AUD/USD Price Forecast: The 200-day SMA holds the selling pressure

- AUD/USD reversed part of its recent weakness and looked to regain 0.6700.

- The US Dollar maintained its constructive move well in place on Thursday.

- Australia’s labour market release came in on the strong side.

AUD/USD managed to regain some balance on Thursday, bouncing off recent lows near 0.6650 and flirting once again with the key 0.6700 hurdle.

The daily uptick in the Australian Dollar came despite further strengthening of the US Dollar (USD) and steady concerns surrounding China’s recent stimulus measures.

In addition, the reversal in the Aussie Dollar came amidst a marked pullback in copper prices, which contrasted with a slight rebound in iron ore prices, all against the backdrop of ongoing doubts about the true effectiveness of China’s stimulus packages.

On the monetary policy side, the Reserve Bank of Australia (RBA) maintained its cash rate at 4.35% during its September meeting. While acknowledging inflationary risks, Governor Michele Bullock signaled that a rate hike is off the table for the time being.

The Minutes from the RBA’s meeting reflected a more dovish tone compared to August, when guidance had pointed toward stable rates in the near term.

Current market sentiment indicates a 50% probability of a 25-basis-point rate cut by the end of the year. The RBA is expected to be one of the last G10 central banks to lower rates, likely in response to slowing economic growth and reduced inflationary pressures.

Although potential Federal Reserve rate cuts could provide some relief to the AUD/USD later this year, uncertainty around China’s economic prospects and stimulus remains a significant challenge.

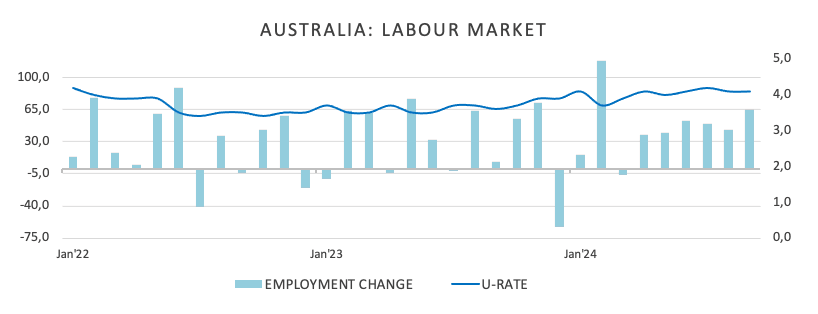

In domestic data, AUD derived extra support from auspicious results from the Australian labour market report, where the Unemployment Rate held steady at 4.1% and the Employment Change showed an increase of 64.1K individuals.

Next to watch in Oz will be the release of advanced Judo Bank Manufacturing and Services PMIs next week.

AUD/USD daily chart

AUD/USD short-term technical outlook

Extra losses might push the AUD/USD down to its October bottom of 0.6657 (October 16), ahead of the September low of 0.6622 (September 11), which is still supported by the key 200-day SMA.

On the plus side, the first challenge comes at the 2024 high of 0.6942 (September 30), just before the key 0.7000 mark.

The four-hour chart suggests that a rebound could be in the offing. The initial support is 0.6657, followed by 0.6622. On the upside, the initial resistance level is at 0.6758, slightly above the 200-SMA at 0.6769 and the 100-SMA at 0.6796. The RSI rose to nearly 46.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.