Daily Forecast - 20 February 2017

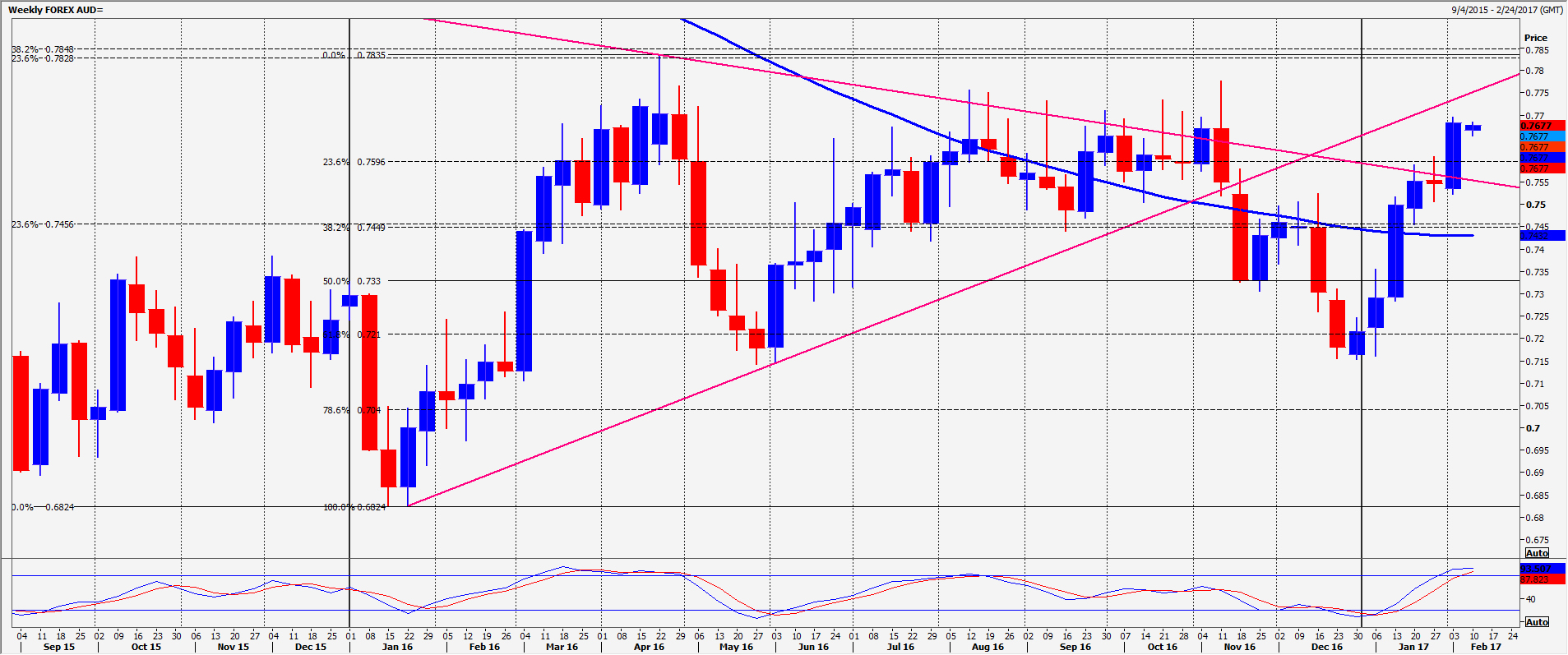

AUDUSD Spot

AUDUSD first support at 7650/45 is the most important of the day. Try longs with stops below 7625. A break lower however is more negative targeting less important support at 7600/7595. A break below is an add sell signal targeting 7560/55.

Holding strong support at 7650/45 re-targets 7680/90 before resistance at last week's high of 7730/32. Abreak above 7740/44 this week targets 7760/65 then strong 1 year trend line resistance at 7800/7810 Try shorts with stops above 7845.

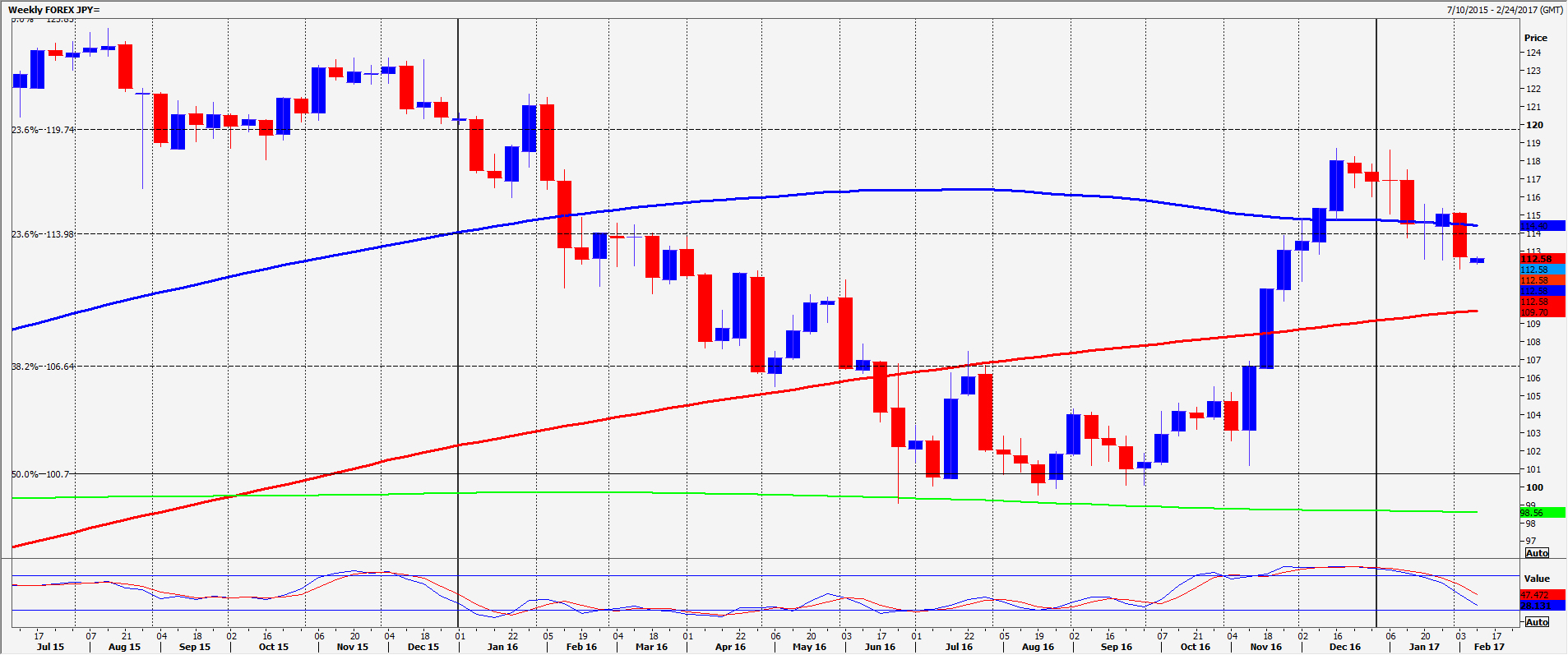

USDJPY Spot

USDJPY just holding trend line support at 112.70/65. We are oversold short term so a bounce from here is possible as stated on Friday, but longs need stops below 112.30. A break lower however targets 112.00/111.90 before the 111.70/60 low. Try longs with stops below 111.20.

Holding trend line support at 112.70/65 targets quite strong resistance at 113.10/20 but above here try shorts at 113.50/60 with stops above 113.95.

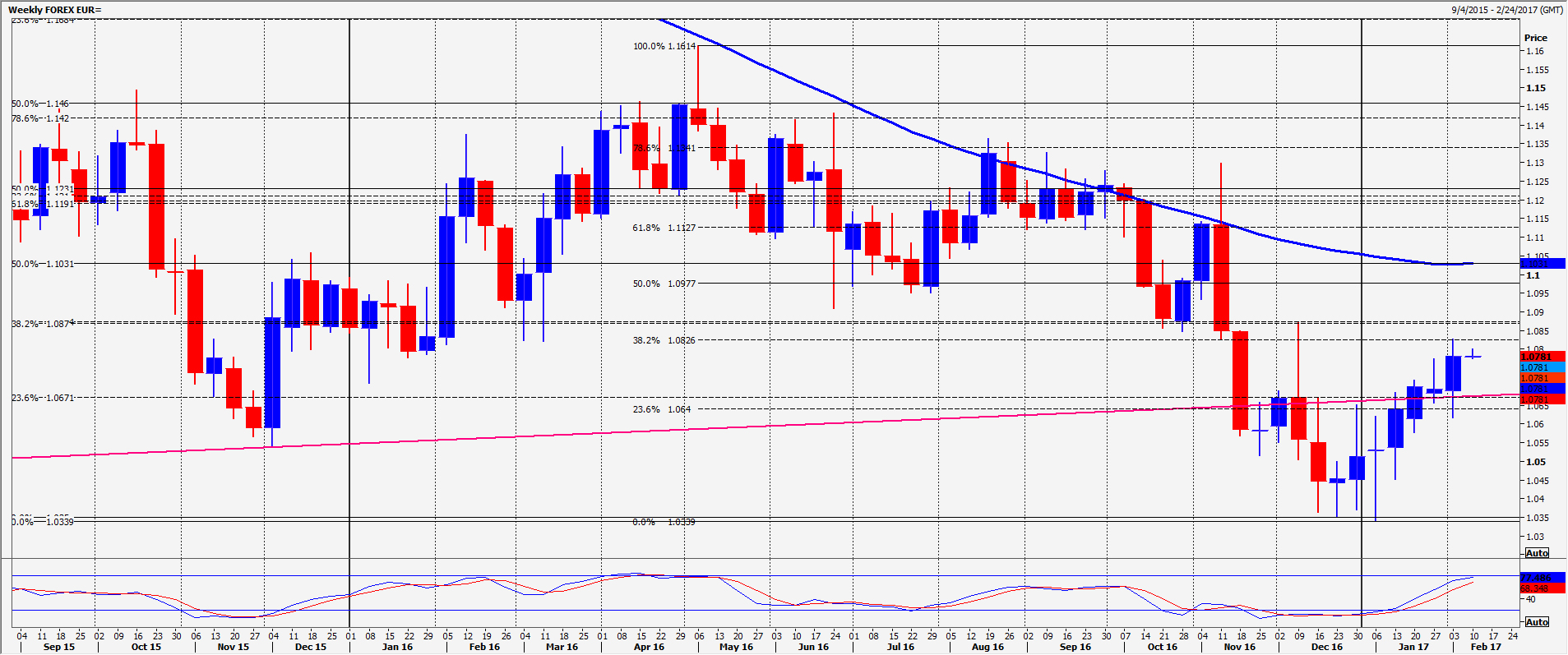

EURUSD Spot

EURUSD has recovered to first resistance at 1.0635/40 which should be the strongest of the day. If we continue higher look for a retest of Friday's high at 1.0670/75 but we could continue higher as far as resistance at 1.0710/20. Try shorts with stops above 1.0735. A break higher would be very unexpected...but targets 1.0760/65.

Failure to beat first resistance at 1.0640/35 re-targets 1.0615/10 & minor support at 1.0595/90. On further losses look for 1.0570/60 then a retest of last week's low at 1.0530/20.

GBPUSD spot

GBPUSD bottomed 6 pips above last week's low at 1.2379 on Friday. On further losses this week look for support at 1.2350/40. Longs need stops below 1.2320. A break lower targets 1.2260/55 for a short term buying opportunity, but longs need stops below 1.2230.

First resistance at 1.2485/80 should be the strongest of the day but above here targets 1.2535/40 then minor resistance at 1.2570/80, also the 2 week high. On a break higher this week look for 1.2600 then 1.2630 before the January high at 1.2670/73. Further gains test the February high so far at 1.2703/07.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.