’re done. Everything happens on the device; you don’t have to log in with a complicated password or use a smartphone app. You can even buy and sell bitcoins from this device.

It’s always good to see that companies are working on solutions that would make using Bitcoin more secure and easier. It seems that it’s not only Case but potentially also other companies are exploring improvements in security protocols and interface. The idea to make Bitcoin transaction safer and more accessible is appealing. Having said that, we’re not entirely sure that making an additional piece of hardware to go with the Bitcoin system is the way to go.

Part of Bitcoin’s appeal is that it might potentially offer quick, cheap and easy transactions. We, however, expect the development to heavily involve smartphones rather than separate hardware. The trend seems to be to streamline payments into simple transactions where you confirm payment by tapping your phone against a wireless reader. It doesn’t seem that adding new hardware to the process is the way to go. We would expect solutions like the one proposed by Case to transpire to smartphones in the next couple of years.

For now let’s focus on the charts.

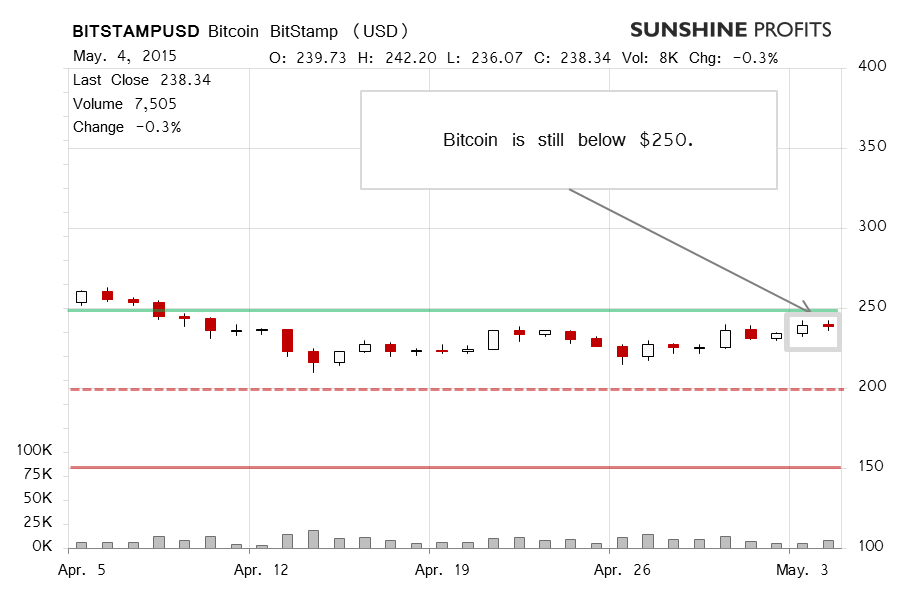

On BitStamp, we saw little movement yesterday, but the volume was higher than on Sunday. Bitcoin stayed below $250, so yesterday doesn’t look like a continuation of a rally. Yesterday, we wrote:

(…) we haven’t seen any strong move (…). The price action and the volume have been relatively weak. Bitcoin is above our previous stop-loss levels, so our hypothetical positions were closed. The outlook is now less bearish than it was on Thursday but it doesn’t look too bullish either. Yes, there still seems to be some space for a move up, to $250 or so (green line in the chart), but in our opinion the action we’ve seen suggests that any further appreciation could be followed by more declines.

This is still up to date, even more so in light of the action we’ve seen so far today (this is written before 11:00 a.m. ET). Bitcoin has moved down, not really strongly but the volume might end up being higher than what we saw yesterday. So, Bitcoin is still below $250 (green line in the chart), it might have started moving down. Is it time to get back on the short side of the market? Let’s consider that.

On the long-term BTC-e chart, we see that Bitcoin is still above a possible declining trend line. This suggests that we might still see a move up before more declines. Our points from yesterday are still valid:

At present, our take is that Bitcoin might still move further, possibly to $250 (green line in the chart) before taking one more dive. The volume has been relatively weak and this hints at a potentially transitory situation and at a possibility of more declines. It seems that the picture is now less bearish than it was on Thursday but not actually bullish. We would prefer to wait for Bitcoin to start moving back down before possibly suggesting getting back in on the short side of the market as far as speculation is concerned.

The action today isn’t really indicative of a strong decline, so our take right now is that Bitcoin might still move up but the next big move might be to the downside. The move down doesn’t really seem to have started by now.

Summing up, we don’t support any speculative positions at the moment.

Trading position (short-term, our opinion): no positions.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 ahead of US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The US Dollar holds its ground following the Fed-inspired decline as market focus shifts to mid-tier US data releases.

GBP/USD holds steady above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside ahead of Unit Labor Costs and Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.