What to Expect

Sales are anticipated to rise by 0.2% in December, bucking the rather pessimistic two-month slump for the report previously. October sales declined by 0.8%, while remaining unchanged in November. And, there’s plenty of evidence that points to a likely gain.

According to the latest BRC-KPMG retail sales monitor for December, shoppers came out in droves to prep for the holiday season. The resulting momentum helped the UK economy to see a 1.5% uptick in total sales. Online sales help to holster the figure, rising by 17.8% in the month – the highest pace in a year. Individual shops were also referenced as seeing an 8% uptick in month over month sales.

Although the figures aren’t a direct barometer of what’s to come in the official report being released by the Office for National Statistics, they are reflective of overall spender optimism.

Things To Keep In Mind

At or Above 0.2% Gain. This scenario would be considered widely bullish for GBPUSD as it adds to notions that the UK economy is stabilizing. This will bolster the notion that the Bank of England will likely keep a floor on rates for the moment – leaving benchmark interest rates at the current 0.5%. With policymakers still gauging interest from the Funding for Lending measure, any bit of economic evidence that shows an improving economic outlook will help to delay the consideration.

Below 0.2% Gain or Unchanged. Although not devastatingly bearish, a below 0.2% gain would be considered pessimistic for the economy as it reflects waning consumer interest. The scenario would likely lead to consolidation in the pair ahead of the long weekend.

Below 0.2%. Bearish for pound sterling, should the report fall below 0.2%, it would spark speculation over a likely 25 basis point cut by the central bank. Even if the Funding for Lending measure remains functional, the decline in consumer spending is evidence enough that contraction continues to persist.

Outlook

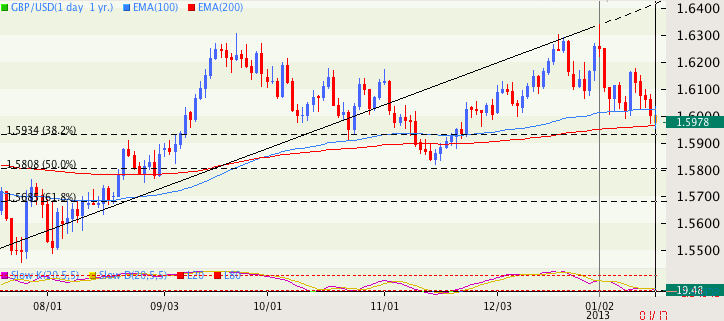

With GBPUSD falling over the last five days, support is now surfacing amid the 1.5950/1.5900 area. The region is being protected by 200-EMA support and 38.2% fib barriers. The confluence provides a formidable support level for bulls in the near term. However, a break below would open scope for a test of 1.5800.

Source: FXTrek Intellicharts

Source: FXTrek Intellicharts

注释: 本网页上的所有信息随时可能更改. 使用本网站的浏览者必须接受我们的用户协议. 请仔细阅读我们的保密协议和合法声明. 撰稿者在Forex21.cn发表的观点仅是他本人观点, 并不代表Forex21.cn或他组织的观点. 风险披露声明: 外汇保证金交易隐含巨大风险, 它不适合所有投资者. 过高的杠杆作用可以使您获利, 当然也可能会使您蒙受亏损. 在决定进行外汇保证金交易之前, 您应该谨慎考虑您的投资目的, 经验等级和冒险欲望. 在外汇保证金交易中, 亏损的风险可能超過您最初的保证金资金, 因此, 如果您不能负担资金的损失, 最好不要投资外汇. 您应该明白与外汇交易相关联的所有风险, 如果您有任何外汇保证金交易方面的问题, 您应该咨询与自己无利益关系的金融顾问.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 ahead of US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The US Dollar holds its ground following the Fed-inspired decline as market focus shifts to mid-tier US data releases.

GBP/USD holds steady above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside ahead of Unit Labor Costs and Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.