JPMorgan, BofA post record results on the back of retail divisions. BofA says it is prepared if a recession hits.

Interest rates have gone up for those seeking loans. Bank profits are up because interest rates have not gone up as much for depositors.

Please consider Big Banks Lean on Main Street for Profit Before Fed's Pause Hits.

The Fed’s four interest-rate increases last year and a relatively buoyant U.S. economy have boosted what banks can charge for loans, with the average rate the firms earned rising almost 0.5 percentage points in the past year. They’ve also so far been able to limit how much of the hikes they’ve passed on to depositors.

At Bank of America, the consumer unit’s net interest income climbed 10 percent, helping propel the bank to record quarterly earnings.

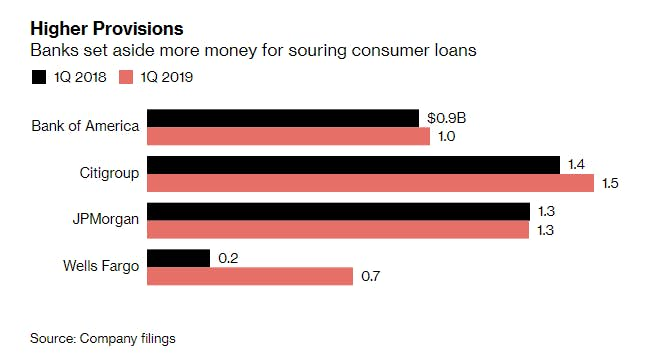

Bank of America said net interest income growth will slow over the rest of this year, while Wells Fargo & Co. went even further and predicted a decline. And three of the four largest lenders increased provisions to cover consumer loan losses, with Wells Fargo more than tripling the amount it set aside.

“Just for the record, I want to be very clear -- we don’t see any evidence of a recession,” Bank of America CFO Paul Donofrio said on a call with reporters Tuesday. “In any event, if a recession were to come, we are very well prepared.”

For now, the Fed’s March reversal and a flat -- and at times inverted -- yield curve is the more pressing concern. Wells Fargo said net interest income could fall as much as 5 percent this year, while Bank of America sees it growing at half of 2018’s pace.

Still, JPMorgan, which stuck with its outlook for net interest income to climb to more than $58 billion in 2019, sees a silver lining in the Fed’s pause: less pressure to raise rates for its $1.5 trillion deposit base.

Prepared for Recession?

Banks always say they are prepared for recession but history shows they aren't as soon as recession hits.

That said, US banks are far better prepared than their European counterparts.

ECB vs the Fed

The ECB made a huge mistake with negative interest rates whereas the Fed bailed out US banks slowly over time by paying interest on excess reserves.

Negative interest rates (charging banks instead or paying them) harmed already crippled European banks.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

GBP/USD rises above 1.3300 after UK Retail Sales data

GBP/USD trades with a positive bias for the third straight day on Friday and hovers above the 1.3300 mark in the European morning on Friday. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, supporting Pound Sterling.

USD/JPY recovers to 142.50 area during BoJ Governor Ueda's presser

USD/JPY stages a modest recovery toward 142.50 in the European morning following the initial pullback seen after the BoJ's decision to maintain status quo. In the post-meeting press conference, Governor Ueda reiterated that they will adjust the degree of easing if needed.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.