Aussie forms bearish pattern after the RBA decision

The euro was little changed after the relatively weak Eurozone unemployment rate data. According to Eurostat, the bloc’s unemployment rate remained unchanged at 8.3% in February as most countries continued to battle the pandemic. In total, more than 15 million people in the bloc were out of work during the month. The EU unemployment rate is relatively worse than that of the United States and the UK. The situation will likely remain because of the slower pace of vaccinations. Most countries in the region have vaccinated less than 15% of the total population compared to the UK and US rate of 47% and 32%.

The Australian dollar declined slightly after the RBA interest rate decision. The bank left interest rates unchanged at 0.10% for the fourth consecutive month. It also left the yield curve control unchanged as it continues to support the economy. It hinted that rates would remain at the current range for a few more years. Still, the bank expressed concerns for the vibrant real estate industry, where house prices have risen at the fastest pace since 1988. This growth is mostly because of the current low interest rates. The RBA will publish its financial stability report on Friday.

UK stocks rallied after Boris Johnson made plans for the reopening of the country. In a speech during the weekend, the prime minister said that he expects to reopen the country on April 18. This happened since the number of daily infections has dropped to about 3,000. Also, the government has already vaccinated more than 30 million people. The best performers in the FTSE 100 were SSE, Entain, Rio Tinto, BP, and Antofagasts. In the rest of Europe, the German DAX and French CAC 40 also rallied by more than 0.50%.

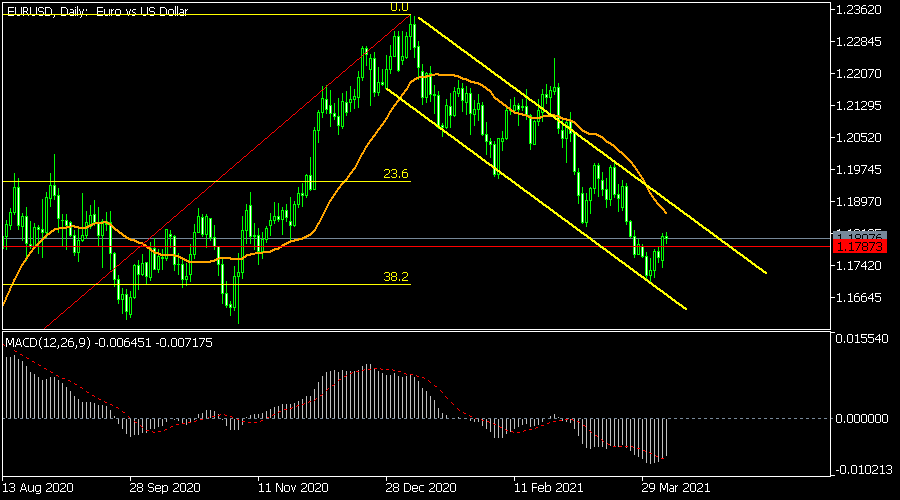

EUR/USD

The EUR/USD was little changed today at 1.1805. On the daily chart, the price is between the 23.6% and 38.2% Fibonacci retracement levels. It is also inside the yellow descending channel and is slightly below the 25-day and 15-day moving averages. The signal and main lines of the MACD are also below the neutral line. Therefore, in the near term, the pair may keep falling as bears target the 50% retracement at 1.1492.

GBP/USD

The GBP/USD pair declined to an intraday low of 1.3825 today. On the daily chart, the price is at the same level as the middle Bollinger Bands. It is also at the 25-day exponential moving average while the signal line of the MACD has made a bullish crossover. The pair is at the upper side of the descending channel shown in yellow. Therefore, the pair may keep falling, with the next target being the lower side of the descending channel at 1.3668.

AUD/USD

The AUD/USD pair declined slightly after the RBA interest rate decision. On the daily chart, the pair is still slightly above the ascending trendline shown in yellow. Notably, it has formed a head and shoulders pattern, which is usually a bearish sign. It has also moved below the 25-day moving average while the MACD is below the neutral line. Therefore, the pair may ultimately break-out lower in the near term.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.