The Bolivian government banned Bitcoin in May, CoindDesk announced yesterday:

El Banco Central de Bolivia, the central bank of the South American nation, has officially banned any currency or coins not issued or regulated by the government, including bitcoin and a list of other cryptocurrencies including namecoin, peercoin, Quark, primecoin and feathercoin.

(…)

The decision to fully ban bitcoin puts Bolivia in unique standing in the international community, as other nations previously believed to be embracing restrictive policies – including China, Thailand and Russia – have since backed away from implementing similar measures.

(…)

Bolivia’s announcement is also unique within the context of decisions made by its South American neighbors. For example, earlier this March, a report suggested that The Superintendencia Financiera de Colombia (SFC), Colombia’s central bank, may have been seeking to implement a bitcoin ban.

However, despite worries from the local community, such fears did not come to pass. Colombia stopped short of the expected announcement, choosing instead to bar banks from working with digital currency companies.

Elsewhere in South America, central banks in Argentina and Brazil are permissive to digital currencies (…).

This is a major setback for investors in Bolivia but it doesn’t change much as far as the international picture is concerned. It is possible that the country will follow in the footsteps of those countries which previously had banned Bitcoins but have reneged on this since then. It’s too early to see this coming but we’ll be keeping an eye on more info about Bitcoin and Bolivia.

For now, let’s move on to the analysis of charts.

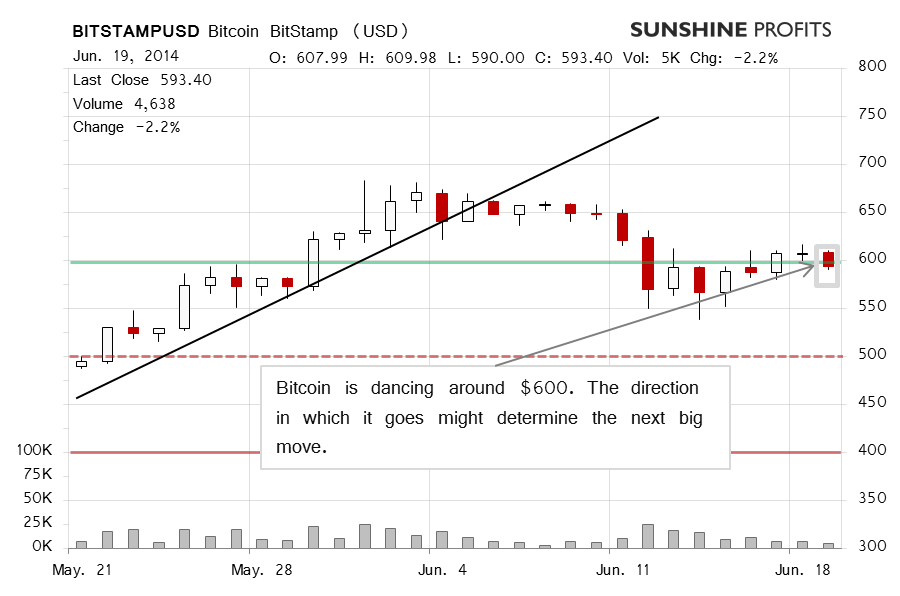

On the BitStamp chart, we see that Bitcoin declined back below $600 yesterday. This means that the next move up is not confirmed at this time. On Wednesday, we wrote:

We saw a move above $600 (solid green line in the chart) yesterday. This seems extremely bullish for the short-term if we look at the price action only. The volume is slightly more worrying since it was actually lower than on Monday. Because of that, we don’t think this is a signal to jump into the market right away.

This caution turned out to be warranted since Bitcoin has come down since then. The move yesterday took place on relatively low volume which doesn’t indicate that the move is lasting.

Today, we saw Bitcoin move down but it has returned since then (this is written before 10:30 a.m. EDT). The volume is increased compared with yesterday but neither the action nor the volume confirms a move up. The fact that Bitcoin is dancing around $600 seems to indicate that moves in both directions are possible.

On the long-term BTC-e chart we’re seeing a period of consolidation around $600 (solid green line on the chart). Bitcoin is currently below this level but the volume is also down and this doesn’t support any strong short-term move just now.

At this time, it seems that Bitcoin might still move lower in the short-term (this is not a sure bet) but the long-term move still seems to be up as the previous trend (black declining line) was broken decidedly.

Our best bet at the moment is a short-term move down followed by more appreciation. The situation, however, is not clear enough to go short just now. We’re more inclined to see a strong move down and a reversal, or a move up and then to open longs.

Summing up, in our opinion no short-term positions should be held at this time.

Trading positions (short-term, our opinion): no positions.

Recommended Content

Editors’ Picks

AUD/USD tests lows near 0.6550 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is testing lows near 0.6550 after Australian Retail Sales dropped by 0.4% in March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data fails to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY rebounds to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.